A terrible expression but a sort of euphemism for stocks with appalling performance – in Australian parlance. Not to be confused with an investment strategy of buying high dividend stocks on the DOW – the so called ‘Dogs of the DOW”’.

Here I talk of stocks that have constantly turned in bad performance – yet investors hang on.

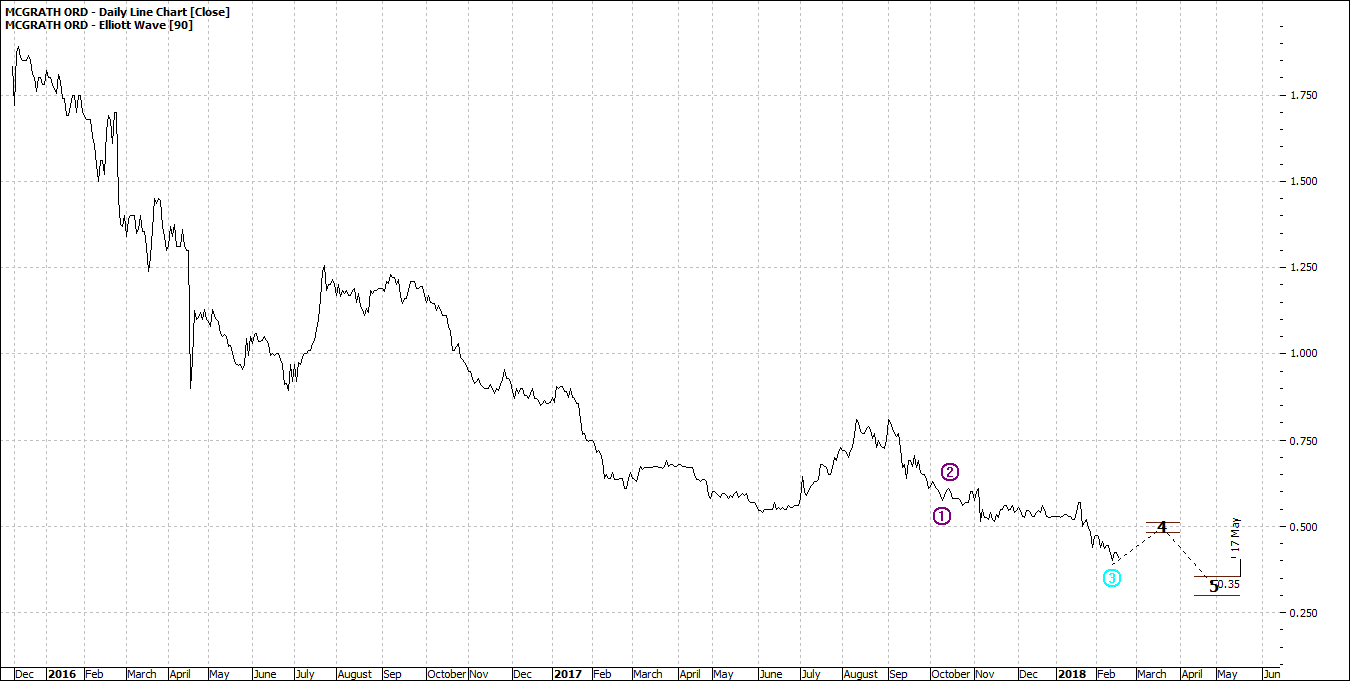

My three dogs for the week just finished, are Telstra, Myer and McGrath Real Estate - TLS, MYE and MEA.

Let’s look at their performance:

Click to Enlarge

Click to Enlarge

Click to Enlarge

All three have much in common. All are household names owned by average

investors who have lost a lot of money.

The demise of all three have been

frequently on the front pages. Yet there

are still buyers – where there is a seller there is a buyer. Maybe punters.

I can understand mums and dads investors

may not quite understand all the machinations of the markets, but I ask what

have the board of directors been doing other than creaming with fat director

fees?

How can they sleep at night or hold their heads high?

I would be ashamed

to have my name associated with any of these companies.

What have management been doing?

A further characteristic of all falling

stars is that there are many many warning signals to get out, yet many investors

hold on with a glimmer of hope that they can get their money back.

Be not ashamed to have a dog in your

portfolio.

But be tough on yourself if

you do nothing.

Rule of thumb is 10% - I am unhappy if a

stock goes the wrong way by even 5-6%. I

constantly review my positions and am quick to cut loose anything that could

become a loser. Always spring cleaning.

I have experienced the pain of making paper profits and allowing them

later to become realised losses.

To stay out of trouble regularly take a

hard look at not just your portfolio but also your strategy.

Enjoy the ride

Tom Scollon

|