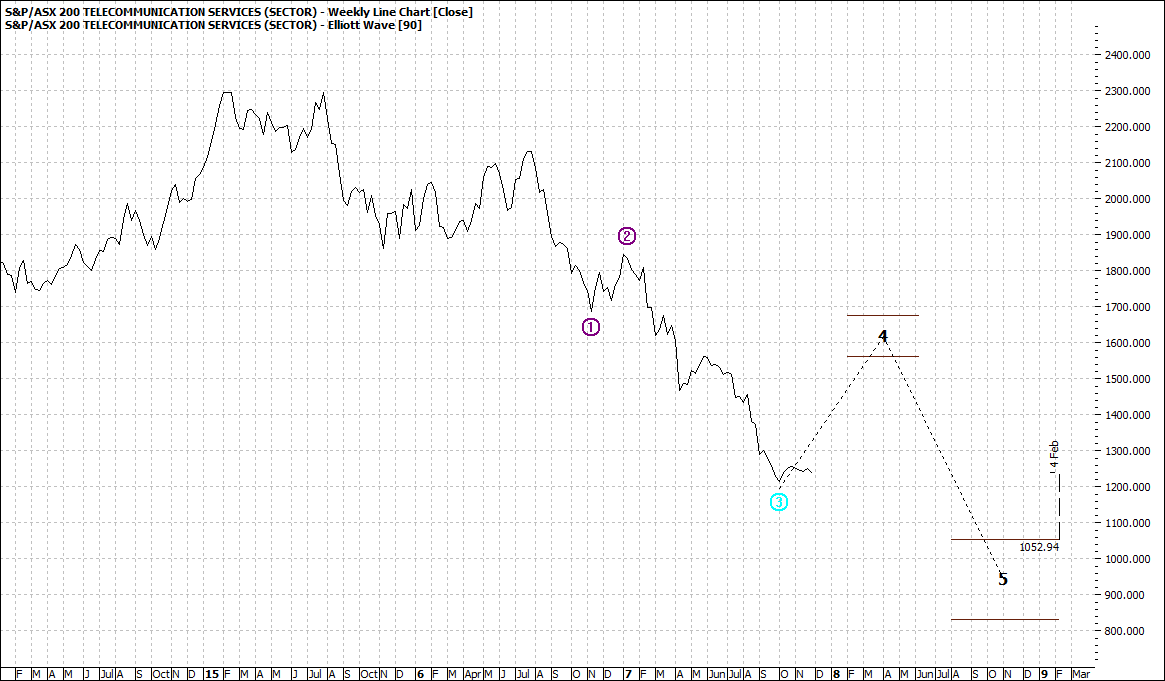

Well except Telecommunications – which is made up mainly of Telstra:

Click to Enlarge

Though we can see a rally in the coming months, generally weakness prevails in this sector.

But others are looking surprisingly resilient:

Consumer Staples:

Click to Enlarge

A pullback ahead – maybe when Amazon kicks in – but after that a move higher over the next couple of years.

