"Bets" is a terrible expression in trading,

but you know what I mean.I speak light

heartedly.

And very much tongue in

cheek.

A keen horse betting friend of

mine uses an App that picks winners. It

is layered with complex algorithms. He argues

technical analysis is not much different. I could never get worked up about this as I know the high level of

confidence in my trading methodology, and the predictability of solid returns.

Anyway, As I do my weekly cycle through the top 200 I see many stocks continue

their slide with perhaps at least one wave five low ahead.

I see some just meandering – no destination

or trend in sight.

I see no new five

wave impulse moves higher.

I do see,

however, a few waves four recoveries with a good chance of a wave five high in

the coming days or weeks.

Some will complete as per the Elliott probability

projection.Some will do so but with a

short lifespan of a few days – that is they are just short-term fizzlers –

which we want to avoid.

Others will

sustain an extended move higher and in fact the projected wave five will become

a wave three. The significance of that

is that we know wave three is the strongest of all waves and the most profitable.

I will nominate the stocks I have identified

in my visual scan and show the daily chart – my stock standard chart but with

the addition of the oscillator - This

indicator is an important guiding light as if the oscillator moves below the

neutral horizontal axis by more than 10% it indicates it is most likely to be a

fizzler.

Typically, I wait for the oscillator to

turn up before I buy.

This minimises the

probability of having to sell the stocks at an early point.If I was to buy and the stock was to move

lower I would be quick to sell.

For short

to medium term investing I am very impatient with stocks; They must perform, or I quickly divorce.

Here we go:

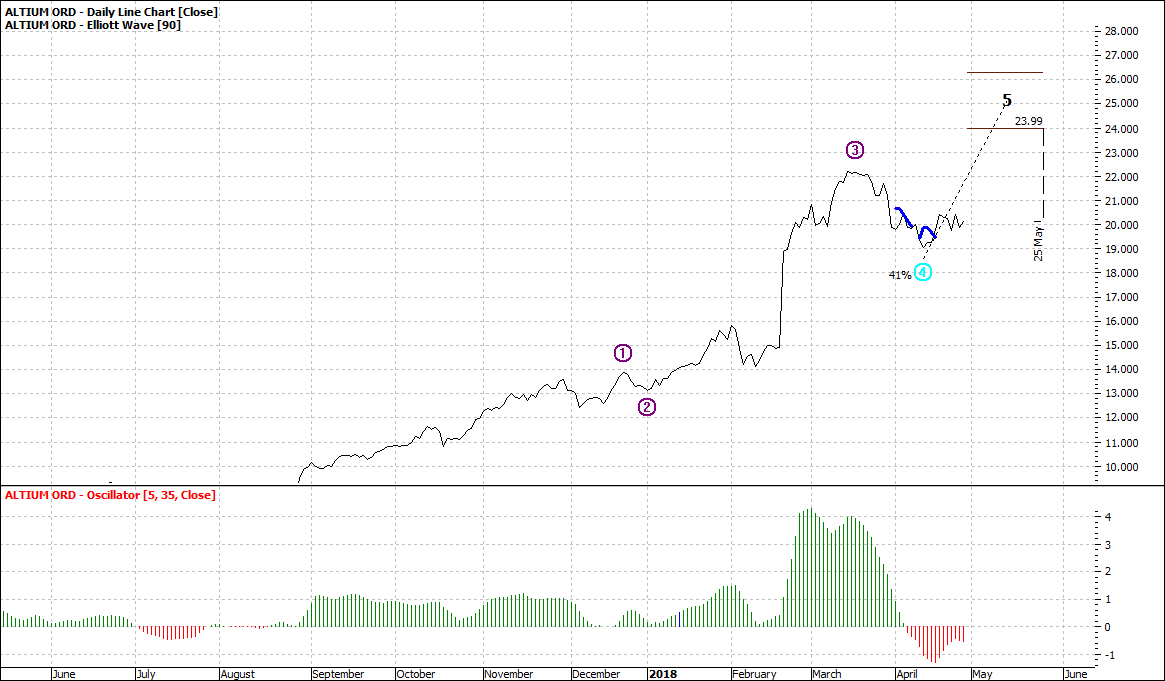

Click to Enlarge

You can see the stock is range trading – that is a sort of balance between buyers and sellers. But also, it means there is no upward momentum. There is insufficient force to drive it higher – for the moment. However, it could range trade and then break out. Often when this does happen the move higher is short lived and the wave five high is reached quickly with no big profits.

