I am inclined to think this is mere posturing.

For China, who take a 50-year plan perspective, well; it is nothing to worry about for them as they will soon be the number one economic power.

Political and defence supremacy is a different issue...

Regardless, though we have seen two days of sharp falls on the USA markets, everything is going to plan.

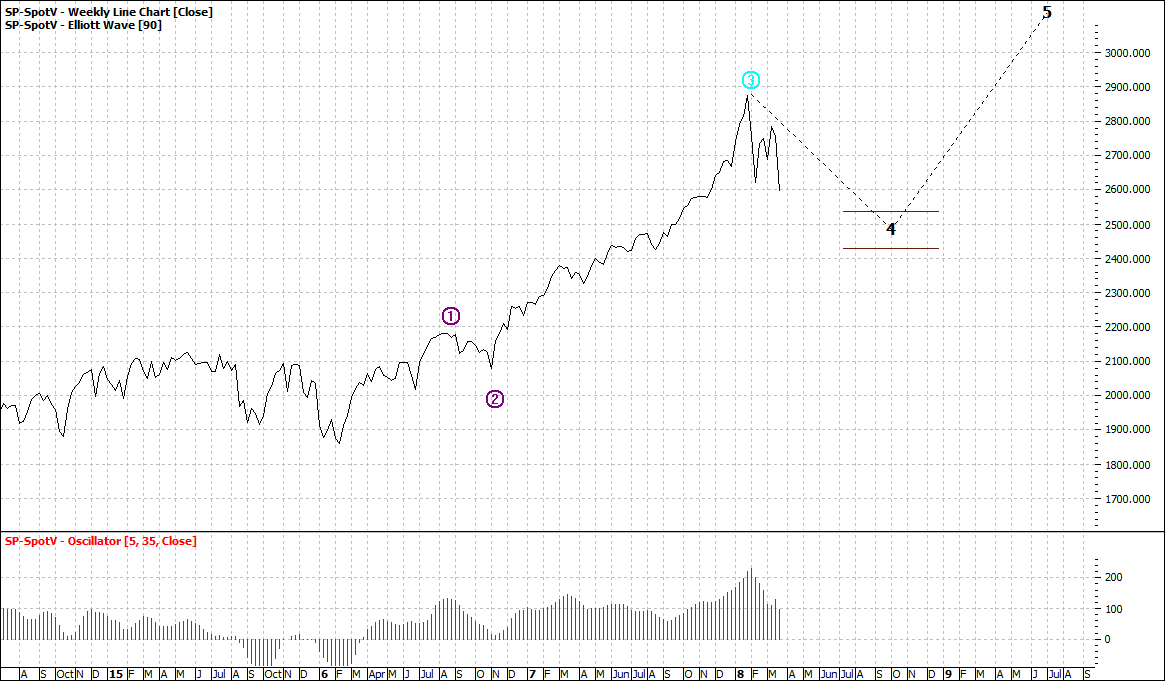

Let's look at the top 500 US stocks index:

Click to Enlarge

We see the long-unhalted run up since 2016 – well and before that – and so what we are seeing is a mere correction.

We could see some more sharp falls, but all is as per the Elliott forecast for the last few weeks.

And you don’t even need Elliott to tell you a pullback would happen...

I have also shown the oscillator as that is a useful guide when the pullback may be complete. At every pullback for stocks, indices, derivatives I always use this very visual guide.

So, my expectation is that the oscillator will come back to the zero level – about – we may then see some consolidation followed by a move up to the projected wave five; and this medium term five-wave impulse move would be largely complete.

We could see a second wave five but that is neither here nor there...

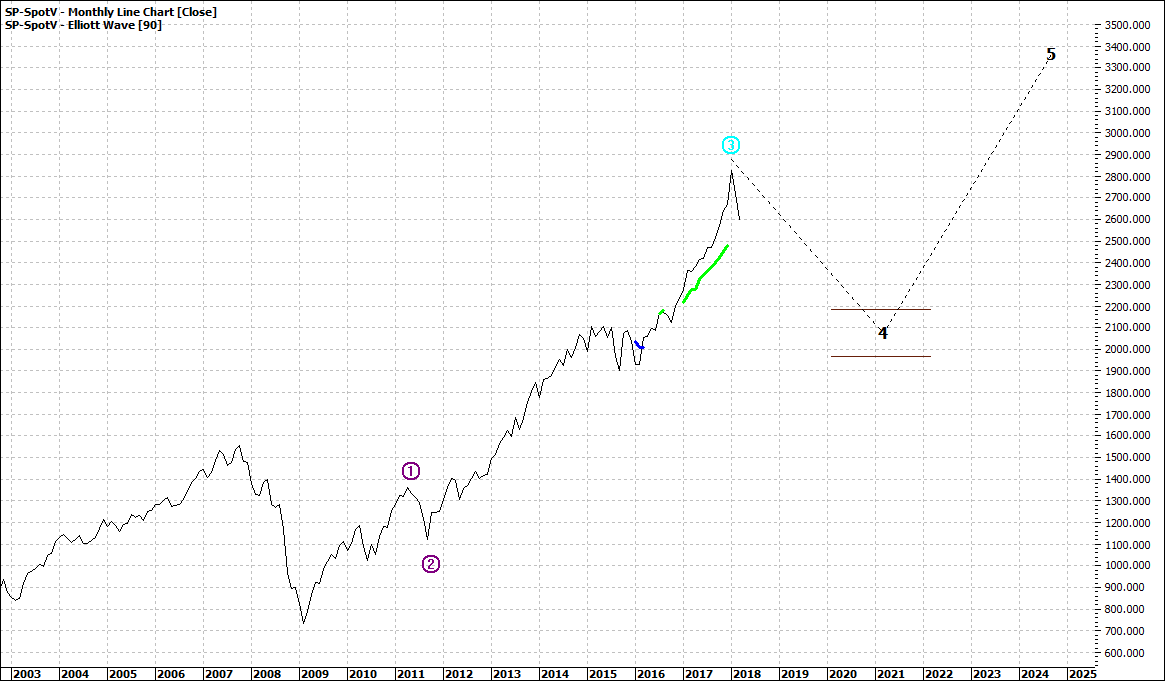

This large move since 2009 as per the next chart will finish with a major pause before deciding what to do next.

Click to Enlarge

You will note there is a major pullback projected in 2020/2021 and then we could see a new screaming high for markets. Well this is a monthly chart which I like to look at from time to time. But I bet nothing on it. I look at it as a matter of interest.

Of course, we will see the S&P fly to 3200/3500, but that is really pie in the sky stuff and much can happen along the way.

Many scenarios – if fact all you can think of - are possible.

Enjoy the ride

Tom Scollon

|