I would like to continue a little more on the big picture clues which form the background to investing or trading.

There is a close link between equity markets and interest rates.

Simply, as the cost of borrowing – that is the price of money, falls or rises this is a precursor to the future direction of the sharemarket - in broad terms over the medium to long term.

Interest rates – heavily influenced by the price of bonds – determine very much what investors will do with their money.

As interest rates rise investors will become more cautious, particularly with property and shares. We have been seeing this in Australia in the last several years, where property prices have defied global trends and sky rocketed but are now starting to look especially soft. If your property is your family home, then you are less likely to be concerned about property prices.

Unless you bought in the last couple years or so and you borrowed heavily.

Interest rates are in simple terms the inverse of bond prices.

They move counter to each other, over time.

If we look at say USA T Bonds, we can see that bond prices climbed steeply 2013 to 2016:

Click to Enlarge

Meaning interest rates plummeted in that period – mainly because of global central bank stimulation to reverse a seriously free falling global economy and secondly to stimulate future economic activity.

Some analysts would argue that when you have artificial intervention then markets will have their way eventually – though it can take some years to take effect.

We can see from mid-2016 that bond prices have fallen – meaning interest rates have climbed back from their lows of 2016. Of course, markets know that < 1% interest rates could not last for ever – even though the average consumer/buyer may have been sort of encouraged to think that.

We can see that in the last two months the fall in bond prices has been very steep.

Back to basic economics.

So, we know that there is an inverse relationship between bonds and equity markets. They move in opposite directions over the, medium term. So, we have seen falling bonds in recent weeks and in turn rising interest rates. BUT equity markets have been rising – in many case to all-time records – at time when they should be holding steady or even easing off.

As sure as night follows day, equity markets will follow interest rates. And if we see a period of disconnect then the catch up could be rather abrupt.

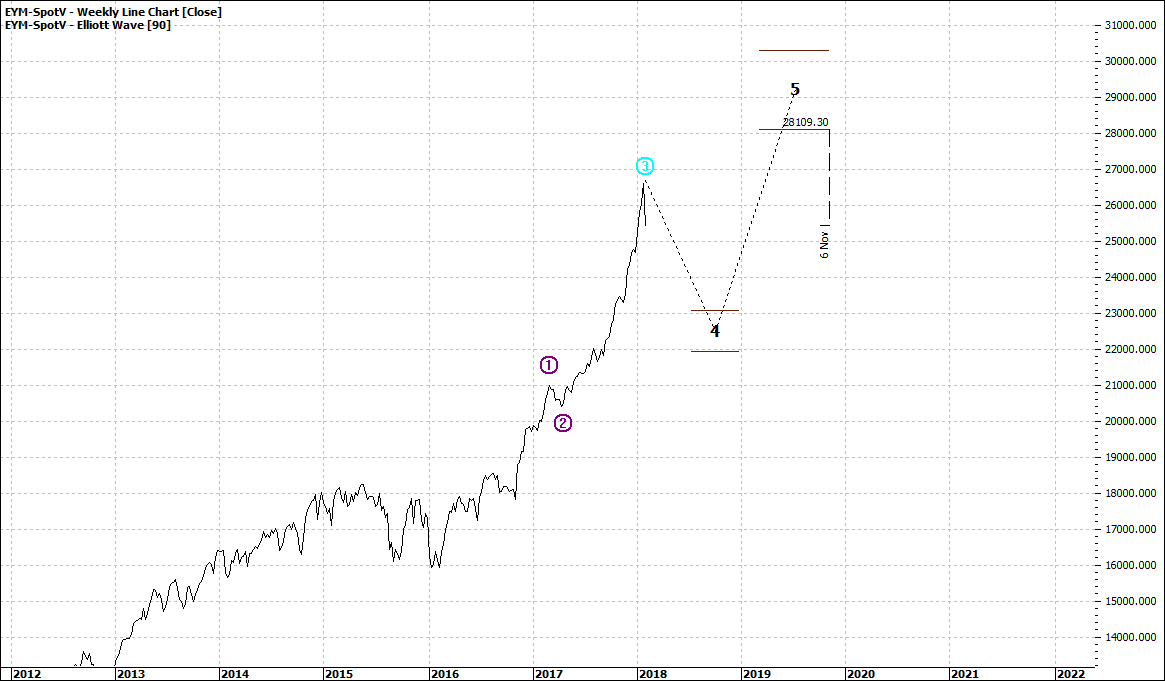

So, we see that the USA equity markets have experienced a sharp fall in the last two weeks and especially Friday:

Click to Enlarge

Now this is likely to be a baby

correction. Just as this correction was inevitable

so will be the big one:

Click to Enlarge

Though it may playout in the latter part of

this year and maybe into 2018.

