The Australian market is set to nudge higher and will eventually climb to the old 2007 high. Right now, though it faces a little bit of a struggle.

Lest look at a few charts:

Click to Enlarge

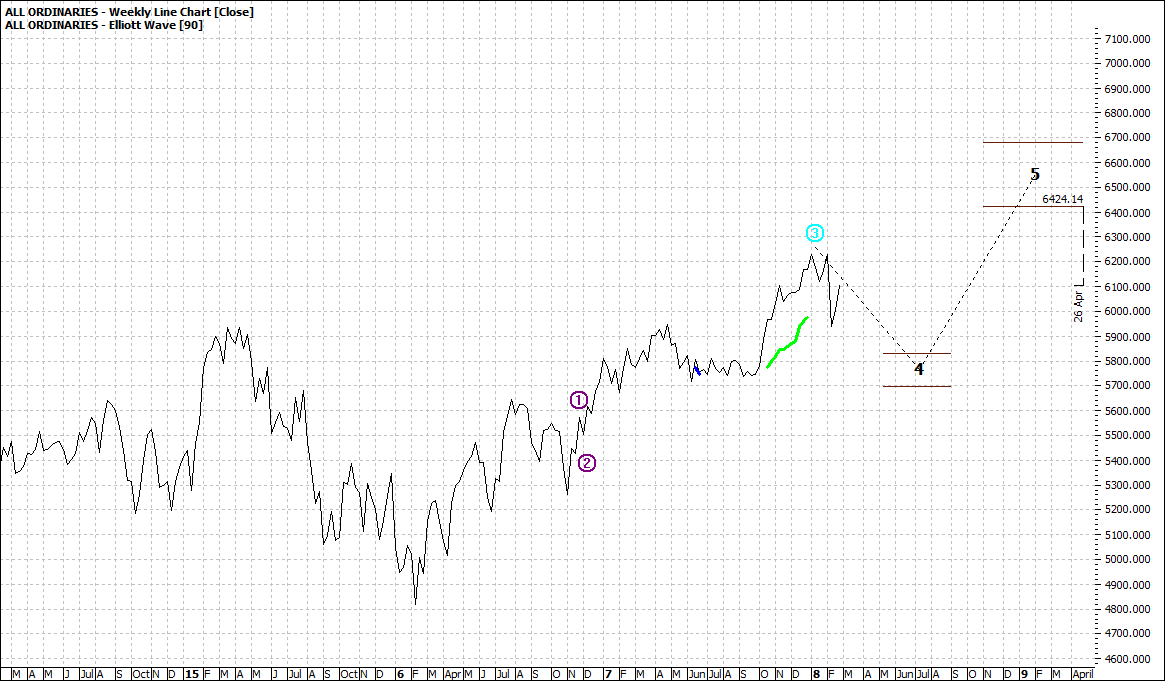

This is a weekly perspective and as you can see there is risk to the downside before an attempt at a new significant high:

