These are only some of the stocks I like. I keep an eye on a much longer list. I bring these stocks to you to illustrate the way you can short list stocks even in a market where there are slim pickings. I still believe the market has some way to go – perhaps another 400-500 points in the coming months.

So, I don’t believe now is the right time to buy for the long term. You can treat my ideas to have a little side play or as a way of tracking stocks with the prospect of good upside in the coming months. Watching a stock fall can give you insight.

I am going to select COH out of a bunch of stocks such as ABC, ALL, ALU, ASX and AWC. There are many more, but what I write about COH you can apply to these other stocks. They are all what we would call blue chip stocks from the ASX top 200.

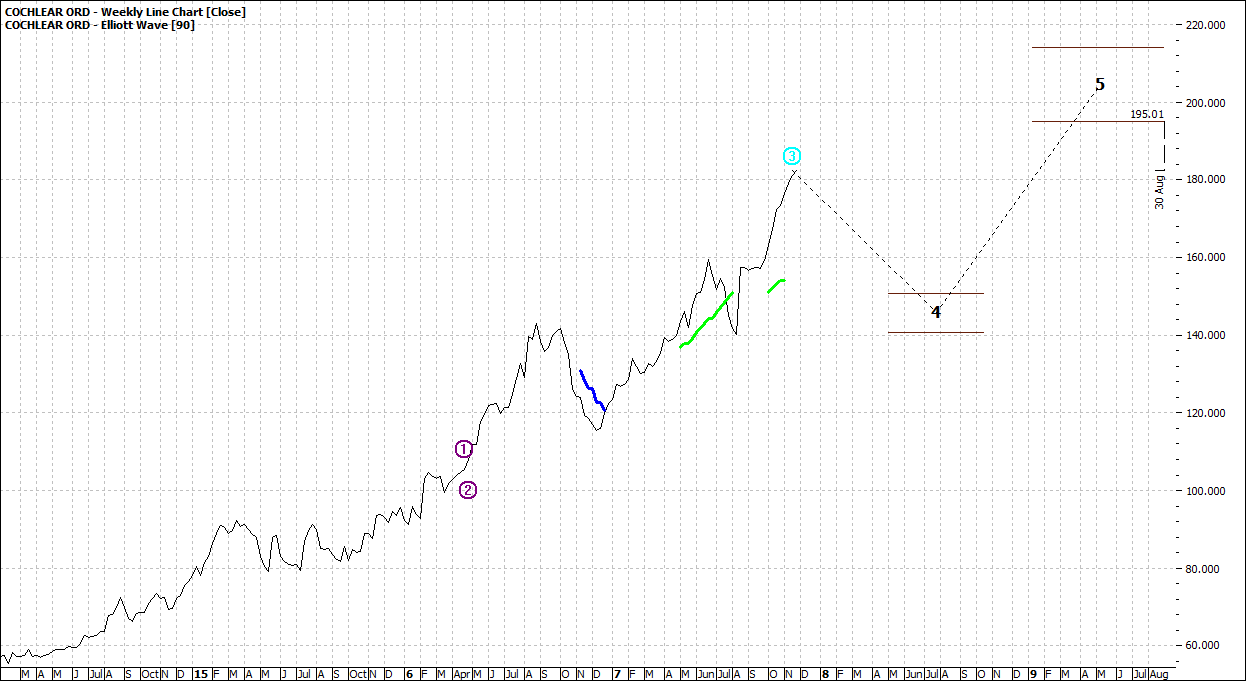

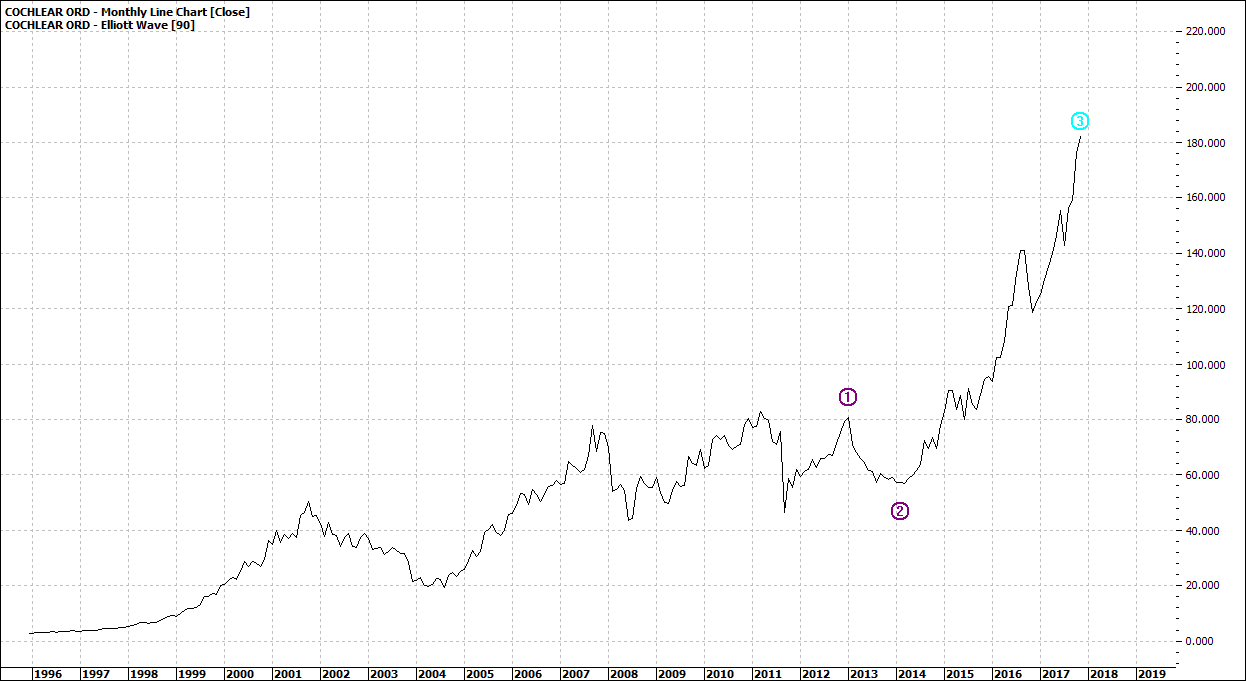

As per usual when I look at any stock, indices or financial instrument – I look at the daily, weekly and monthly charts as below:

Click to Enlarge

Click to Enlarge

Click to Enlarge

As you can see from about 2004 Cochlear has had a solid few years with the last 2 years been spectacularly upwards and upwards. It is a good stock, maybe a market darling and very well supported by the Institutions.

However clearly this is not a good time to buy – though – it could go higher before buyers do start to take profits which will in turn cause it to retreat. This is basic Elliott and Fibonacci theory.

Elliot believed – as do I - that we can envisage a level of retreat – based on the run up the stock has had.

The weekly chart suggests a retreat to around $140 and the monthly around $120. The weekly time projection is that this may happen during the middle of 2018. The monthly time projection is about 2019-21. The reason for the difference is that the monthly looks at a much greater time projection – the macro outlook.

While I look at all three-time horizons I am particularly interested in the daily and weekly outlooks as they will influence my entry timing.

Though mid 2018 seems a long way away, at times like this patience is a powerful attribute. I never have the feeling that my money will burn a hole in my pocket. I am happy to sit on cash.

Several times during each week I quickly scan the top 200, which only takes 10-15 minutes. A small investment of my time but it keeps each stock’s pattern formation well in view.

I can assure you COH will become oversold at some point and this will represent a good buy in time.

Enjoy the ride

Tom Scollon

|

|