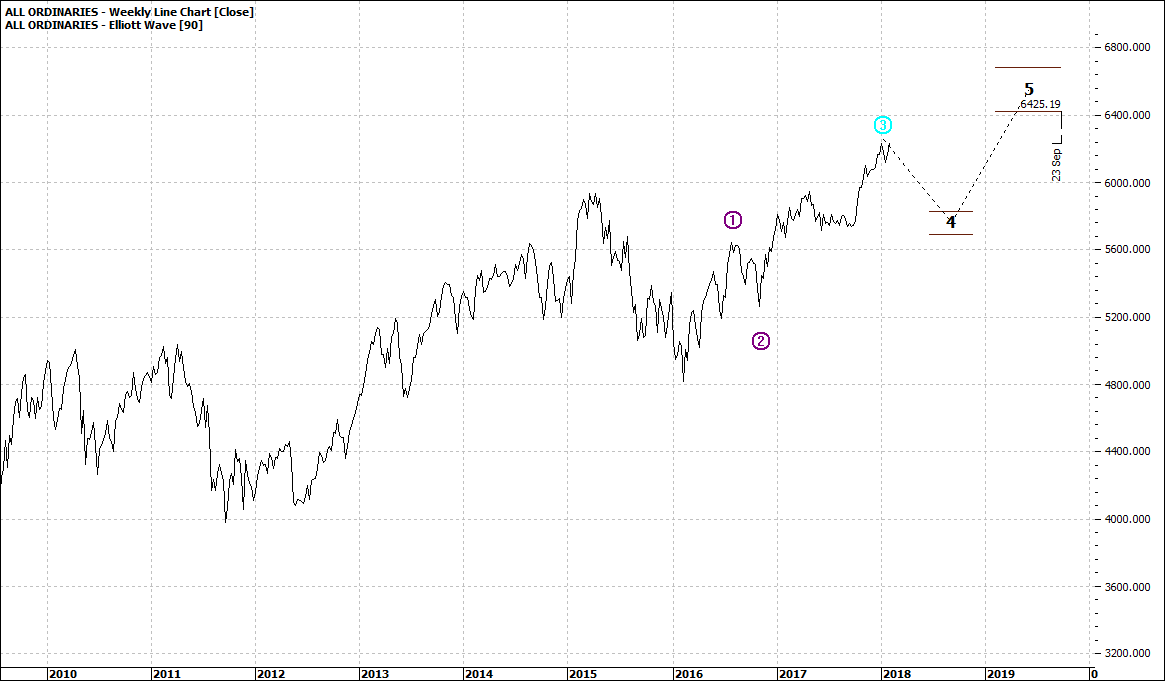

So, what about our Australian investors?

We have not seen such sharp rises and falls

in either bonds or equity markets in Australia:

We have seen steady bond prices:

|

ASX 3 Year Bond: ANY-Spotv

|

|

|

Click to Enlarge

And relatively moderate movements in the All Ords:

Click to Enlarge

So, we are unlikely to see any implosion in the Australian market.

Lastly the fear index – the VIX:

Click to Enlarge

We can say from the above – monthly chart – there have been few fear phases in the last 20 years – except of course 2007/2008 when the market totally freaked out. Some periods of touch and go in the last two decades but overall fear has been low. This can also equate to investors turning their back on the markets.

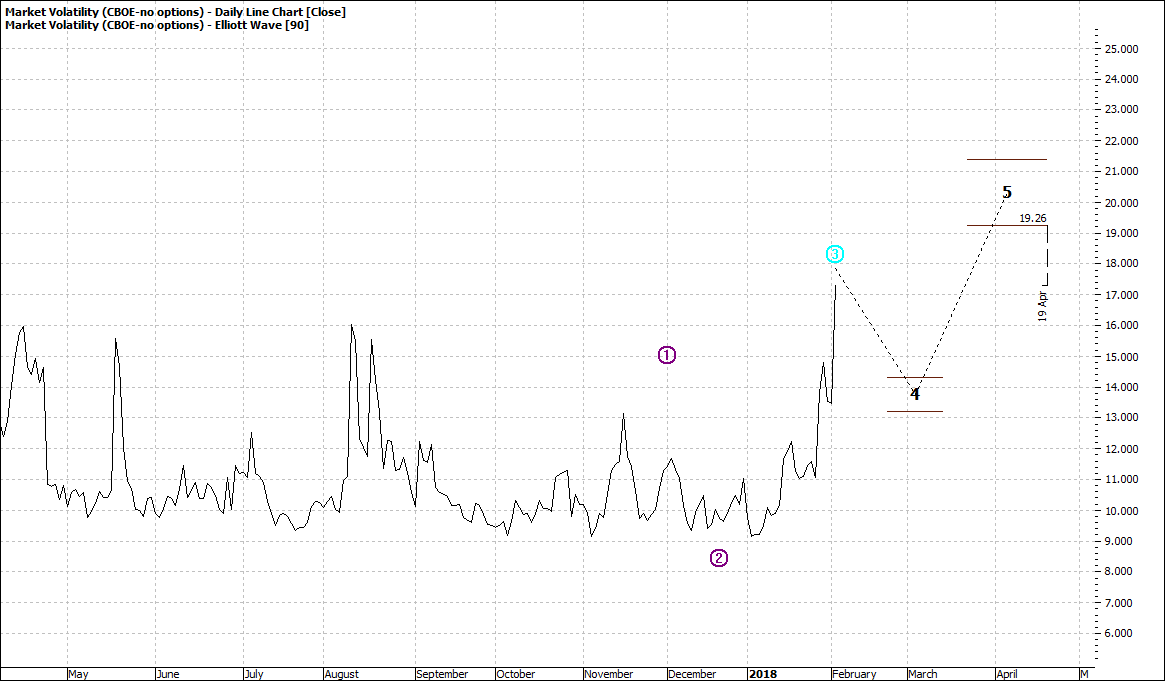

If we look at the daily VIX:

Click to Enlarge

We can see fear has crept in over the last month. And it may well continue to caution investors in the coming weeks.

Pressing buy and sell buttons is the easy bit. More importantly developing a sound plan based on macro indicators is an essential part of success in the markets.

Enjoy the ride

Tom Scollon

|