Click to Enlarge

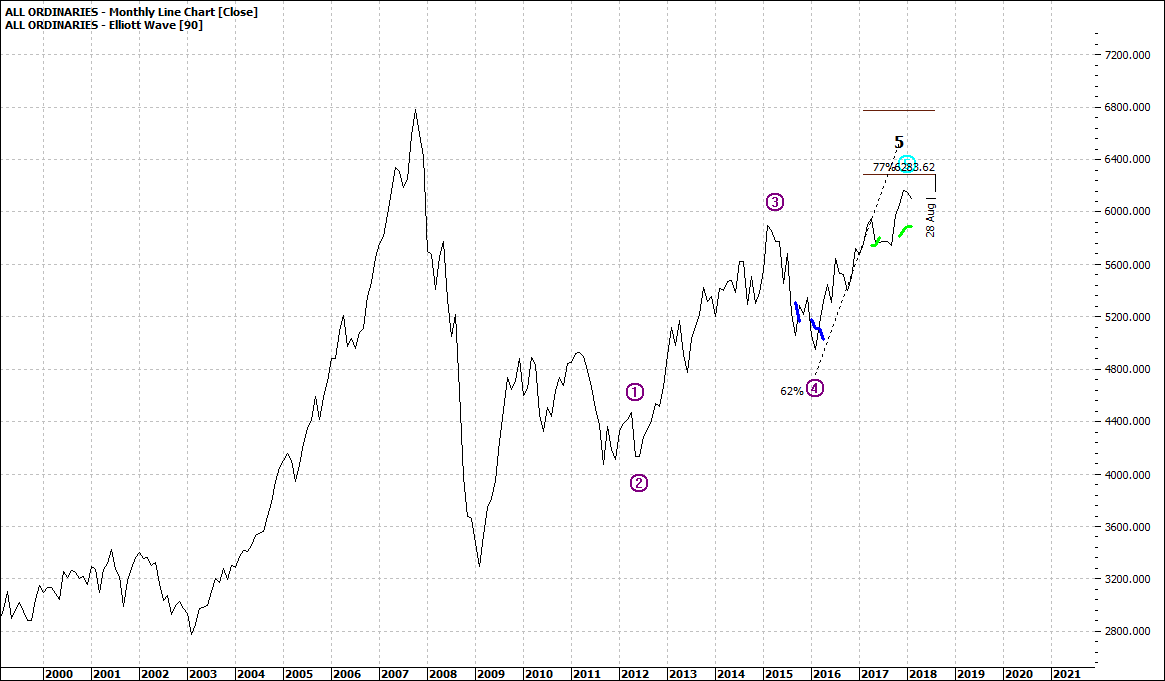

The last chart is monthly, and it suggests a near significant high sometime this year.

