I don’t trade commodities, but I have always been around them over most of my working life.

Metals, in my days with BHP and then a British non-ferrous producer. In most roles I have had a need to follow the building and construction industry closely, so I have always followed such indicator metals as steel, zinc, nickel and the likes. And in my farming days I always had a deep interest in grains and sheep and cattle prices. So, I can say I have taken an ongoing interest in the macros that drive the global economy.

My main area of interest has been equities and in their various derivative forms. Amongst many factors, commodities have an influence on stocks that are involved with manufacture, farming and currencies. The weighting of influence has changed much in my business career times span with now there being less influence by the primary sector (agriculture) and secondary sector (manufacture). I suspect many ‘’old’’ portfolios have an overweight of these two industry categories. ‘’New’’ portfolios will of course have a much bigger emphasis on non-bank finance, services and technology.

So, these ever-changing factors have been the back drop to my investing/trading for the last 30 years.

Lets away to the charts and see if we can find guidance to the year ahead:

The first one is the CRB index – this is a high-level overview index and is made up of about 40% each energy and agriculture and the balance metals. It is a health index to me for the global economy:

Click to Enlarge

It is not a very encouraging index to start with, but it is a reality check also. All the charts today are weekly – so do not be alarmed. This chart subscribes to the view that maybe there is some ill ease in the global outlook. Not driven by specific commodity issues, but rather geo-political factors. There may well be other views as to why we may see some easing in the coming couple of years – but the reason ‘’why’’ rarely interests me when I am purely focussed on the technicals.

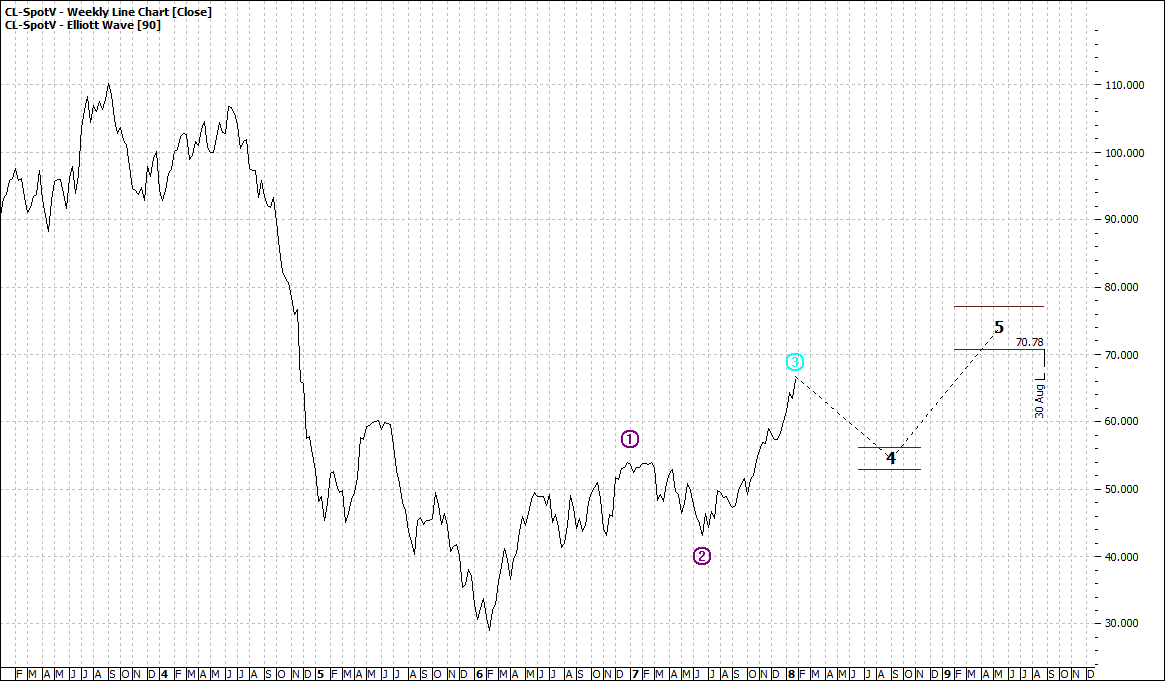

Oil is still an important indicator of global momentum – but its importance is decreasing progressively and we will see that bear out in the coming couple of decades. Regardless, the momentum we have seen recently may well continue over the coming year or so.

Click to Enlarge

We cannot look at the year ahead without looking at gold – but again its importance is lessening – as is momentum:

Click to Enlarge

Zinc is a commodity that is more telling as it is an indicator for the growth economies of the world – Asia, Africa etc as opposed to the now stable mature economies of USA, Europe etc. We can see that there has been considerable growth in ASEAN and BRIC economies in the last couple of years. Maybe we might see a pause in the year ahead after rapid fire growth - not a bad thing.

Click to Enlarge

Nickel is the higher income growth metal index in that it is used in mainly stainless steel – expensive end products as opposed to zinc/carbon steel products which are used in low-cost entry level housing in the developing countries. Increasing nickel demand will happen as global per capita increases – e.g. as air conditioning affordability improves in emerging countries.

