Amongst mail this week, is a request from a very long-standing client:

‘’Tom, any chance of having a look at MQG, the price is bouncing against the big $100 level and I was interested in your thoughts on its future. Many thanks, Jim’

When the stock or market review request is of general interest I will use this forum to respond – but I will always reply to you directly if unable to publish here my response to your challenge.

Generally many readers will have similar or same question for comment.

Here I go Jim:

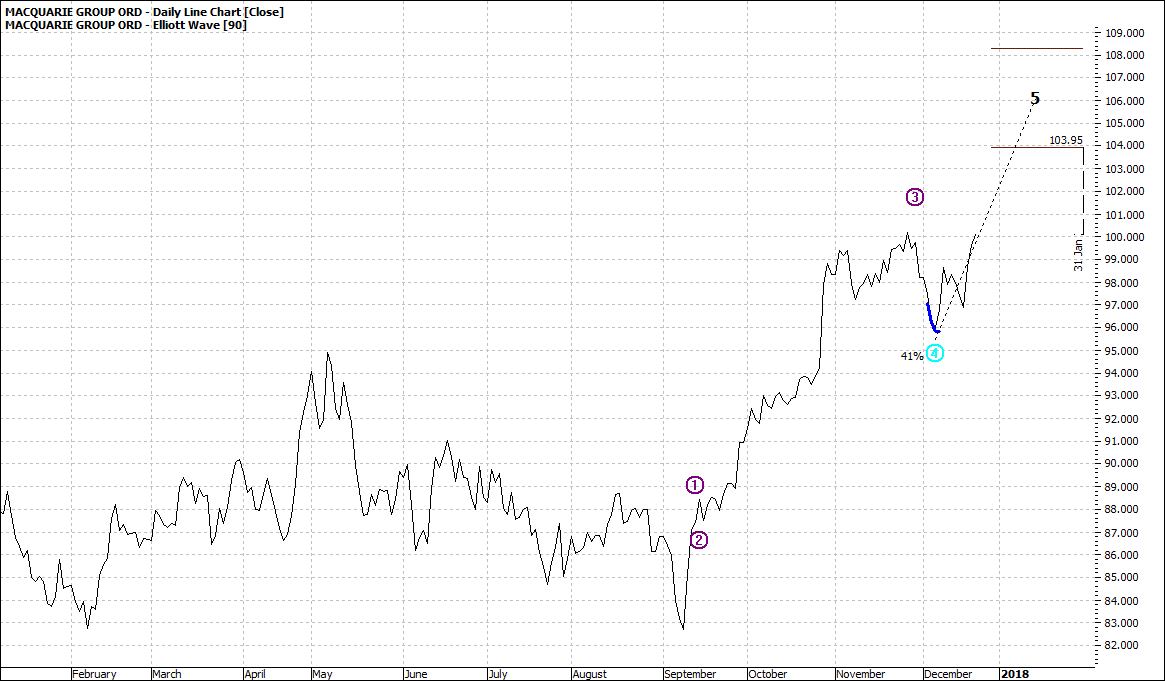

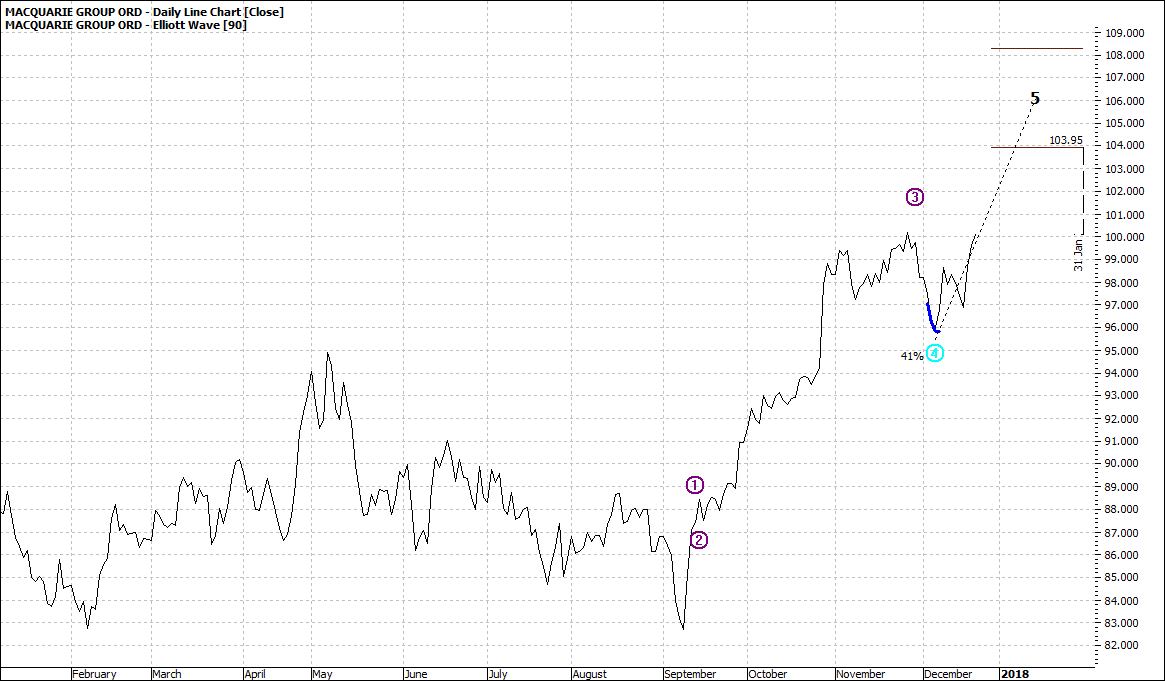

MQG – Macquarie Group – rarely far from the headlines – has been knocking on the door of $100 for the last six weeks – got its foot in the door November 27 and again December 20. The question is can it hold the $100 mark and then move higher.

In summary I think MQG will continue higher – but there will be retreats along the way.

What we see here is quite common for stocks and markets generally. When they reach a keystone level they can sometimes pause, vacillate and then sail through. Some hit the crucial level and then retreat. But I think MQG can make it.

Markets are weird. Now when I say markets, I mean people. Because a price is the sum of buyer and seller views. At crucial points some investors take profits while others will buy after resistance has been broken.

Let’s look at the charts:

Click to Enlarge

I always use a line chart for my own trading as it gives me a clean uncluttered view. But when I look at support and resistance I like to use a bar. A bar gives me the range for the day of week. The top of the bar gives me a sense of what some are prepared to pay and the bottom the level some investors will sell at.

The bar chart is more cluttered but also very telling:

Click to Enlarge

Of note is the gapping up we saw in October and again Tuesday this week – albeit a smaller one way this time.

Of note also is the Elliot projection – maybe a high of $104-$108 in the next month.

There is often much talk of a Christmas rally, but I think the new year rally can be more significant even though it is on smaller volume. For many reasons, not the least of which is Instos pushing up calendar year end performance? Performance bonus? I not suggest that.

If I am going to do even a shortish term trade – play – I still take account of the weekly picture:

Click to Enlarge

Maybe it only confirms the daily view – but it does caution us that the time frame for the top of wave five could be several months away.

An oft’ common issue for stocks in the Australian market that hit the $100 level is that many retail investors baulk at that round number and they then sell looking for cheaper stocks.

And lastly there is the question of ‘’stock splits’’ Never a straight forward answer Jim – but I hope this gives some food for thought.

Lastly A very happy Christmas to all our readers!

Thank you for your support this year – especially in our transition.

I can quietly promise you many positive changes in 2018 that will help you outperform the markets – our fundamental goal.

And, lets hope for a healthy and prosperous 2018 for all.

We will take a wee break but will be back by mid-month – barring any major market disasters.

Enjoy the ride

Tom Scollon

|