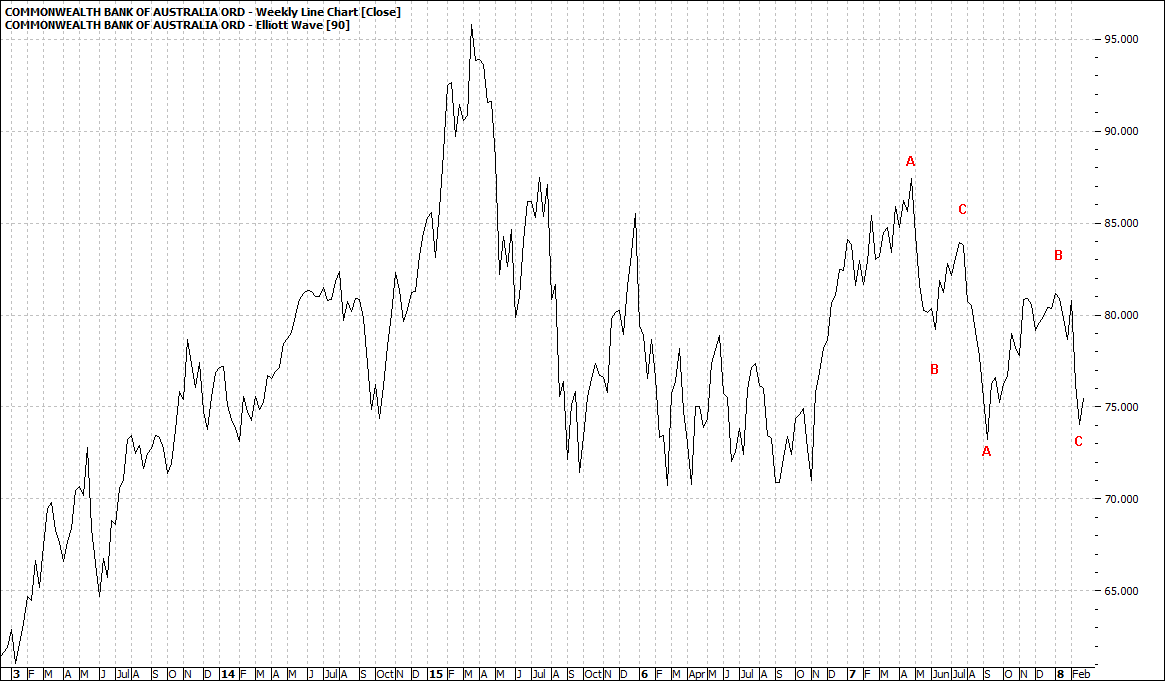

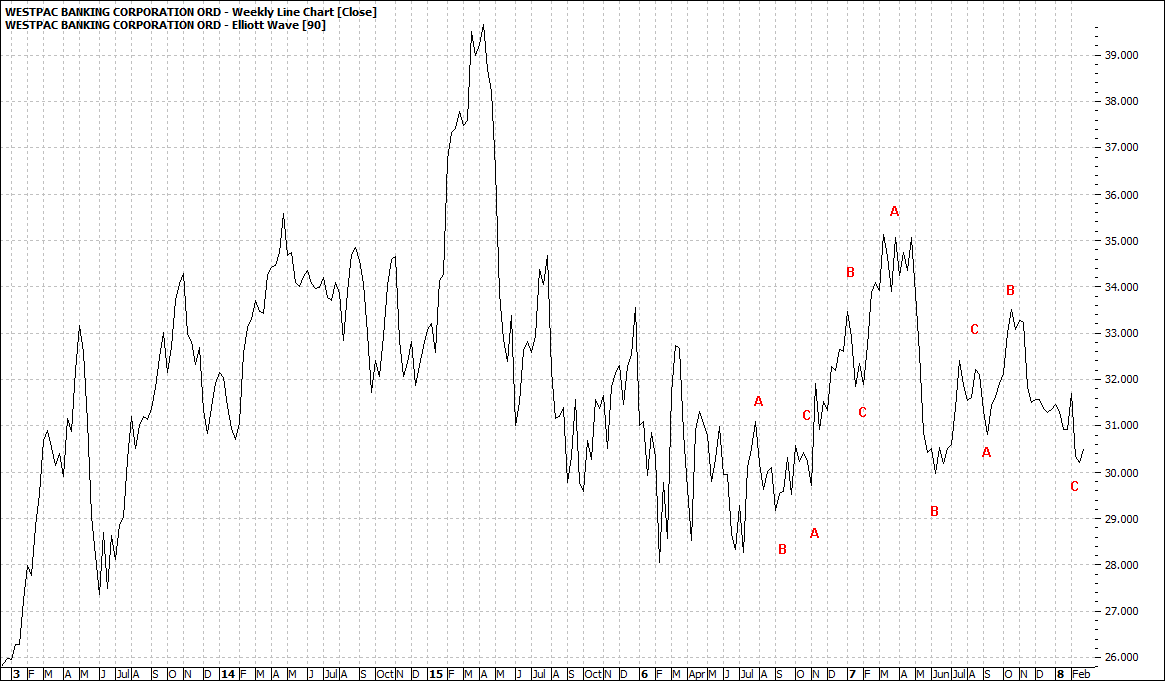

Let's look at the key banking charts:

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

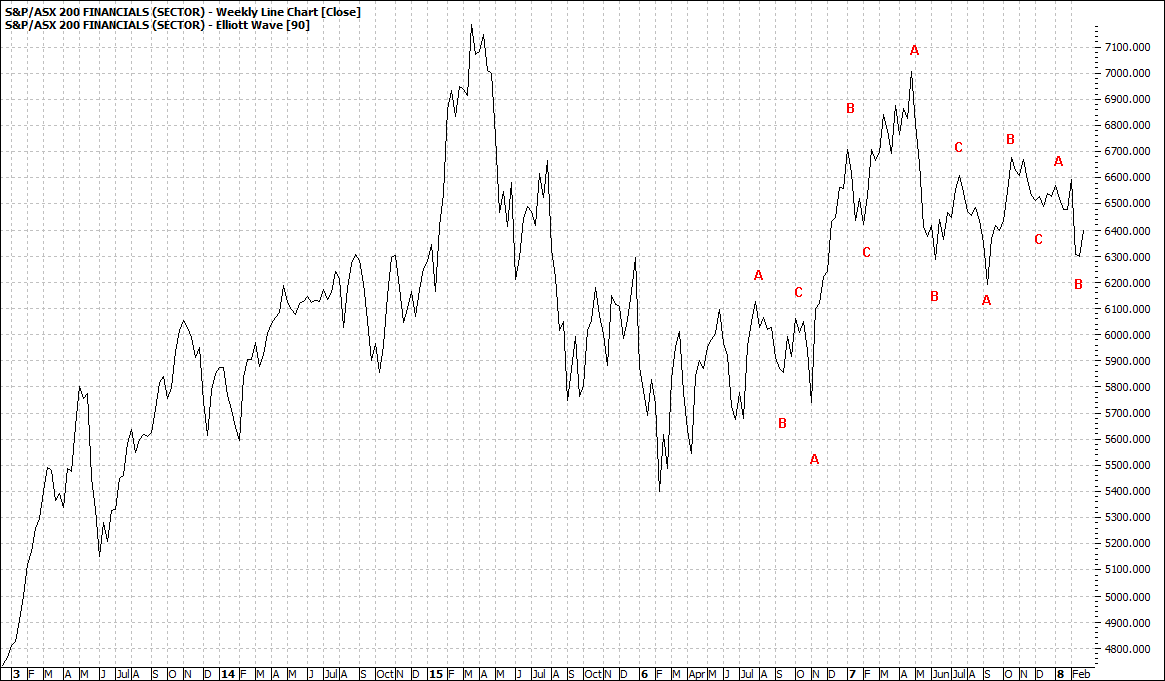

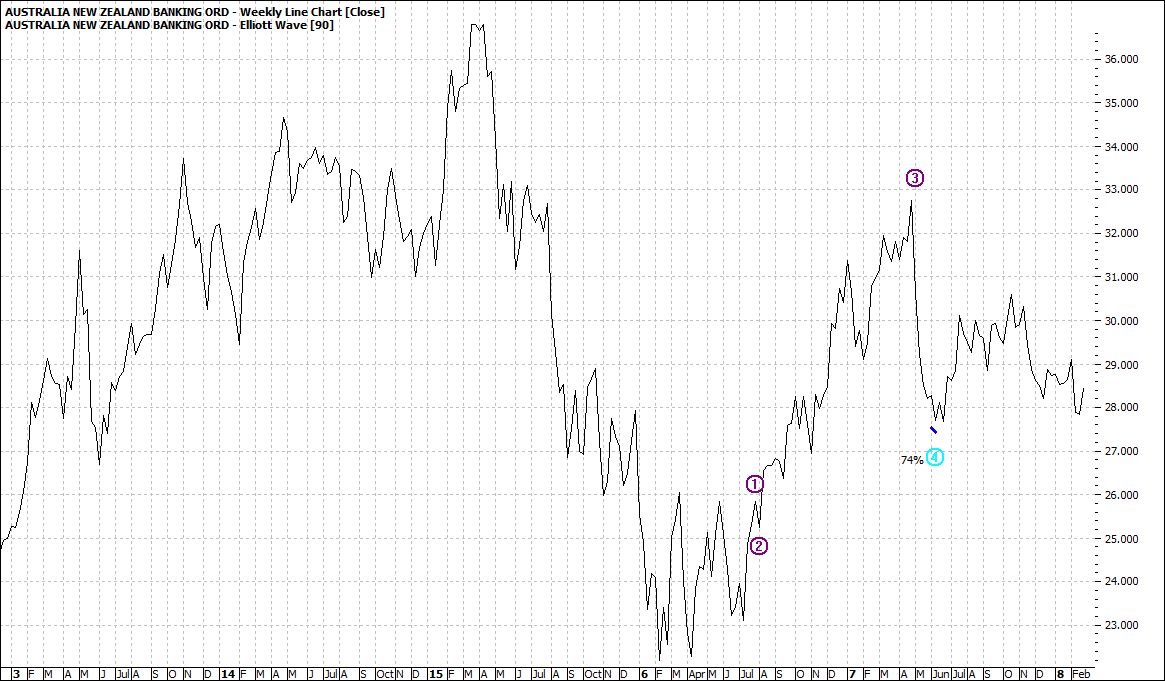

All are going nowhere and as the XFJ makes up a third of the Australian market the overall market needs a robust finance sector to take it higher.

Banks especially provide great franking credits and thus are popular in super and retiree portfolios and important in providing tax breaks and income flow. For this reason, it is rarely selling pressure that causes the Finance sector to struggle.

But it does need strong buying to push prices higher.

For various reasons Fund Managers have recently re-weighted away from banks, though Funds will support a baseline level of buying because the charter of some Funds ensures a certain amount of buying – even if the market was falling!

Enjoy the ride

Tom Scollon

|