Well there is no reason why they must be.

Despite all the headlines of a rising China and Russia as super powers – which have foundation - the USA is still the leading global financial power.

That is not to say that global markets look to the USA each day to see whether they should go up or down.

But if any market diverged too much, they would be quick to analyse why.

Now I am not talking of the longer term and what the economic power rankings might be in 15 years, but for now and still many years to come, the USA markets is where the action and volume is.

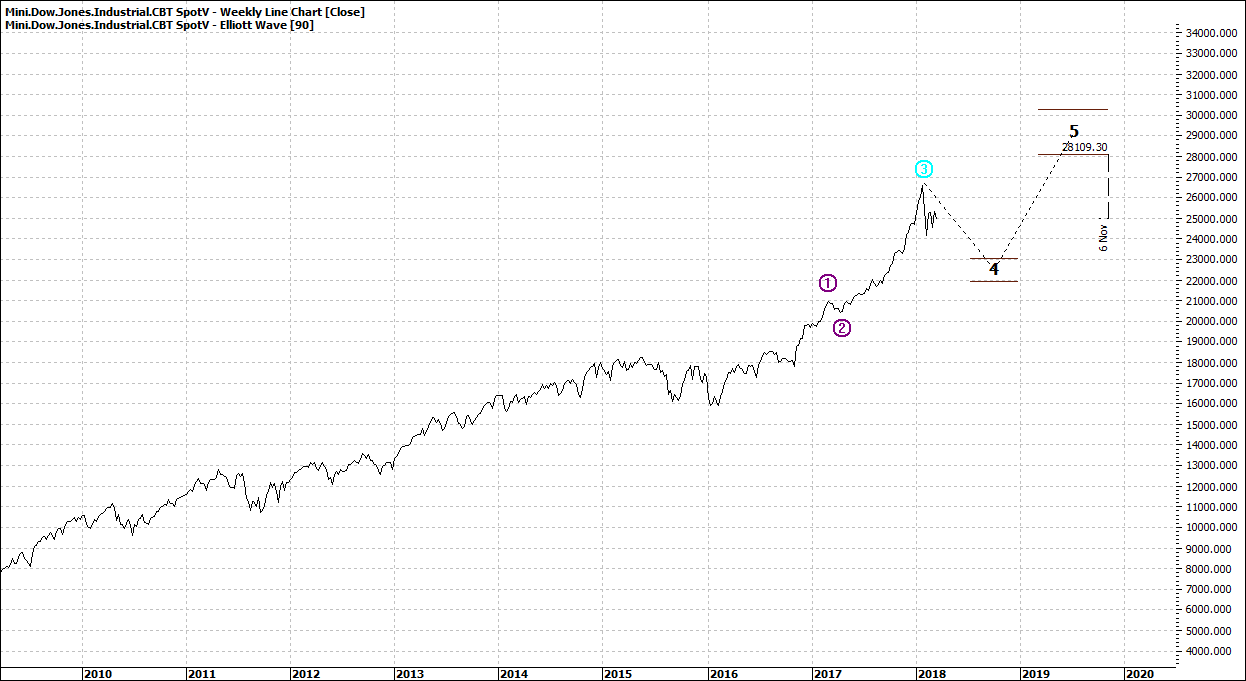

Let’s look at some charts – the Oz XJO and the USA mini Dow Jones:

Click to Enlarge

|

EYM-Spotv: Mini Dow Jones

|

|

|

Click to Enlarge

The first aspect that hits us in the eye is that the Dow is in a wave four retreat – and it appears an orderly one at that. The XJO is not in retreat but rather is struggling along to new highs; with some drifting and sideways tracking along the way.

The Oz market is in fact still limping along to the old `high of 2007. The USA markets took out that old high some five years ago.

In fact, since the lows of 2009 the US market is up over 350%. The Australia market up only 81%.

So, we have seen a vibrant US market but a lacklustre performing market in Australia.

Maybe why one might look at leveraging into US markets with US options. Not now but perhaps after a pullback.

The beauty of US options is that they enable you to diversify and in fact spread risk and take positions in any market whether they are trending up or down or range trading.

They also enable you to hedge against a more conservative market like the Australian. Derivatives in the USA offer a very liquid and massive market offering untold opportunities.

They are generally short term plays whilst biding time in an otherwise tame and quiet market.

Not for everyone but not to be ignored as for many investors the Australian market can be a bit like watching and waiting for paint to dry.

You could of course invest in Asia or the BRICS – but take it from me; this requires a huge amount of research and risks are many times greater than a transparent market like the USA

Enjoy the ride

Tom Scollon

|