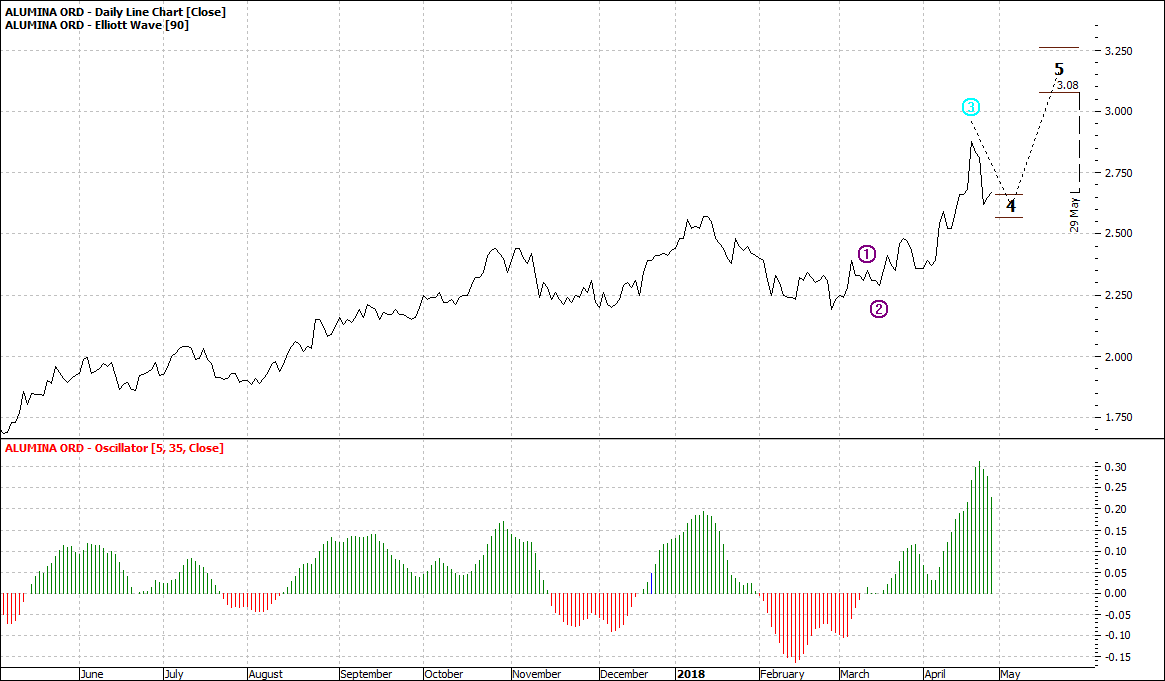

Click to Enlarge

Maybe the oscillator must come back to zero.

