Well that was what happened at school in the not so politically correct days. It did me no harm.

In my first 25 years on the corporate ladder I walked for blue chip companies and in those companies and in those days doing anything that lacked propriety was a no-no.

In fact, divorce at one of my blue-chip employers meant your career would stand still.

I am not saying that everything was squeaky clean in the twentieth century but certainly life has become faster, slicker and dare I say not always straight and at times down right sloppy.

Recent stocks that I have written about that have misbehaved have been caned by the market – as you would expect. What amazes me is that boards are so tolerant. I am stunned by their leniency.

After I finished the blue-chip phase of my business life I became involved in venture capital and corporate restructuring and that was something of an eye opener.

I bore witness to many, what I would call dodgy capital raisings.

I witnessed first-hand the foundation entrepreneur who thought he could walk on water (I sometimes thought I could) who had been a rising star and were prematurely ‘’living the life or Riley’’ only to come crashing to earth.

The so called independent directors are paid generous stipends to hang in there when the ship is bouncing around at sea.

I frequently ask myself why it takes near death before they bring in the doctor. You the shareholders can see it a long way ahead and I am pleased to see you bail out when you are no longer a believer.

This week I look at Retail Food Group.

I pass no judgment on the company, management or board and do not link my comments to RFG. I only look at the technicals. I can only see from my distance and have no wish to be inside the machinations. And therefore, I cannot comment on the fundamentals or strategy of that company.

When I trade I put aside judgment and I am usually well gone before any form of slide happens. I was well taught at the school of hard knocks. There I learnt relatively quickly after a few early mistakes.

So, let’s look at RFG:

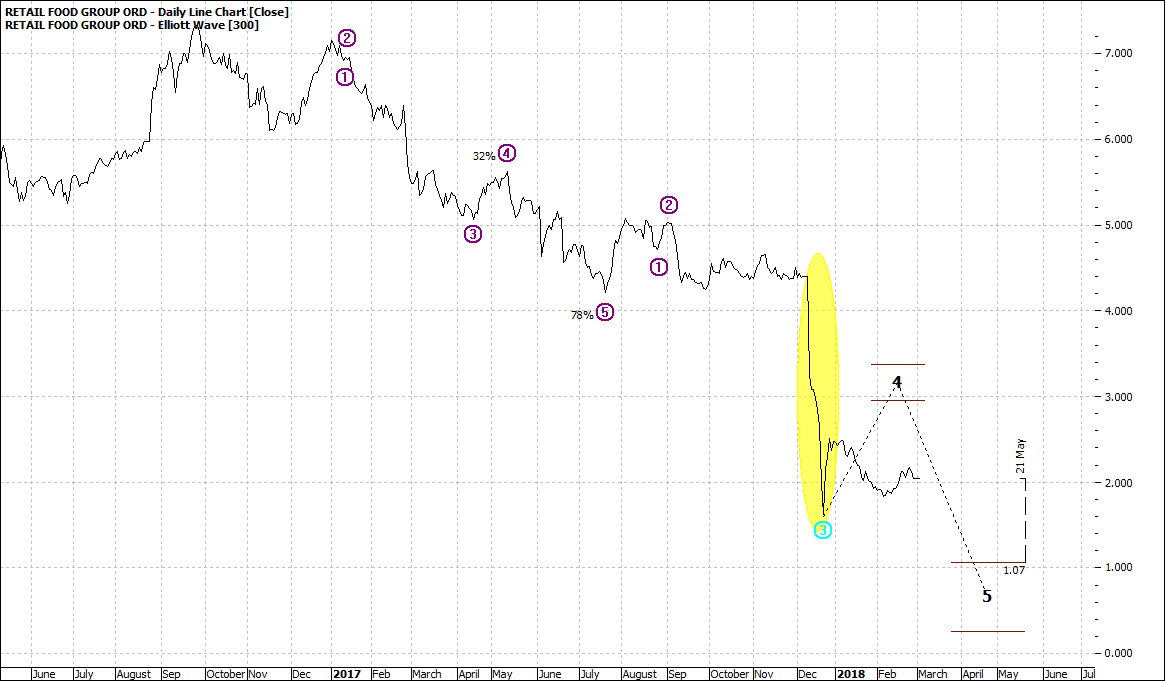

Click to Enlarge

Not caned this week even though they were late with their accounts – always an alarm bell to head. But look at the yellow shading in December. The smart money knew something in November and deserted the stock December. Retail traders thought it was a bargain and bought in.

