I remember just a few years ago suggesting to a local shopkeeper that I would be ‘’tapping’’ rather than paying cash. The chronic irritant had lost his sense of humor after numerous years of 4:00AM starts and was quick to dismiss me.

ATM machines days are numbered – as we move to a cashless society – a long term dream of governments. But I have been reminded many times in life – ‘be careful what you wish for as you may just get it’’ Governments will now have the ultimate for a cashless world and will be faced with managing an unregulated money system – i.e. cryptocurrencies. Not just Bitcoin but several. Cryptos of course have their own peer to peer regulation – the definitive in discipline which is key to their growing popularity.

Years ago it would have never crossed my mind I would one day write an article on this relatively new phenomenon – although they were first muted almost a couple of decades ago. But now they see the light of day to the extent that Bitcoin futures listed this week on the CBOE.

Yet many governments deny its reality. What shape cryptos will take over the next couple of decades I dare not speculate – though we do have enough price data to get a sense what might happen to its price over the next couple of years.

So to access the data in your HUBB software, the code is FXBCUS - we have designated it FXBCUS (Foreign Exchange+Bitcoin+United States) and it is mapped to the Bitstamp Bitcoin and we have created data going back 8 years*

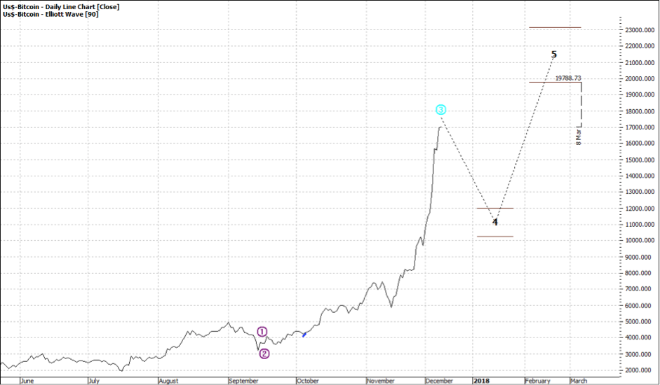

Let's first look at the daily:

|

Bitcoin (FXBCUS) - Daily Chart:

|

|

|

Click to Enlarge

With the sharp dramatic move in the last two weeks it is not surprising that we are already seeing signs of a pullback – it is just following Elliott form. But that is not to say that Bitcoin could not head to a valuation of 20,000 before a pullback. And at these levels many early adopters would be taking profits and the shorts would also start to appear.

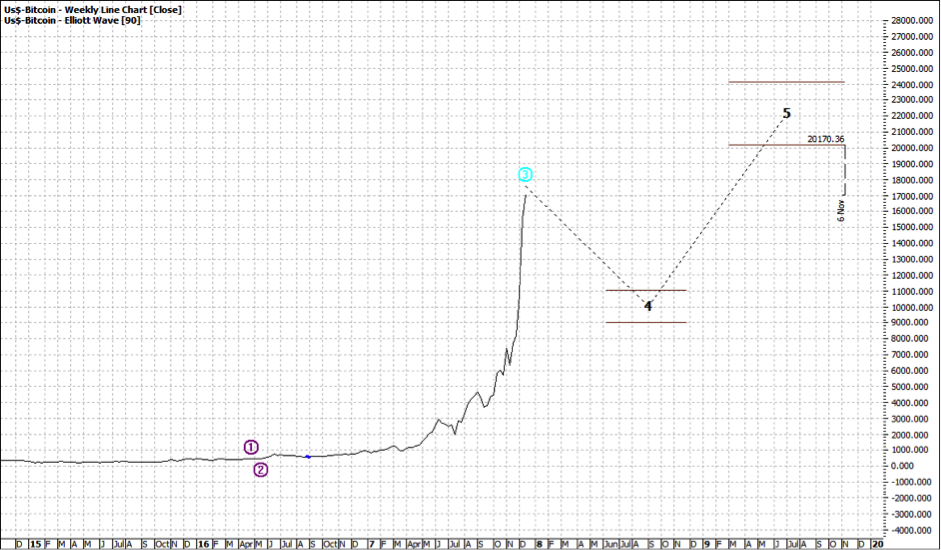

We can look at a weekly, but we are unable to glean much more:

|

Bitcoin (FXBCUS) - Weekly Chart:

|

|

Click to Enlarge

The differences are marginal in price and timing.

Love it or loathe it Bitcoin is not going away. It will continue to make headlines as there will be much volatility – but also much discussion as regulation authorities see a growing secondary adoption and will be forced to form a view about controls.

Enjoy the ride

Tom Scollon

*Note to ProfitSource clients to find Bitcoin run a symbols maintenance wizard via the Tools menu, and ensure the Forex market is selected, this will pull down the new symbol.

Open a new price chart for FXBCUS and right click on the chart, then click on Data on demand, run a custom data on demand for 8 years as we added data going all the way back to 2010.

|

|

|