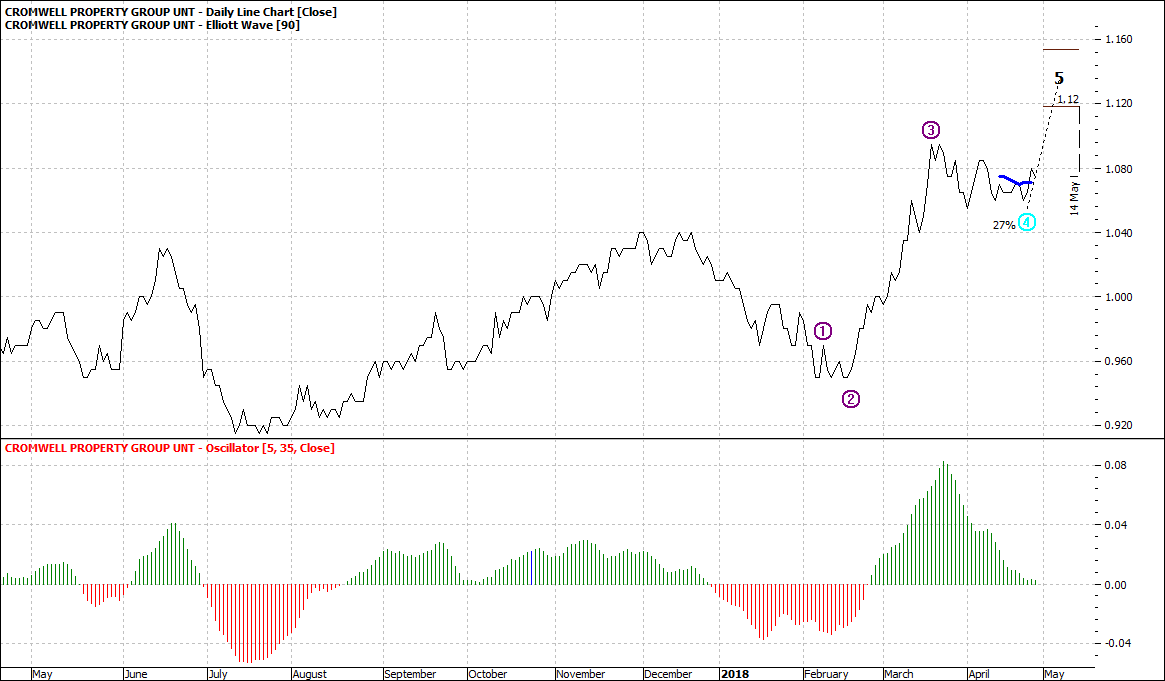

Click to Enlarge

Note the oscillator. Might move higher but will fizzle.