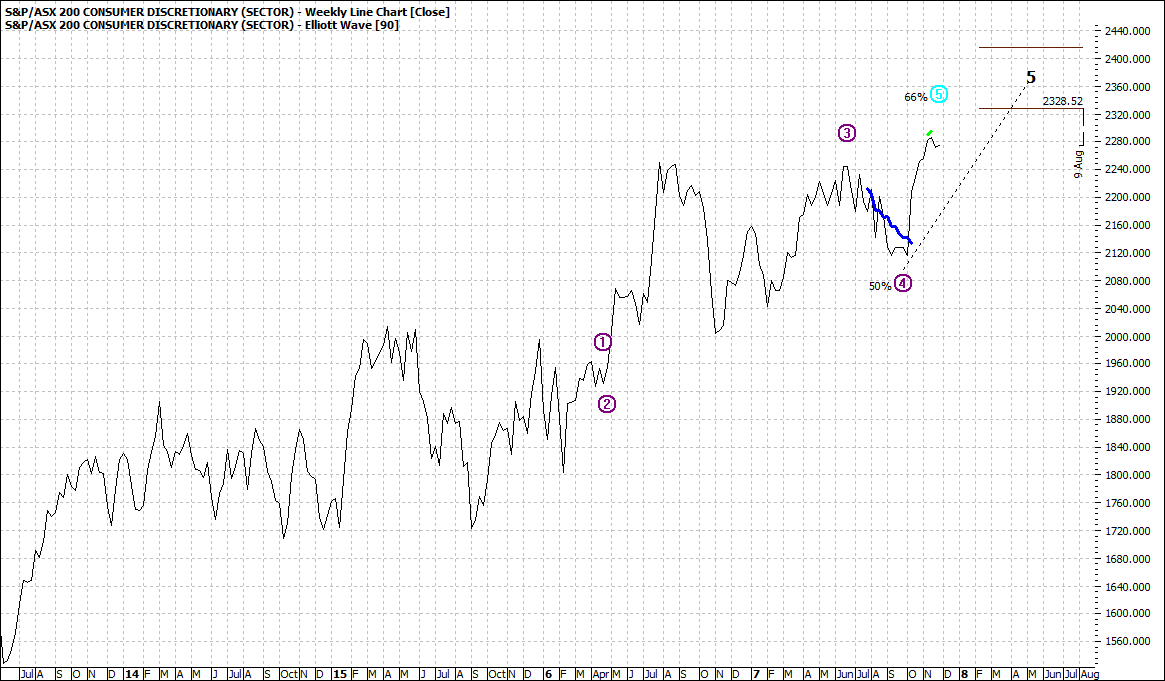

Discretionaries:

Click to Enlarge

No sign of weakness yet – but the sector will top in the coming months.

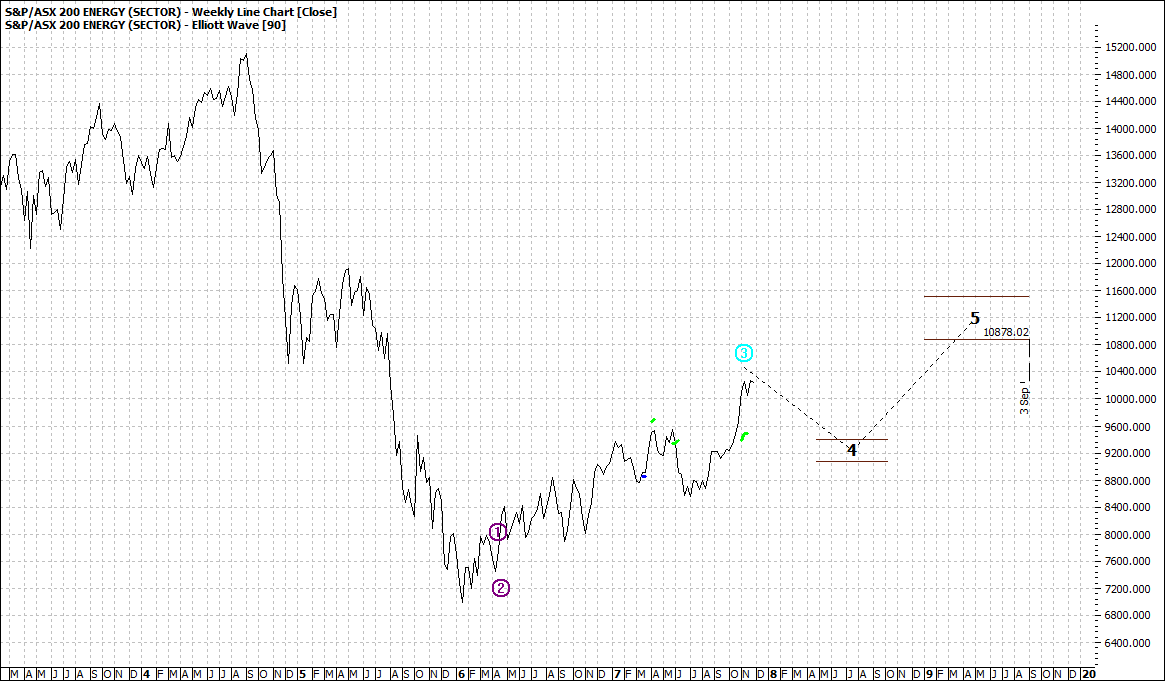

Energy:

Click to Enlarge

A retreat and then a move higher over the next couple years.