Click to Enlarge

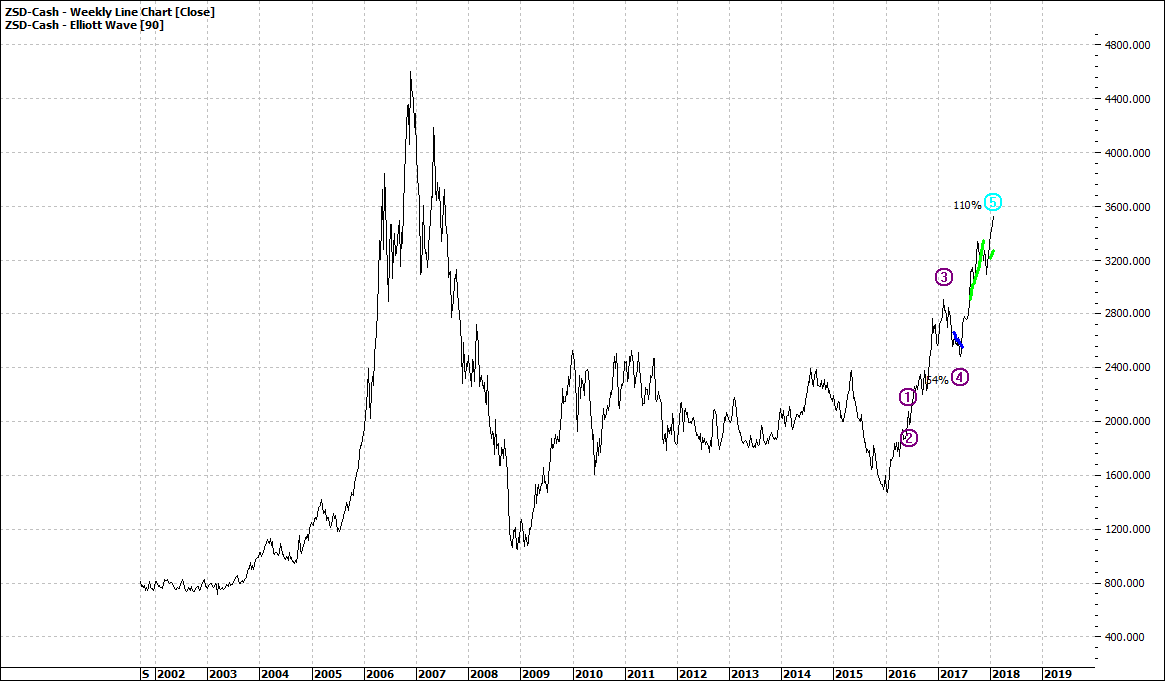

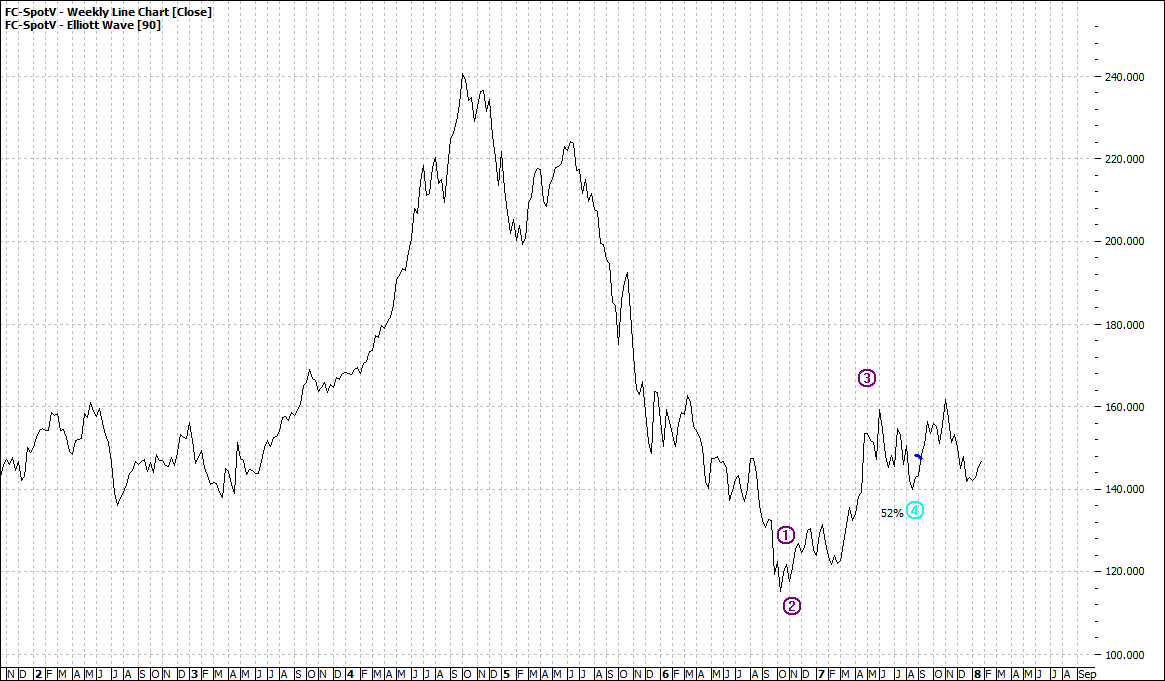

The three charts below are my key indicators for the agricultural industry rice, oats and feeder cattle. They give me clues about global climate and grain production and thus supply and demand. Feeder cattle prices are influenced by many factors such as availability of affordable grain, natural fodder and thus climate but also if demand is growing for feeder cattle that can indicate that the emerging economies are finding meat more affordable.

Click to Enlarge

Click to Enlarge

Click to Enlarge

Now the above charts may not help you directly make money on the markets – but they are an important backdrop to financial markets and can be a guiding light. They enable a wider vision rather than a narrow one and thus aids an open mind – essential for successful, diversified investing.

Enjoy the ride

Tom Scollon

|