Media are struggling for existence and relevance in this paradigm changing world. So, it is not surprising that journalists and Editors will seize on any thread that will give them air.

On the finance side this week, there were many headlines attempts to catch your ear – in particular about where the Aussie dollar might settle and the whys and wherefores.

Interesting to watch from the side-lines.

Some analysts have the Aussie at 60 cents – in time. The rationale for their view is the declining power and health of the Chinese economy and the Turkish lira softness after further USA sanction threats.

What I do know from a few decades relationship with the Aussie is that it is a currency that punches above its own weight. Like so much about Australia. Sport, media, entertainment and the list go on. Quite amazing.

It is true that the Aussie is used as a speculative currency by those who not care tuppence for the effects a volatile Aussie might have on farmers – or inflation because of expensive imports. It is a ‘’trading currency’’ firstly because of its close tie to resources, trade in resources and therefore the health of the global economy and in particular the number two, about to become the number one, power – namely China.

Currency volatility can impact sharply on market stability even though the global economy is in reasonable shape. Watch this space with USA wielding the sanctions AK-47.

So, lets look at the charts before much more ado – the daily, weekly and monthly charts in that order:

|

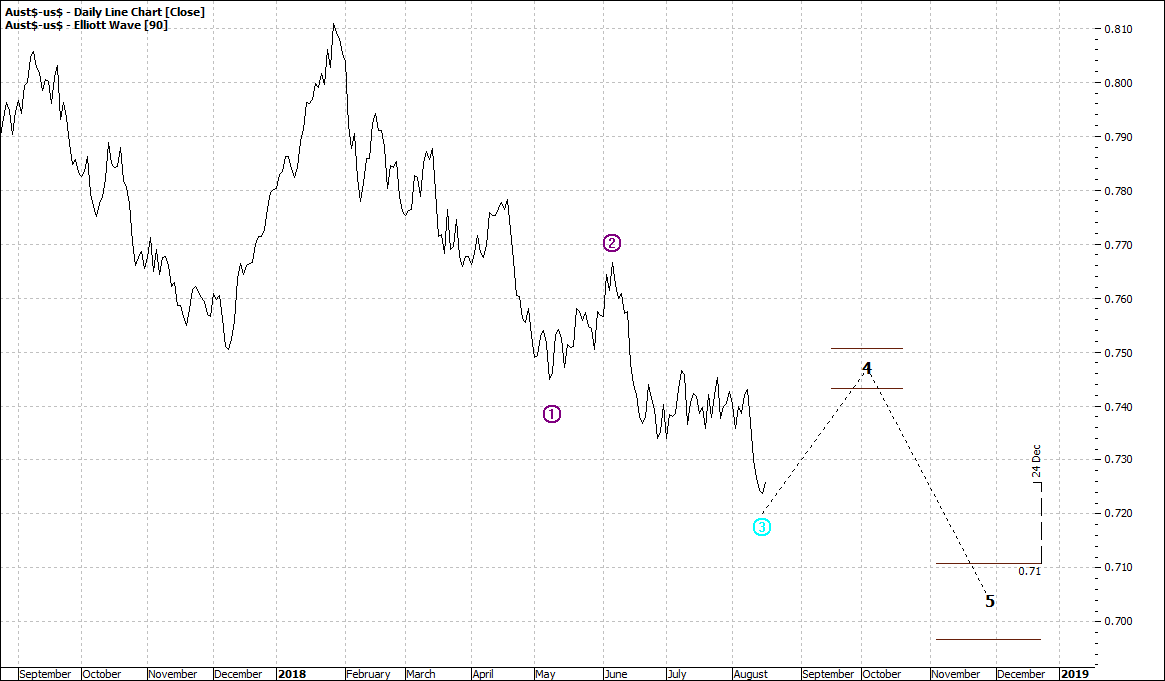

Aust$ - US$ (FXADUS) - Daily Line Chart

