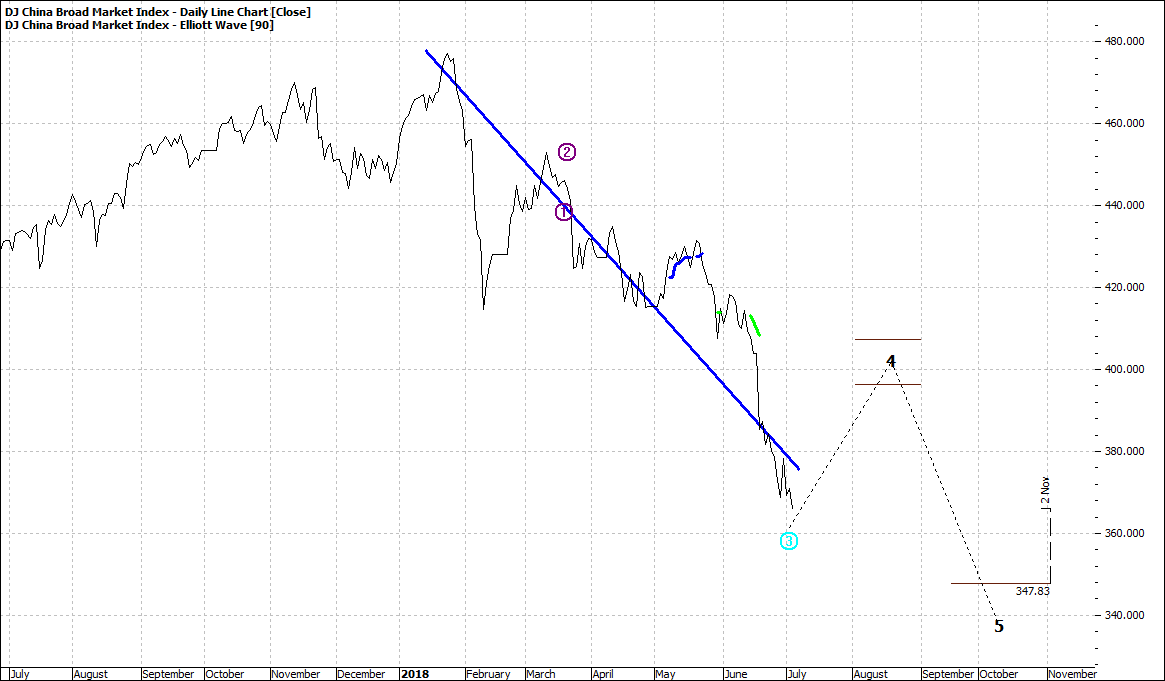

Let's look at my stock standard charts for DJCHINA.

Firstly, a daily:

|

Dow Jones China (DJCHINA): Daily Line Chart

|

|

|

Click to Enlarge

Something is amiss. Global markets have been surging higher and the soon to be number one economic power seems to be losing traction.

Typically, we see a wave four bounce in the market which is usual ‘’technically’’ normality as bargain hunters buy in at what they believe are cheap prices. And just as these buyers get set the Institutions who want to lighten their load or reweight their China holdings, sell down.

Just a common market phenomenon.

Of course, the market could already be cheap enough and more buyers come in and we then see the wave four become the beginning of a new five wave impulse move higher.

Let’s look at the weekly:

|

Dow Jones China (DJCHINA): Weekly Line Chart

|

|

|

Click to Enlarge

You can see there has been a massive decline since mid-2015 and perhaps this can be a sense of reality dawning as the next thing since slice bread became stale.

I have never invested in China in any way.

I believe in the China story and the new world order. China were a number one power in millennia gone by. People are ok with history but when it is in your life time it takes on another dimension.

That aside, between the Australian and USA markets there are fortunes to be made and with extensive historical data available it is a smoother process to make money in these markets rather than taking on the vagaries of a market which is beyond the comprehension of the average punter.

An opinion.

That is not to say we ignore such markets. On the contrary a summary study should be part of any macro global economic/market analysis – which is always a precursor to buying any local stock.

Enjoy the ride

Tom Scollon

|