When I am looking to buy, I look for stocks that have positive signals for both the daily and weekly charts. That eliminates numerous high-risk chances.

Removes the time wasters.

My theory and process are really very simple. I look for wave four pullbacks and then apply the oscillator.

For a short to medium term trade I am happy to apply this to a dally chart – even if the weekly does not look great.

If it is a long-term trade I am looking for both daily and weekly oscillators to impress.

Two examples:

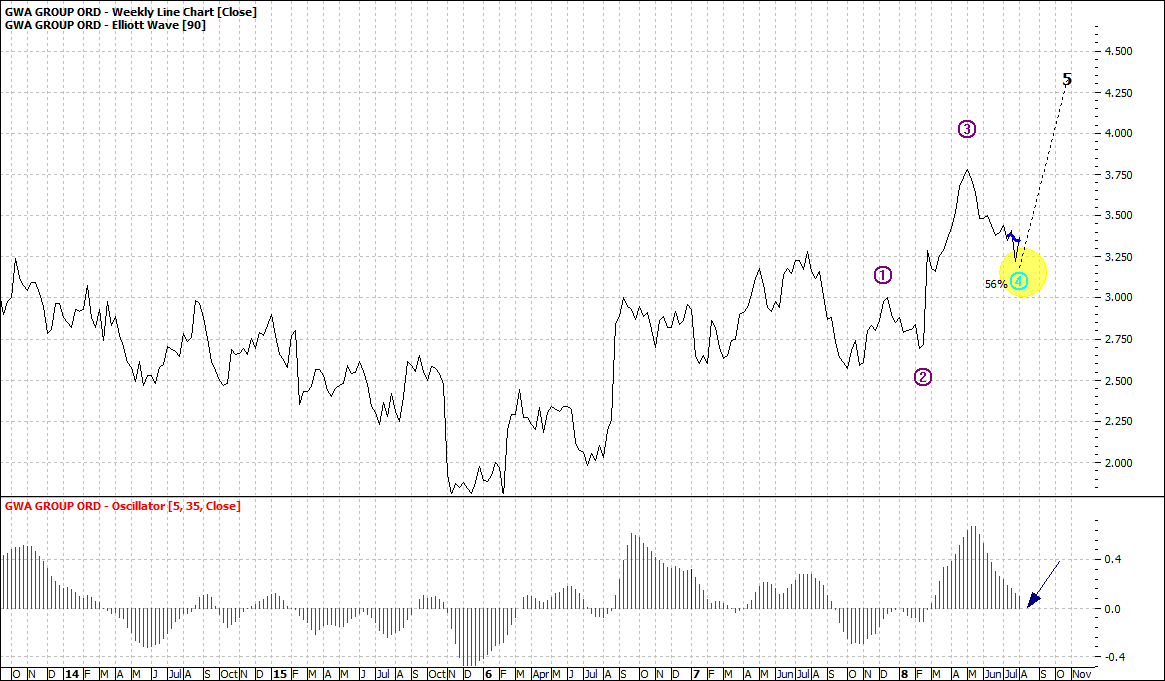

GWA:

|

GWA Group (GWA:ASX) - Weekly Line Chart

|

|

|

Click to Enlarge

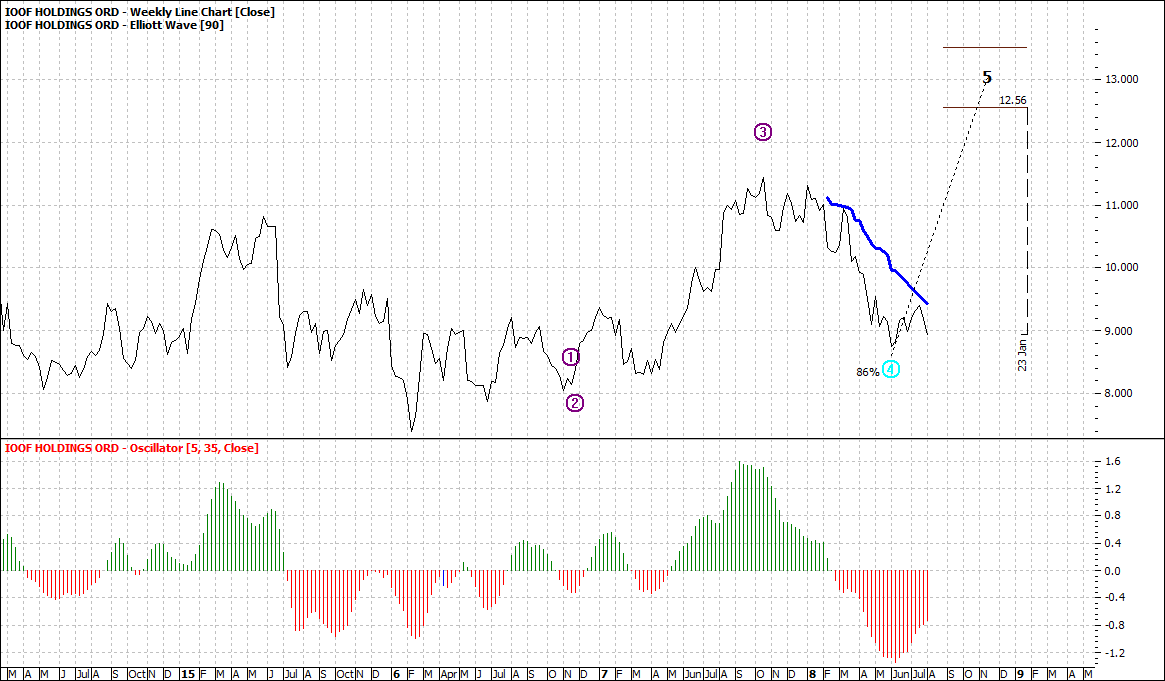

IFL:

|

IOOF Holdings (IFL:ASX) - Weekly Line Chart

|

|

|

Click to Enlarge

Can you pick the preferred set up?

It is GWA.

You will note that the oscillator is approaching the zero axis. Now it is possible that the stock could fall further but it is one that we would put on our watch list.

IFL on the other hand looks weak and there is no signal to indicate the pain is over, so we would not put it on our watch list.

We don’t want to waste our energies if there is no easy money to be made.

So, what we look for in an oscillator set up is one where it falls to the zero line ideally but at worst no more than 10% below. If it falls below the 10% level that means, there has been mass desertion of the stock.

That could mean that intuitions have had a major change of heart and they are selling down for good. This does not mean that the stock is no good but rather that it could be a mere reweighting of a portfolio or that they now see little further upside.

Now when you are watching an oscillator on a weekly chart it is a bit like watching paint dry. So patience is essential.

To elaborate further I may enter a trade on a daily chart set up and be prepared to exit if it does not perform as I expect.

I am also cognisant of the prospect that on a weekly chart it could develop into a classic wave four set up and that means I have got in early for a long run up.

As I cycled through the ASX top 200 for this article I could see others that are worth short listing for a long wave five higher. Stalking a stock – terrible expression – does take patience.

Not time.

Only patience.

Your homework to find these opportunities.

Enjoy the ride

Tom Scollon

|