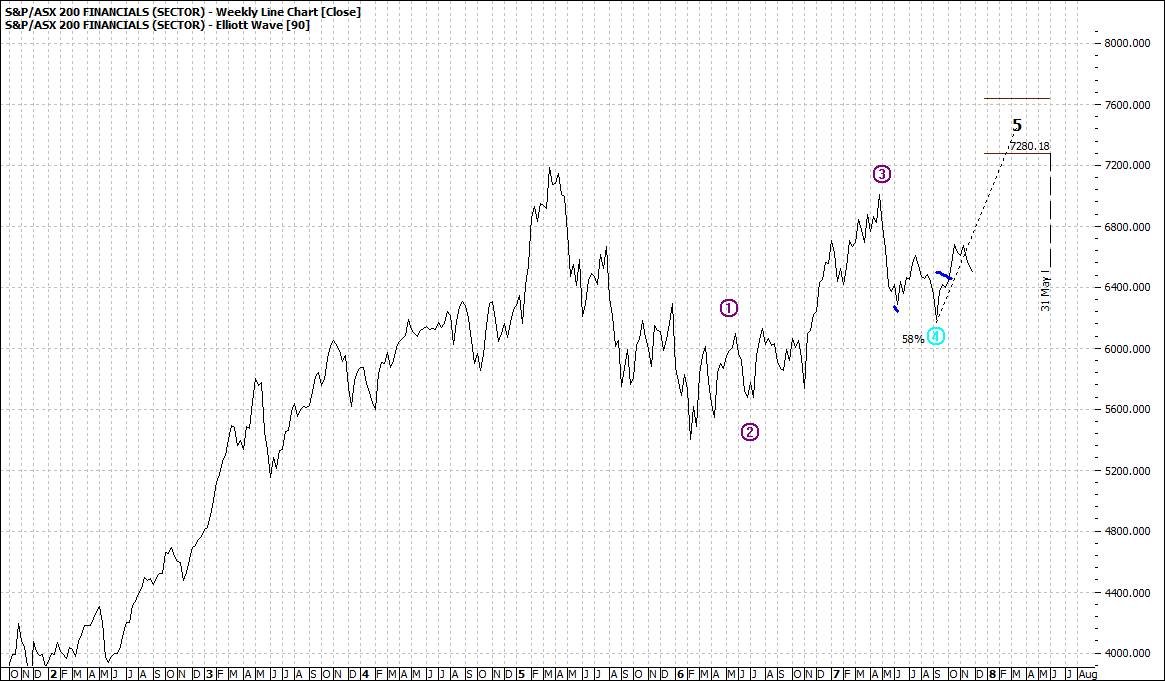

Financials: They are not running scared of the muted banking enquiry:

Click to Enlarge

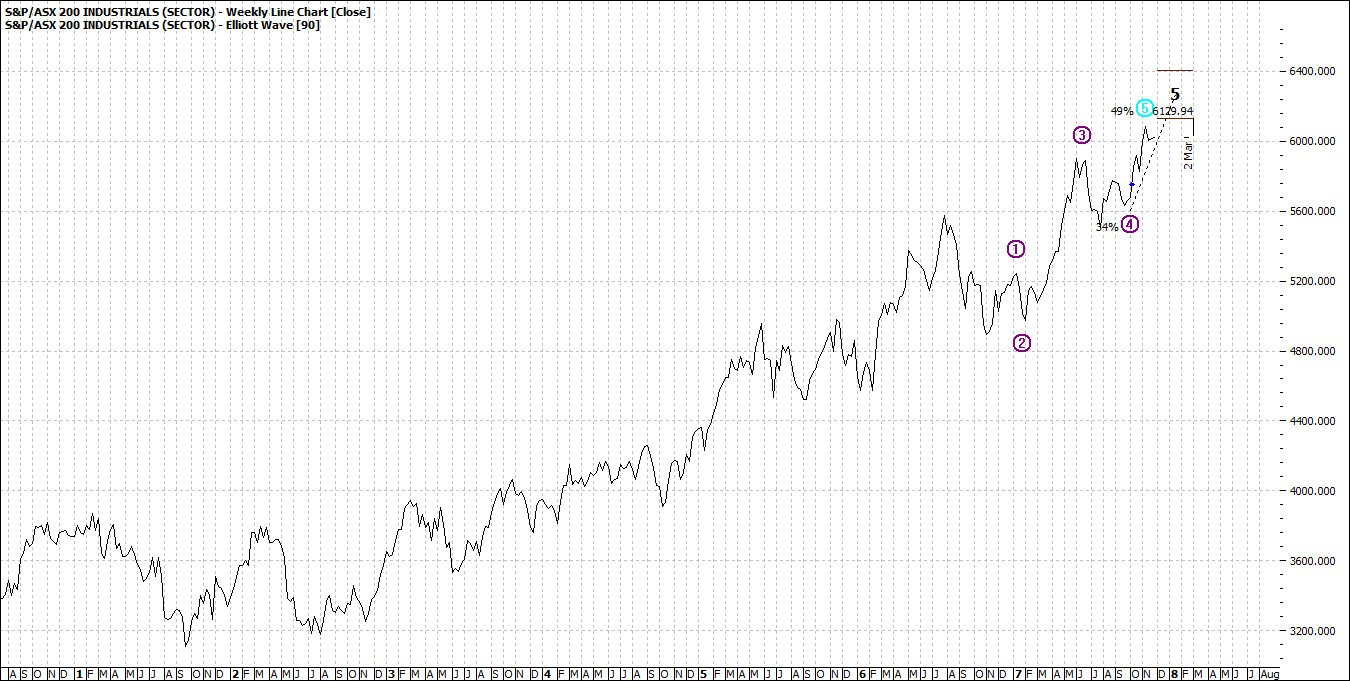

Industrials:

This sector has been the pillar of strength over the last five years – a classic bull run, with strong moves higher followed by retreats and consolidation, before another and possible final surge:

Click to Enlarge

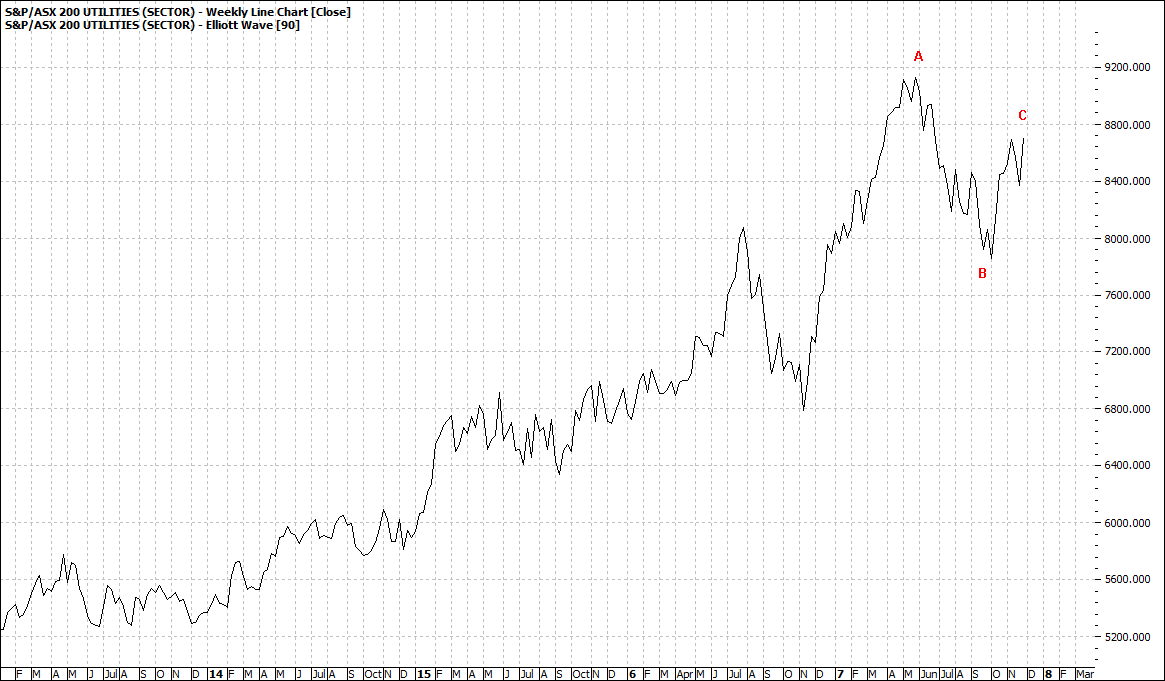

So more to go but it is topping out. Utilities:

Taking a breather – but will head higher:

Click to Enlarge

I note a few media warnings of toppy markets and how a severe downturn could be ahead. Maybe, but it is all in the timing. We all know markets top out after a sustained move higher. Nothing predictive about that. What is clever is to know when and to take the appropriate action. Having lived through many cycles I know a couple of things: Firstly, markets over run. So, some experts are warning that valuations are over stretched, and some Institutional money is being taken out of the market – but not huge volumes yet. No heavy selling but weak buying by the amateurs. Secondly, we get plenty of notice to get out. That is starting now but there will be many more warnings ahead. Thirdly I remind myself not to be greedy. Don’t wait for the last few cents. Don’t be the last one standing. If you have followed this long move up, then think of your comfort factor. The sleep test. If you are tossing and turning at night, then maybe you must take action

Enjoy the ride

Tom Scollon

|