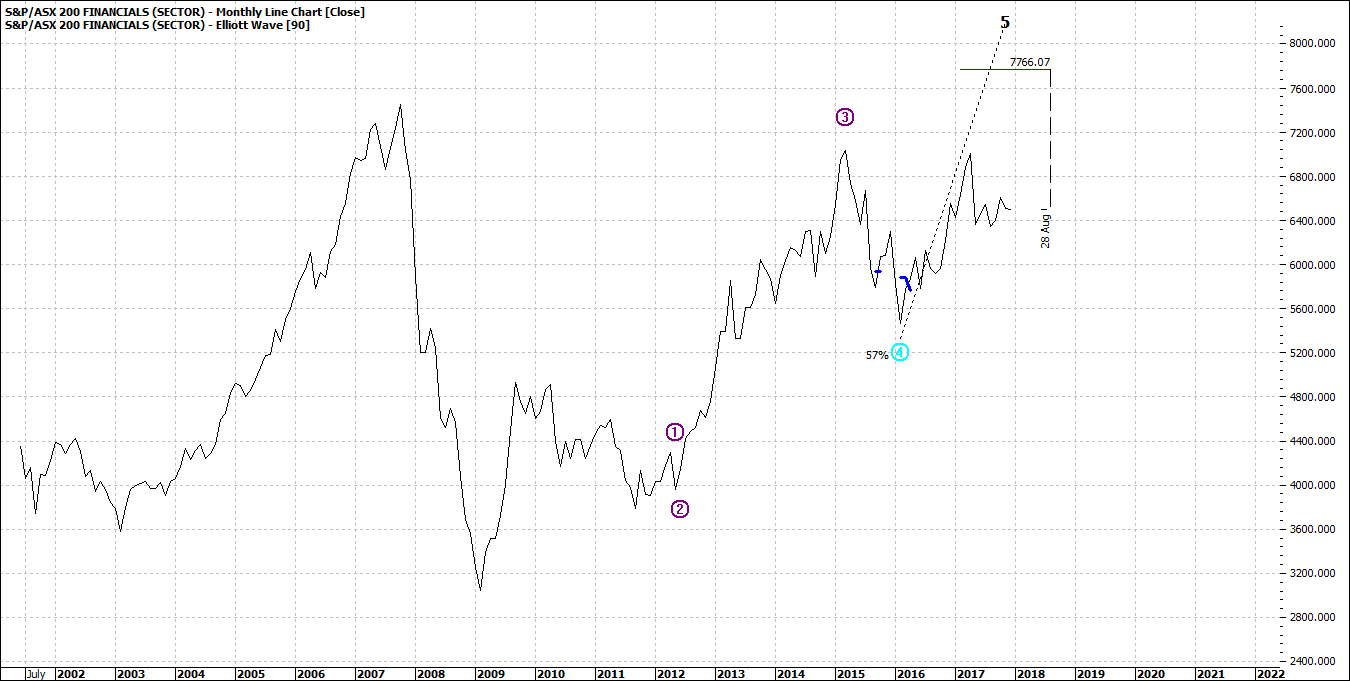

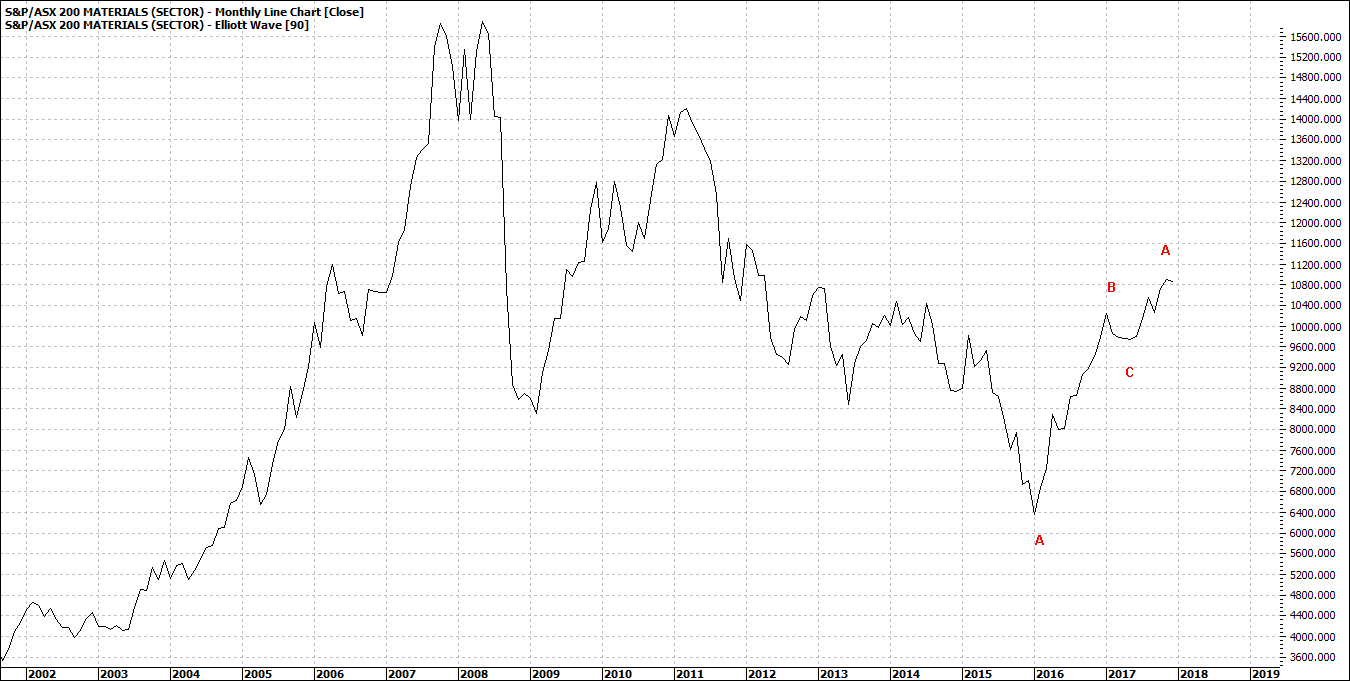

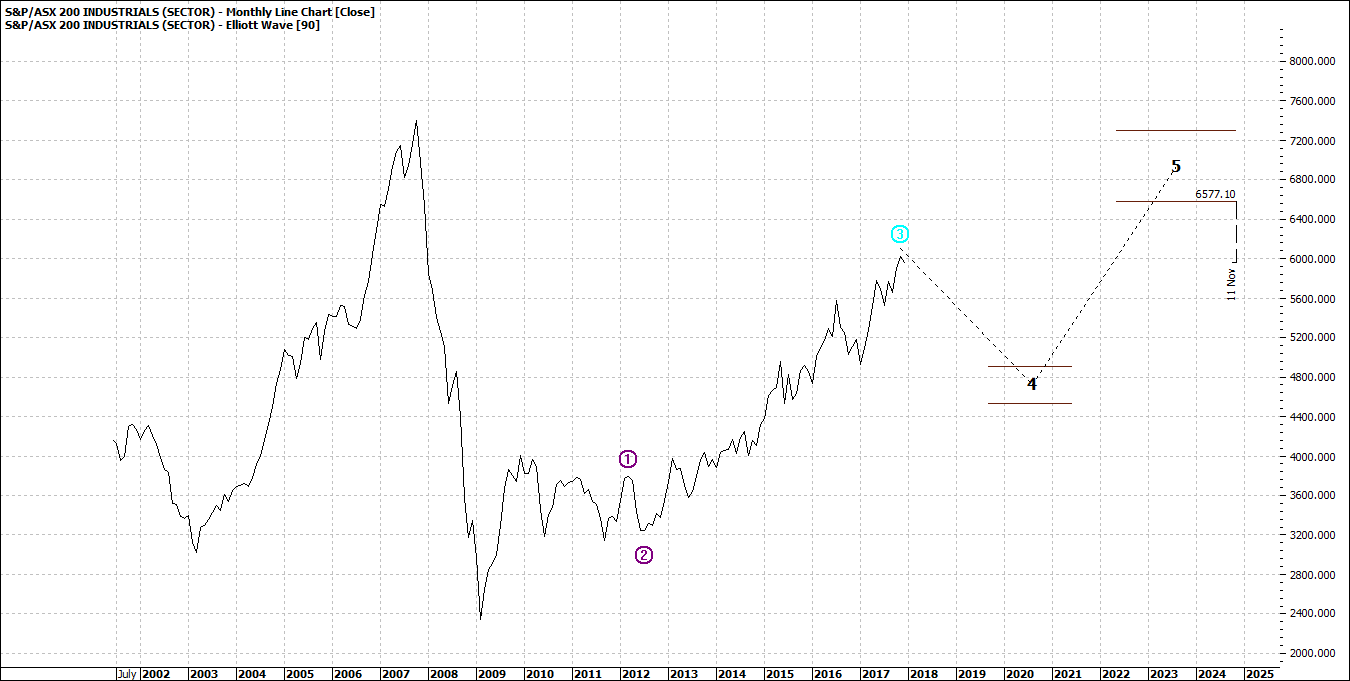

My personal view is that you make superior returns by not what or how you buy but rather your ability to sell. Most people – even seasoned active volume traders can find it hard to press even that ‘’buy’’ button. A bit like famous performers feeling nauseous before every show – though they have outstanding talents. Pressing ‘’sell’’ is something numerous people struggle with and I know many that procrastinate setting up the sell page and hence hang onto stocks that are going to cost them money. I used to practice hitting the sell button just so it would come easy. Brokerage is so low that it should not be an issue when buying and certainly not when selling. This question of when to sell means different things to different investors – but this opening point I did want to make. Oh, and one addendum. Many people talk of a stop loss of 10%. That is, when a stock goes below their buy in price by 10% they sell. To me that is the extreme point of selling. My stop loss is theoretically 10% but I must add that generally if I am not making money within a few days I am out and that might be at 5% level or even less if the pattern that develops looks weak to me. I have no favourite stocks, so I am quite