Well there is not a lot of talk these days. It is clearly not a hot topic at the moment though there have been many halcyon eras of ‘’gold fever’’.

I see one or two brokers/analysts trying to spruik it in recent weeks, but few are buying the talk. Like many investment forms – or more specifically pocket-size investment markets – like mini small caps, junior miners, art, absolutely fringe markets like Bitcoin – those who have ‘’skin in it’’ are busting their boiler for you to get excited too.

I was tempted many many years ago to stock bars of gold when the price was at a low but not a very practical strategy, and I was never truly inspired by gold. I listened to the junior explorers’ stories but again could not sustain interest. So, I have boringly invested in the established miners like NCM, RSG, EVN etc.,

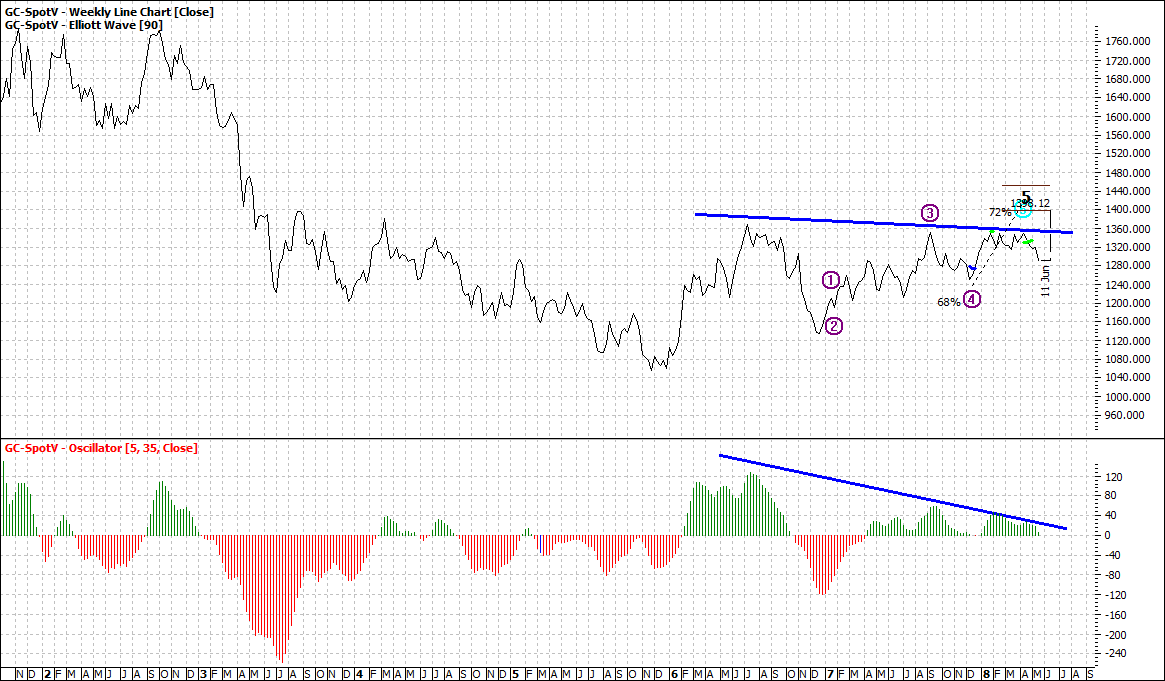

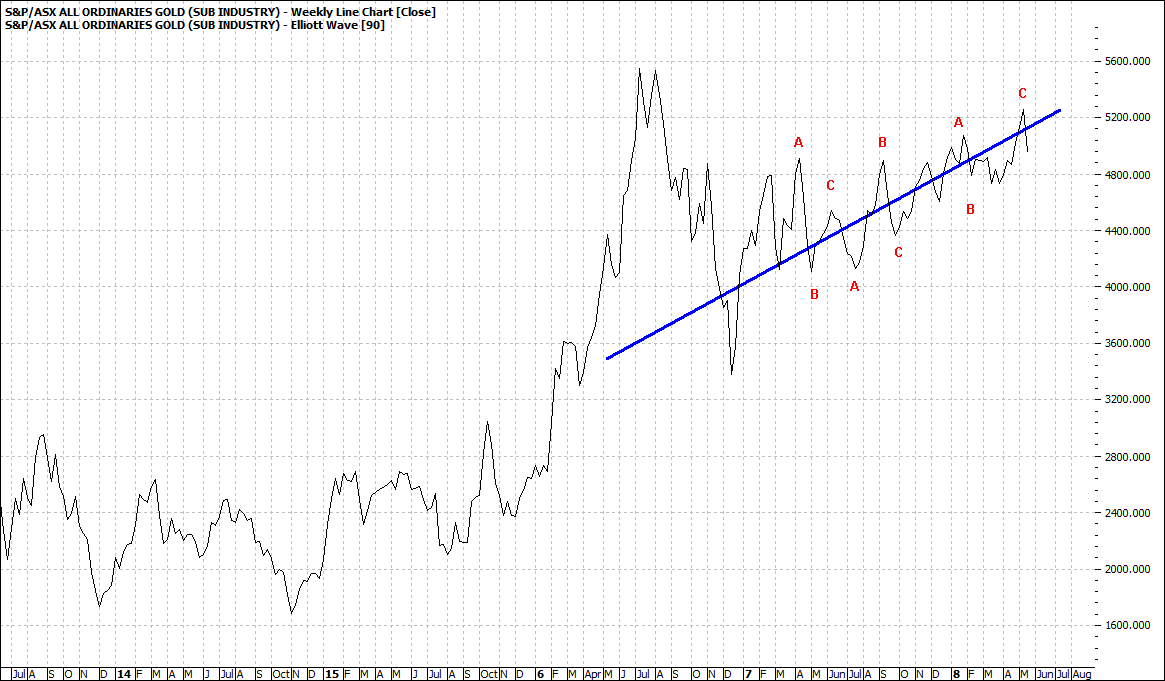

The ASX gold index looks quite positive now and is congruent to the gold futures index.

Click to Enlarge

Click to Enlarge

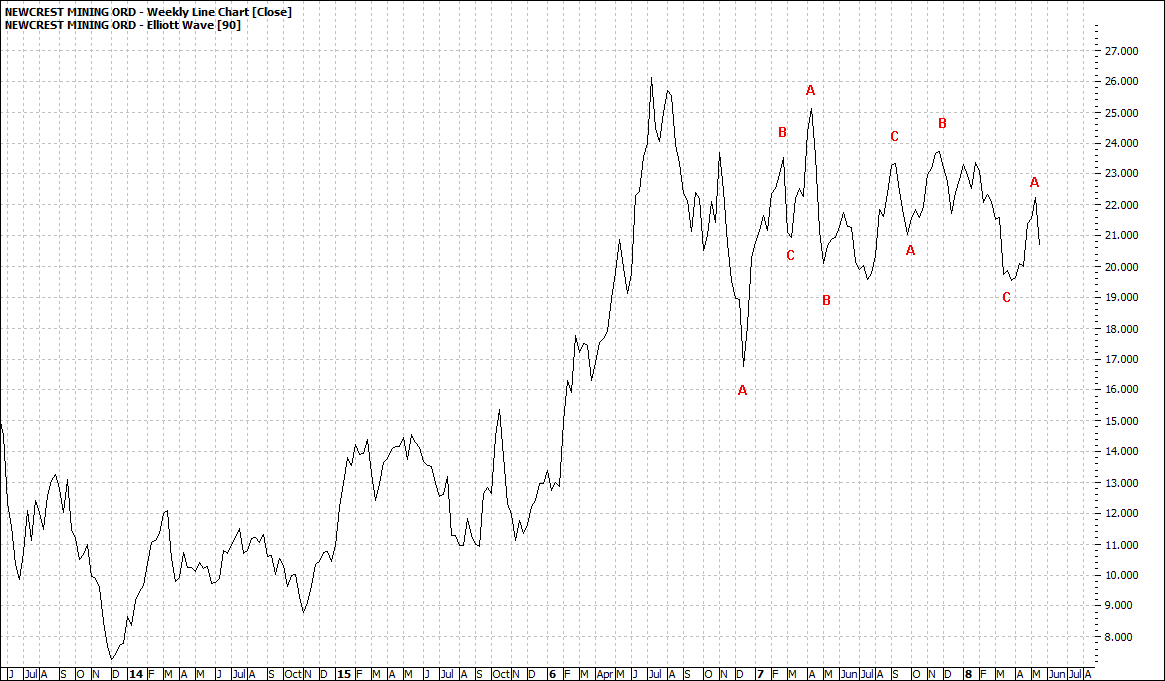

To try and understand what is supporting the index we look at some stocks:

Click to Enlarge

NCM has played some role in supporting the ASX index and though not forging ahead is still holding well at the upper end of its range.

