I took a quick look at all stocks in the top 100 ASX to see what is driving the local Australian market – or perhaps even holding it up, you might say, as it does look to be struggling now.

Here is list of what caught my eye: ALL, AWC, ANN, ASX, BHP BSL, CSL, FLT and MQG. This list is not exhaustive by any means but merely some that stood out in a quick scan.

What did catch my eye was that none of these stocks are doing anything spectacular. There have been moves higher but also plenty of retreats – great for those who think that there is still more upside. But certainly, amongst the top 100 stocks I see few with strong upward trends.

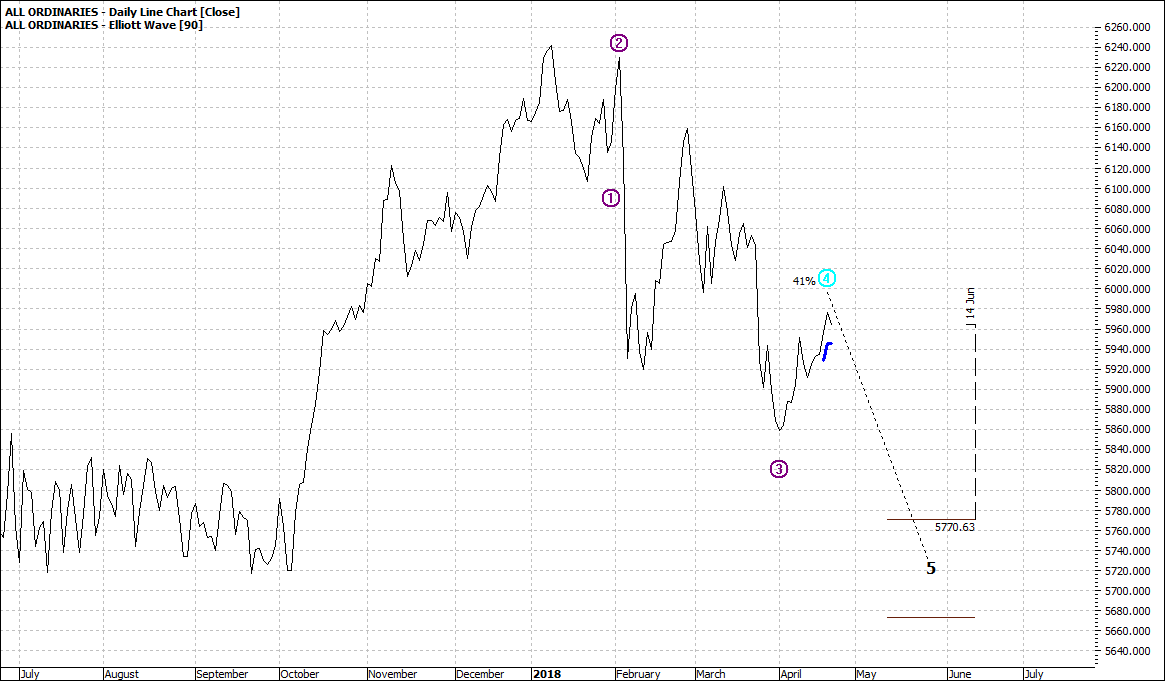

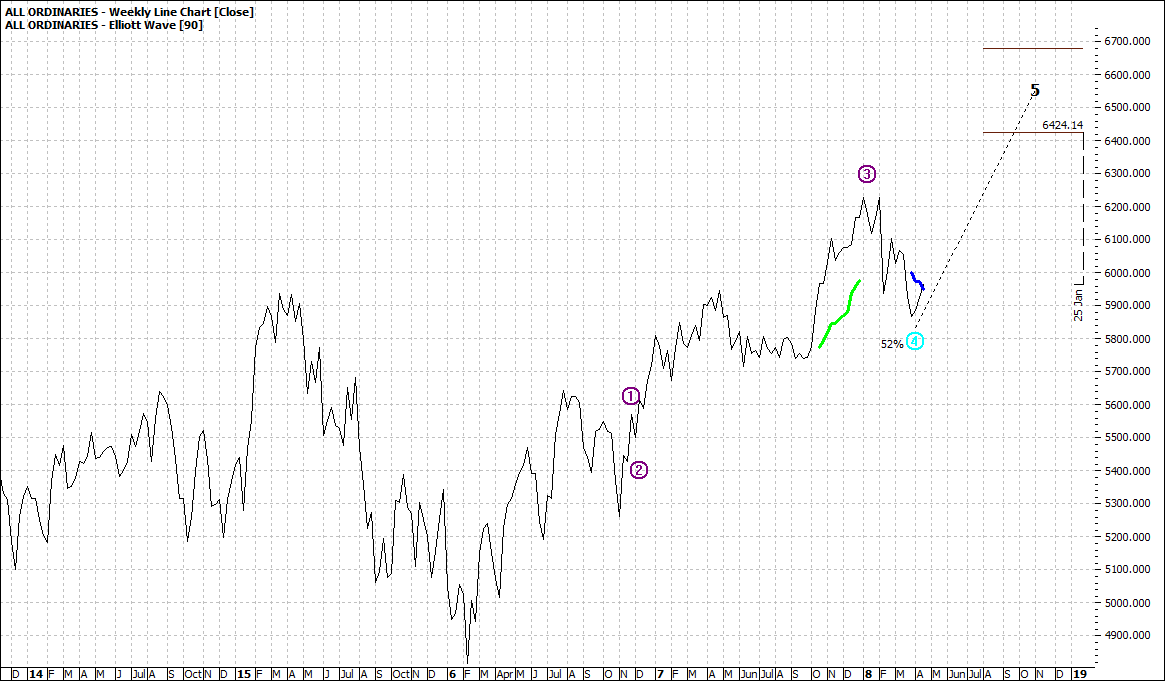

Let's look at a daily and weekly chart of each of the XAO & BHP charts as a contrasting example:

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

The XAO is short term a little weak but in fairness it does shows good sign of a new high albeit an unspectacular one – in the year or so ahead.

BHP on the other hand, while range trading over the last three months has been steadily moving higher over the last year – with healthy pullbacks.

Out of all the stocks that I mentioned that have held the All Ords up – none are in a five-wave impulse pattern. In other words, they are drifting higher.