merciless when selling. I would now like to look at this question in a much broader way. This question of selling is most relevant when we are facing the risk of a major downturn or market reversal. This could happen in the months ahead and that is why I wish to deal with this fundamental question now. If you sold out at the peak of 2007 in any key sector of the Australian market you would still be ahead of the game and would have had many opportunities to buy in once more: I show the XFJ, XMJ and XNJ in turn:

Click to Enlarge

Click to Enlarge

Click to Enlarge

Most people will not pick the very top or the very bottom. In fact I never expect l to do so and I am satisfied if I am near the top and the bottom and I think I can claim to find such levels. Moving on to a slightly different angle to this question. I do not advocate selling out if a major downturn is looming and I would like to use CBA as a case in point:

Click to Enlarge

So, with CBA you would be much better off weathering any storm. It has mostly shown a sound price pattern. Somewhat orderly. Another government float which contrasts greatly to CBA is TLS:

Click to Enlarge

The TLS stock pattern has been somewhat disorderly, unpredictable to a large extent and I feel most uncomfortable with this sort of erratic pattern. This pattern is also often exhibited by small caps and I am more inclined to throw back small caps as soon as unpredictably creeps in. In my early days of hard core trading I must confess I bought and sold aggressively – with heavy leverage at times – CFDs – in super – which is something of a contradiction. My attitude has changed much for many reasons not the least of which is lifestyle. Now I wish to look for sustained growth and I am more prepared to ride out many more storms than before. Our rationale will change from time to time. The vehicle you use for holding your shares is also a major determining factor when considering a sale - as is tax issues – and the two topics are closely related. The extent to which we are leveraged is also more vital than most people think. Many investors right now are heavily leveraged – off the bumper equity they have found in the family home. Many also borrow money against equity in their home and then use this cash in a leveraged account which means they are tripling or quadrupling their leverage. Great if the market is rising but if a crash comes then you lose money at a much faster rate than you had made gains on the market ride to the top. Everyone’s situation is different but regardless the coming weeks and months is good timing for a review of your own situation.

Enjoy the ride

Tom Scollon

|