|

|

|

Click to Enlarge

|

Aust$ - US$ (FXADUS) - Weekly Line Chart

|

|

|

Click to Enlarge

|

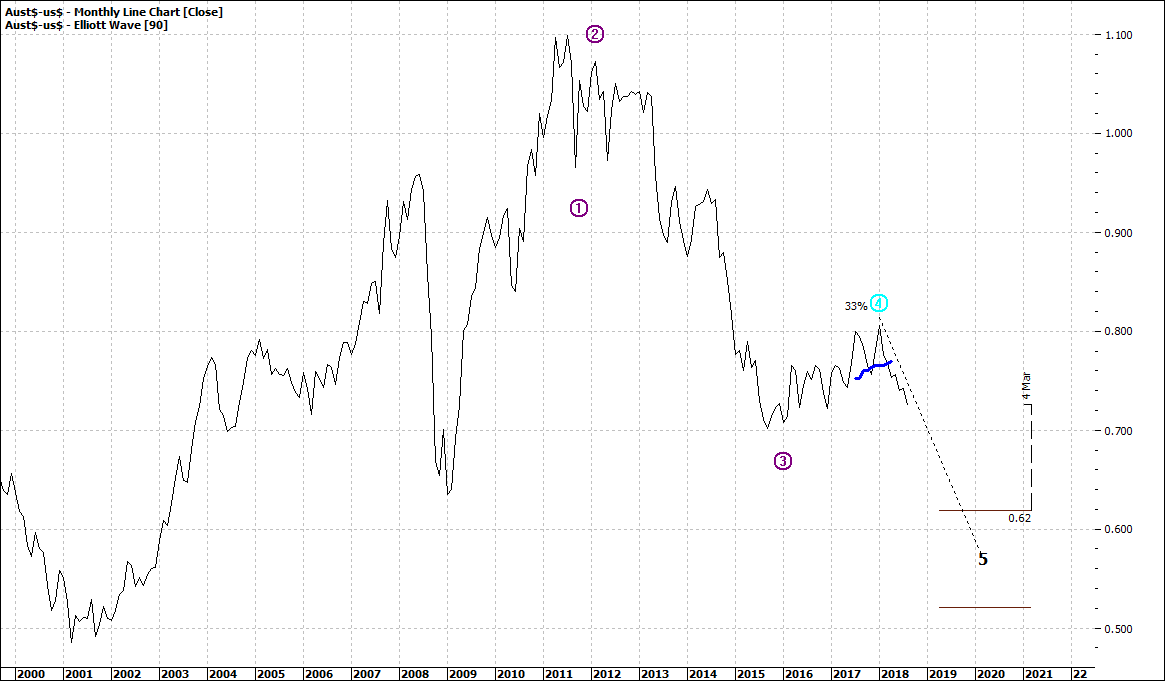

Aust$ - US$ (FXADUS) - Monthly Line Chart

|

|

|

Click to Enlarge

Perhaps the monthly is most clear and hard hitting – straight down to about 60 cents.

Yes, it is possible.

But there are many other factors that will come into play – not the least of which is geo-political factors.

And there is plenty happening in that regard now.

The monthly chart indicates this is 2-3 years away. A fair call.

The daily chart focuses on the now and it suggests a move to about 71/70 cents firstly. Another reasonable call.

The pundits who call it to 60 cents could well be right – but it is always a question of when.

The weekly chart means that once the topic leaves the front pages – well off the finance pages – it will go back to doing its own thing – meandering along. But we know from the monthly, the bias will be down.

The impact of a weak Aussie dollar can have almost zero impact for many – and at the other extreme it can be the tipping edge for some.

Its weakness has been something I have written about repeatedly and it is sort of cutting it fine to take action to cover yourself if it will impact heavily on you or your business.

Changing course for currencies can be a bit like turning a large ocean vessel 180 degrees in a few mere kilometres.

Maybe it is more useful now to look beyond two years for currency planning – maybe five to ten years – as short term strategies work only for expert currency traders.

Enjoy the ride

Tom Scollon

|