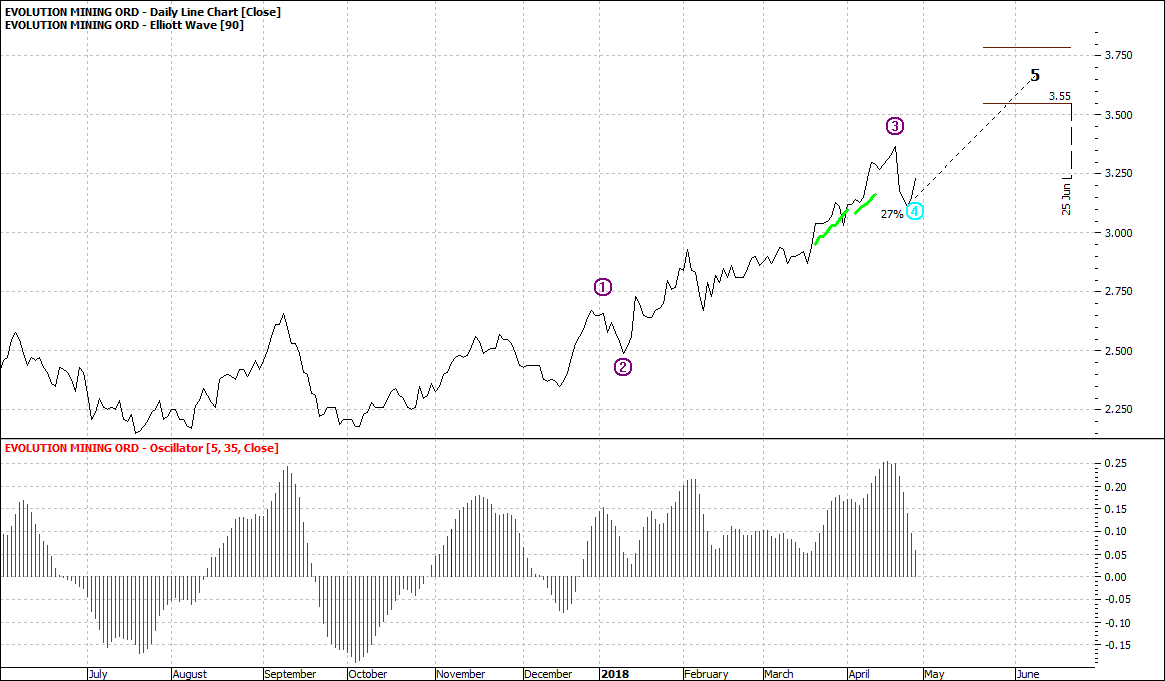

Click to Enlarge

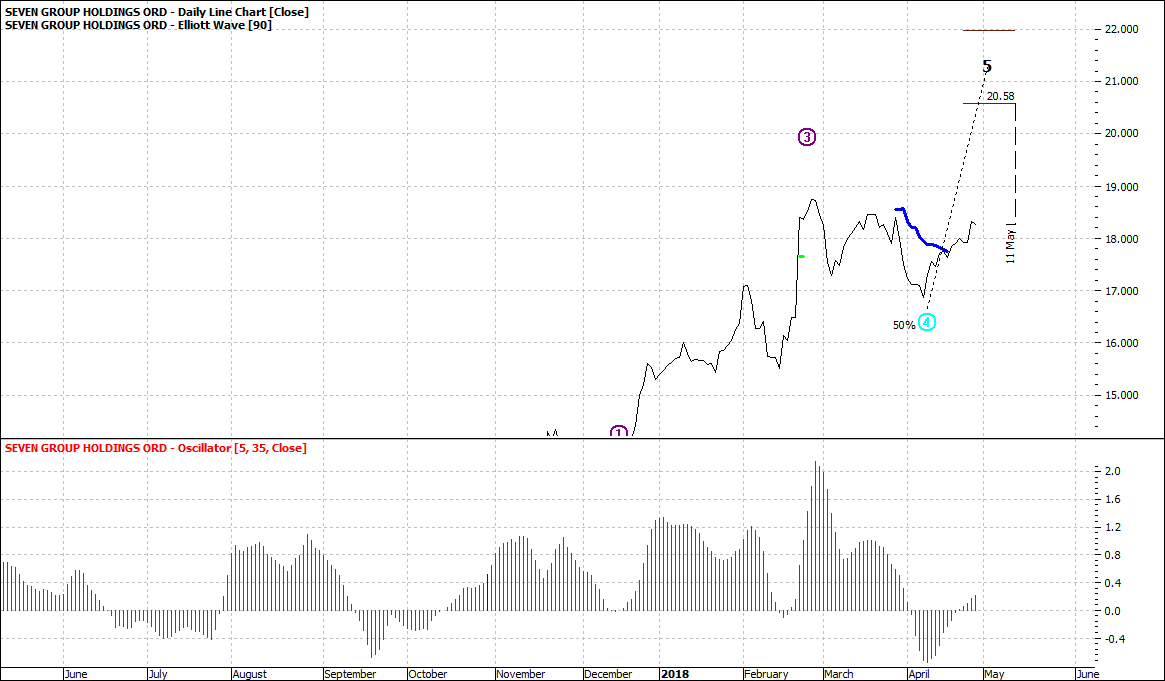

Classic wave four. Stalk this one...

Click to Enlarge

And this one.

Click to Enlarge

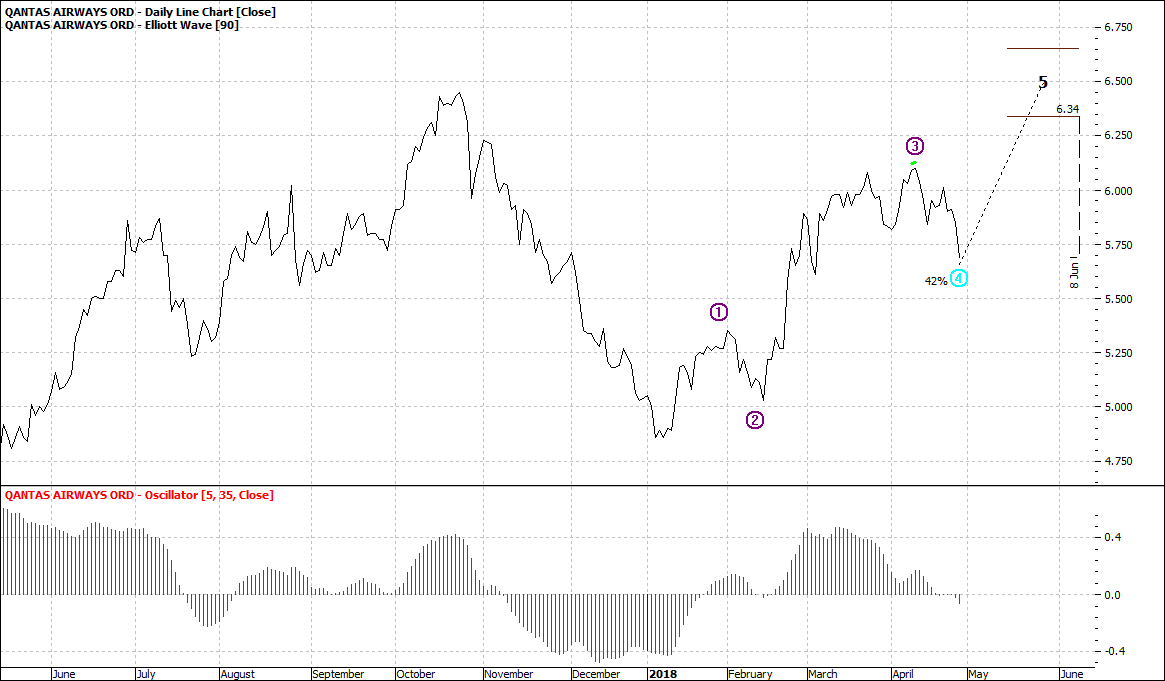

And QAN is worth watching closely

Click to Enlarge

Tough one, Not clear cut. Will move higher but will eventually pause after a few days.

There are of course other prospects, these are a small number you can follow, and I hope prove profitable for you.

Oh, and just one last point:

When I am heavy in the market I would also do a quick calculation of the likely profit. Simple but it helps me short list stocks if there are numerous wave fours like these.

Enjoy the ride

Tom Scollon

|