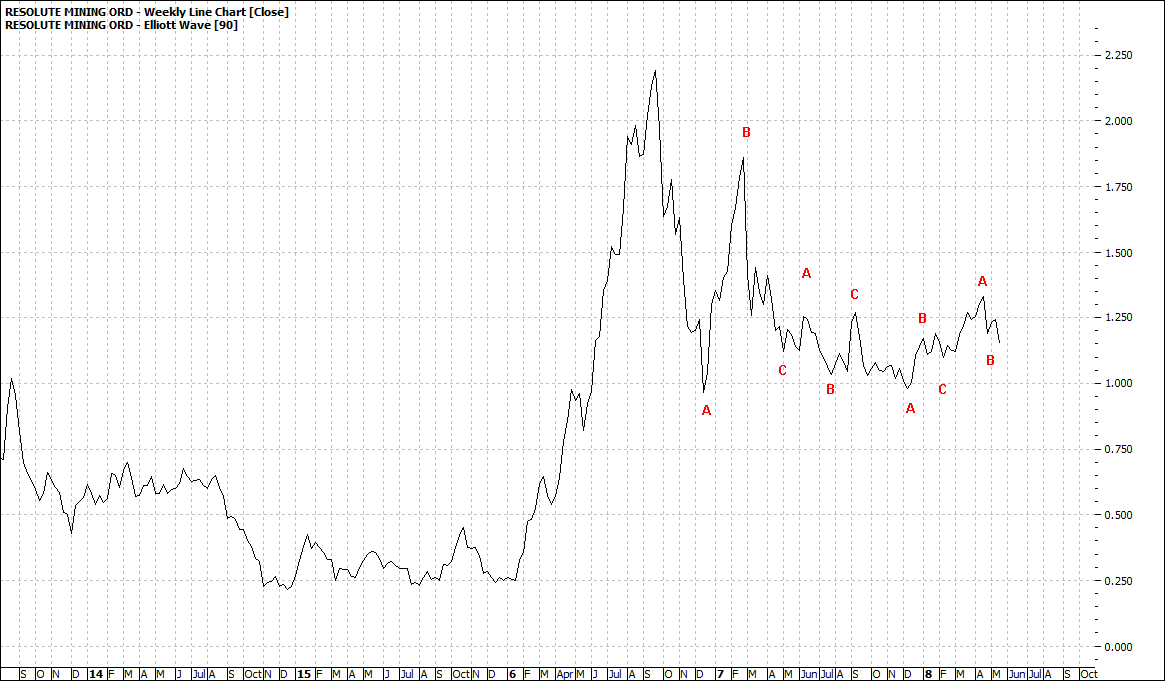

RSG is more like the Spot Gold chart and range trading at the lower end of its range:

Click to Enlarge

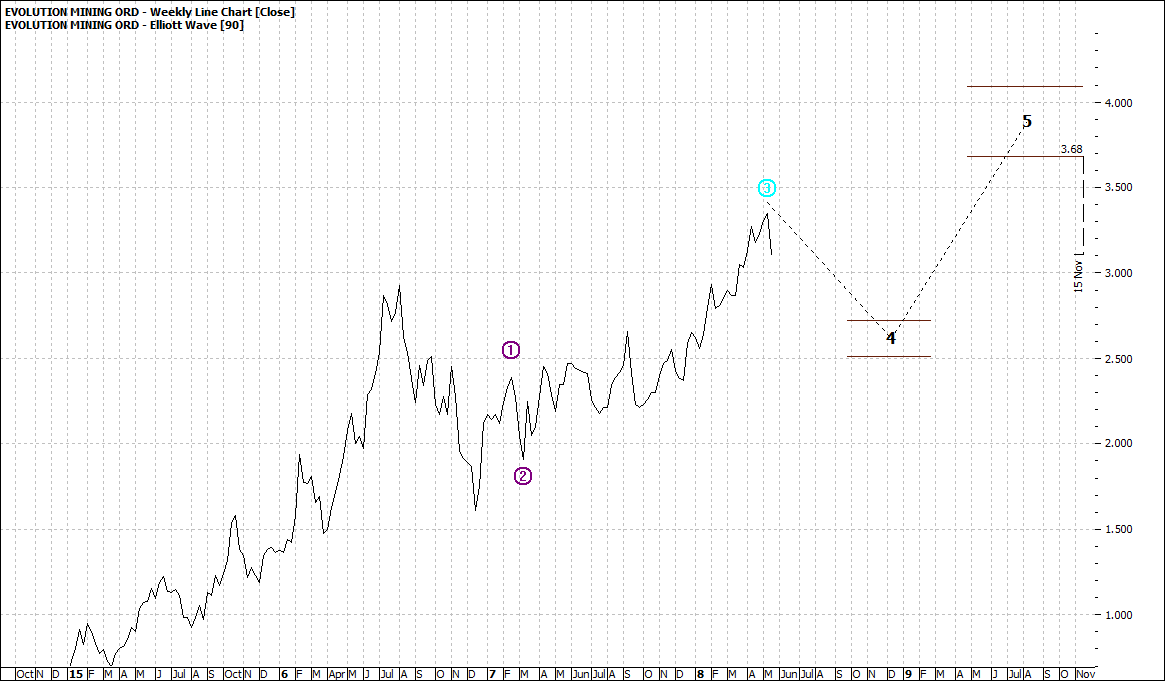

EVN has maintained strength and looks one of the strongest in the sector:

Click to Enlarge

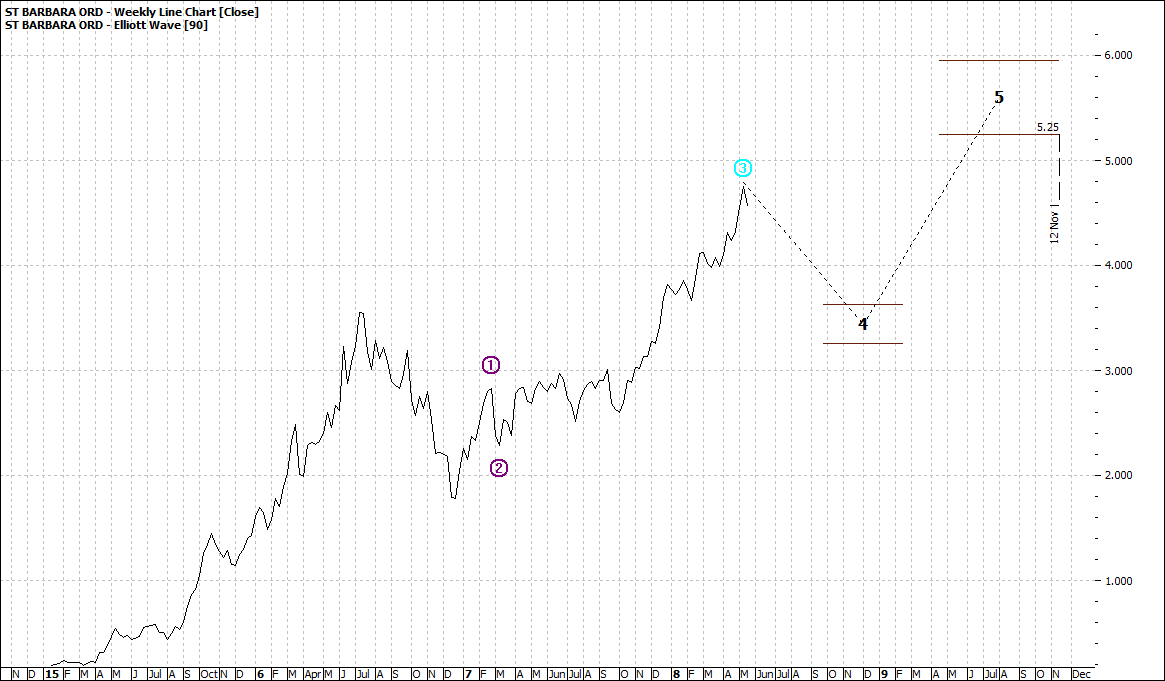

Likewise SBM:

Click to Enlarge

If one had an inkling to buy the gold story ahead of the mob, both SBM and EVN could look good – on pullback!

Note all the above are weekly charts so it will all take time.

Plenty of time to ponder or watch over.

Enjoy the ride

Tom Scollon

|