No such thing as a bargain.

So where to from here?

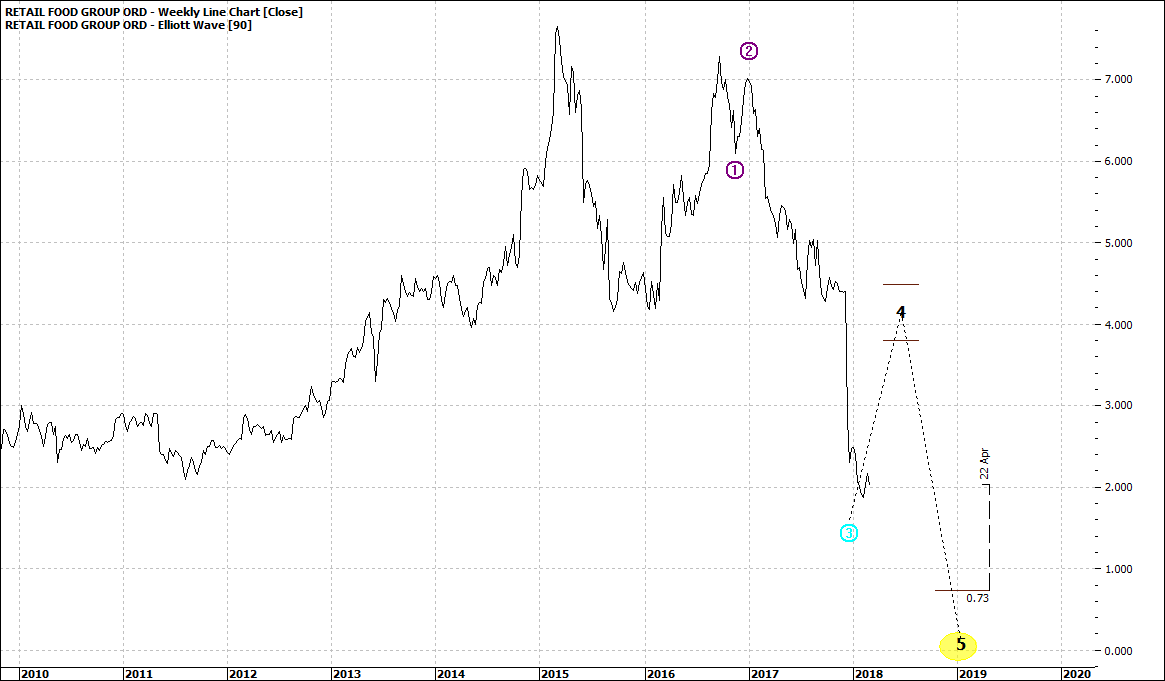

Let’s look at the weekly:

Click to Enlarge

A recovery? Dead cat bounce more likely. As more bargain hunters buy in the big boys sell the last of their holdings. Some become over eager and dump too quickly their holdings and price collapses.

Of course, the board will be ruminating. I know nothing of their thoughts. But I have seen so often such a scenario.

Note the little yellow highlight. It is a highly probable wave five low and it so happens to be zero. That is the stock is delisted – could be because of a ‘’buy out’’ or the business goes into receivership and assets are sold off to recover some value, tiny as it usually is.

I not waste my time hanging around to see what might happen. As I allocate a certain amount of energy to trading and can only focus on positive opportunities.

After all the making of money is a serious business but not the only pursuit in life. I waste no more time on this stock

Enjoy the ride

Tom Scollon

|