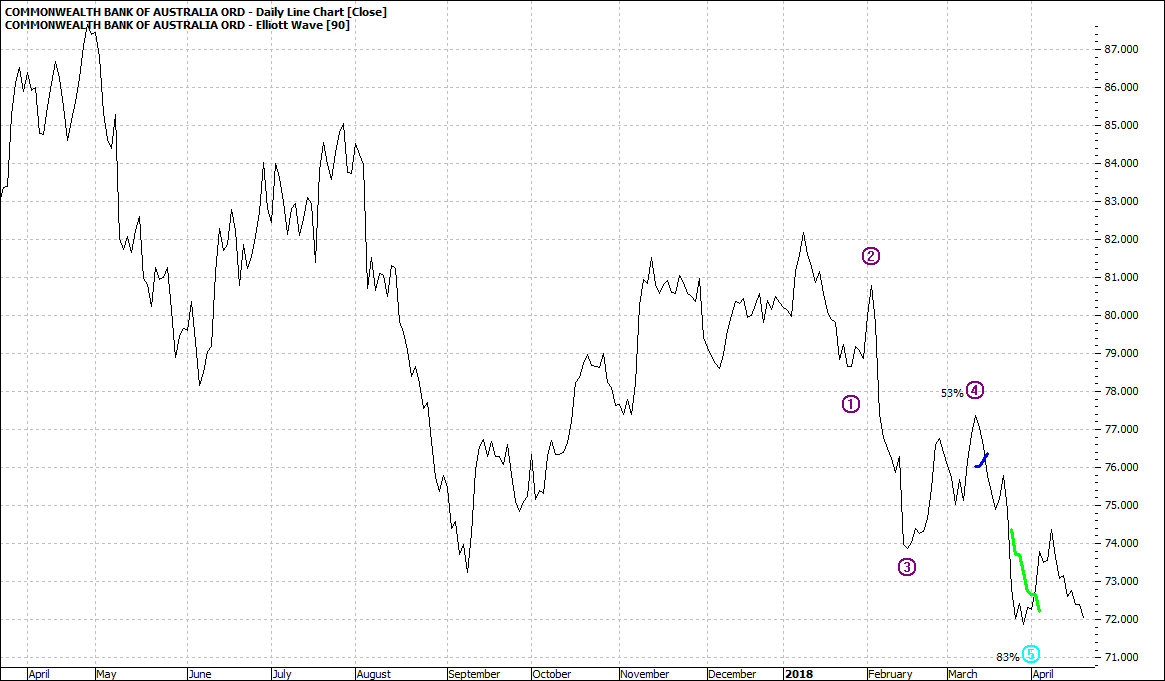

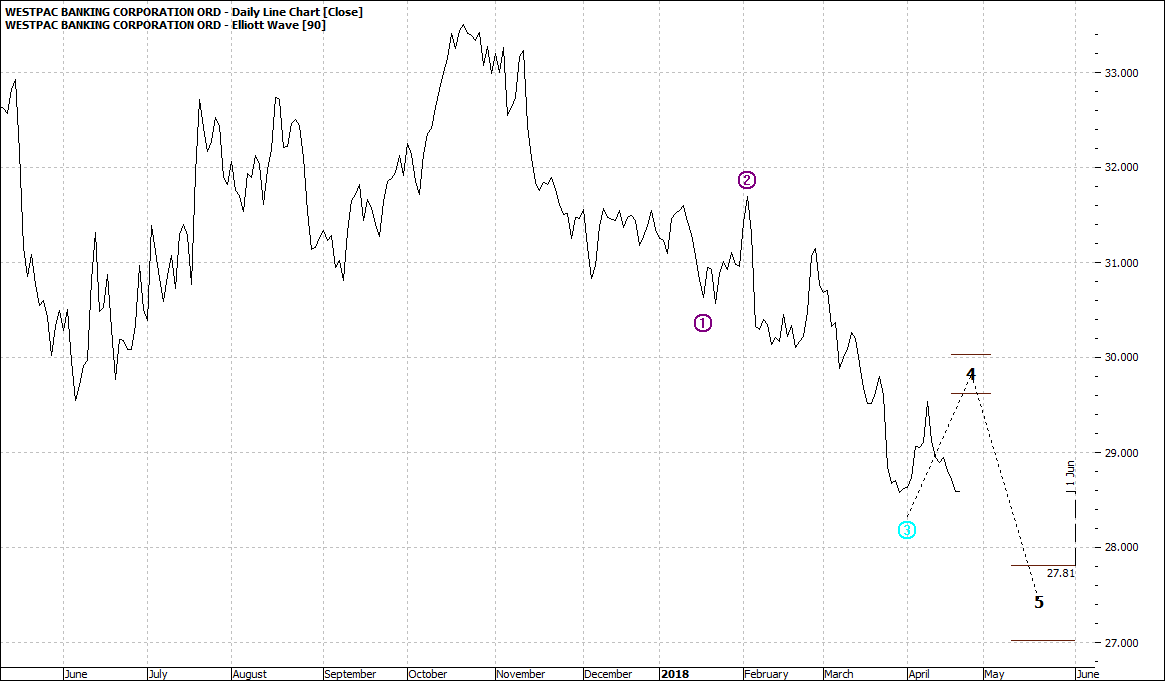

In contrast, Financial Stocks are moving lower. For example CBA & WBC:

Click to Enlarge

Click to Enlarge

Banks are letting the team down whilst those few I mentioned are holding the market together. What surprises me is that, so few stocks are holding it all together.

Perhaps a little tenuous you might say.

Just another perspective for what its worth.

Enjoy the ride

Tom Scollon

|