Gold outlook is not great. Time to set up your stash of gold bars? Even if that is your thing, there is maybe no rush.

But let the charts guide us - daily, weekly and monthly in that order:

|

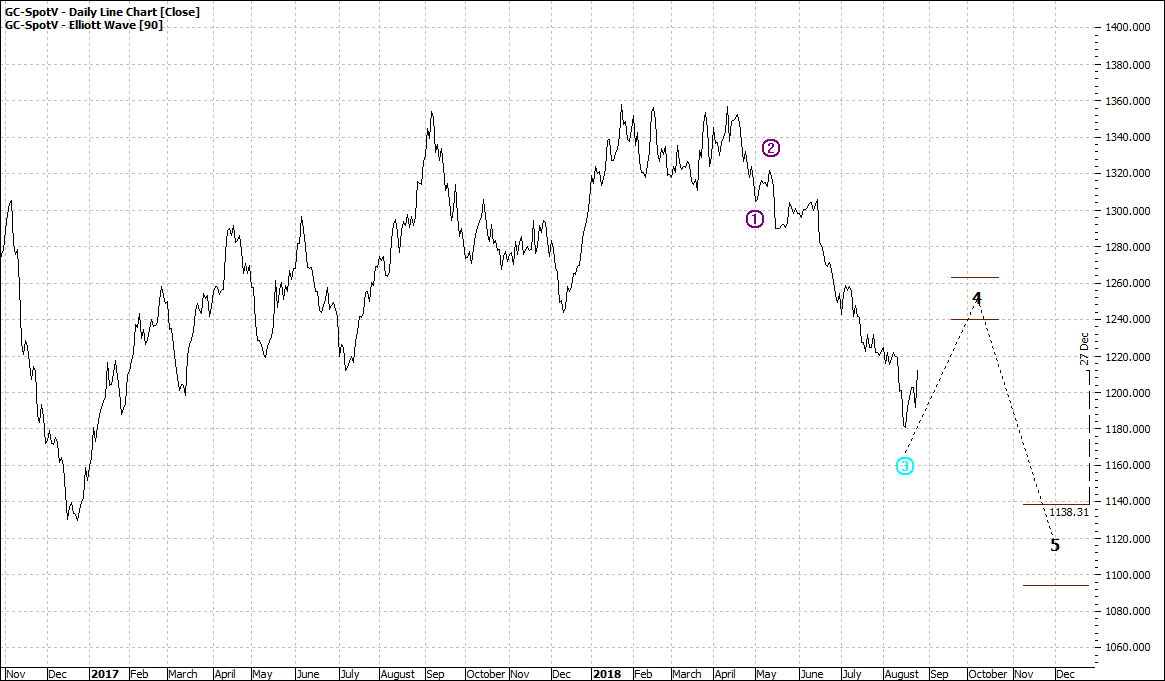

Gold (GC-SpotV): Daily Line Chart

|

|

|

Click to Enlarge

|

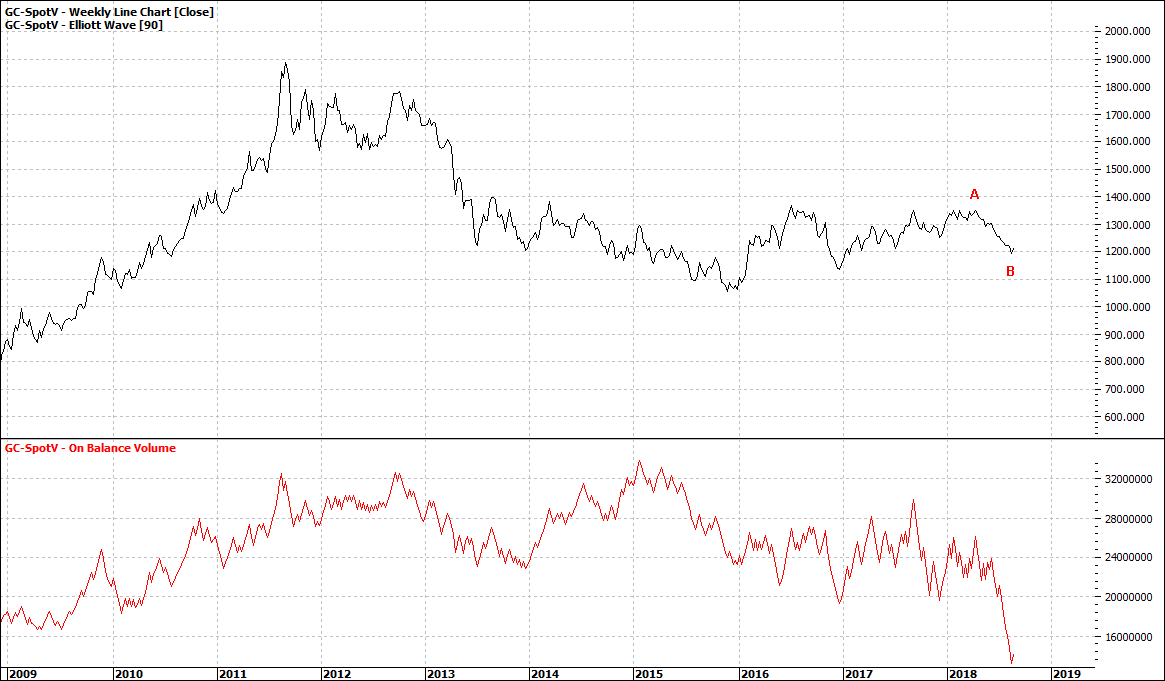

Gold (GC-SpotV): Weekly Line Chart

|

|

|

Click to Enlarge

|

Gold (GC-SpotV): Monthly Line Chart

|

|

|

Click to Enlarge

The daily and monthly give us a resounding thumbs down while the weekly, plausibly, says maybe some range trading for a while.

That is what we would expect.

There is nothing of great significance working against gold, except many punters are backing a rising US dollar.

There is an inverse relationship between the US $ and gold.

As the dollar rises gold falls.

In a way a rising dollar suggests a flight to safety - to the dollar - as a salute that all is good.

All is good politically, economically.

Now you might find that laughable with the shenanigans we see before our very eyes right now.

Punters don’t really have a view on such matters.

After all you cannot be an expert on all things going on in the world. As an investor you are more focussed on expert knowledge on valuations. And all indicators point to continuing rising USA markets.

So why question anything else.

You can save your opinions on geo-political matters for your cocktail parties. Dare not speak of your calculating, materialistic view however – they are for the cloistered environs of your trading enclosure you enter each morning.

Having said all that, the Australian share market does not look any where as great as the USA. So, caution in Oz.

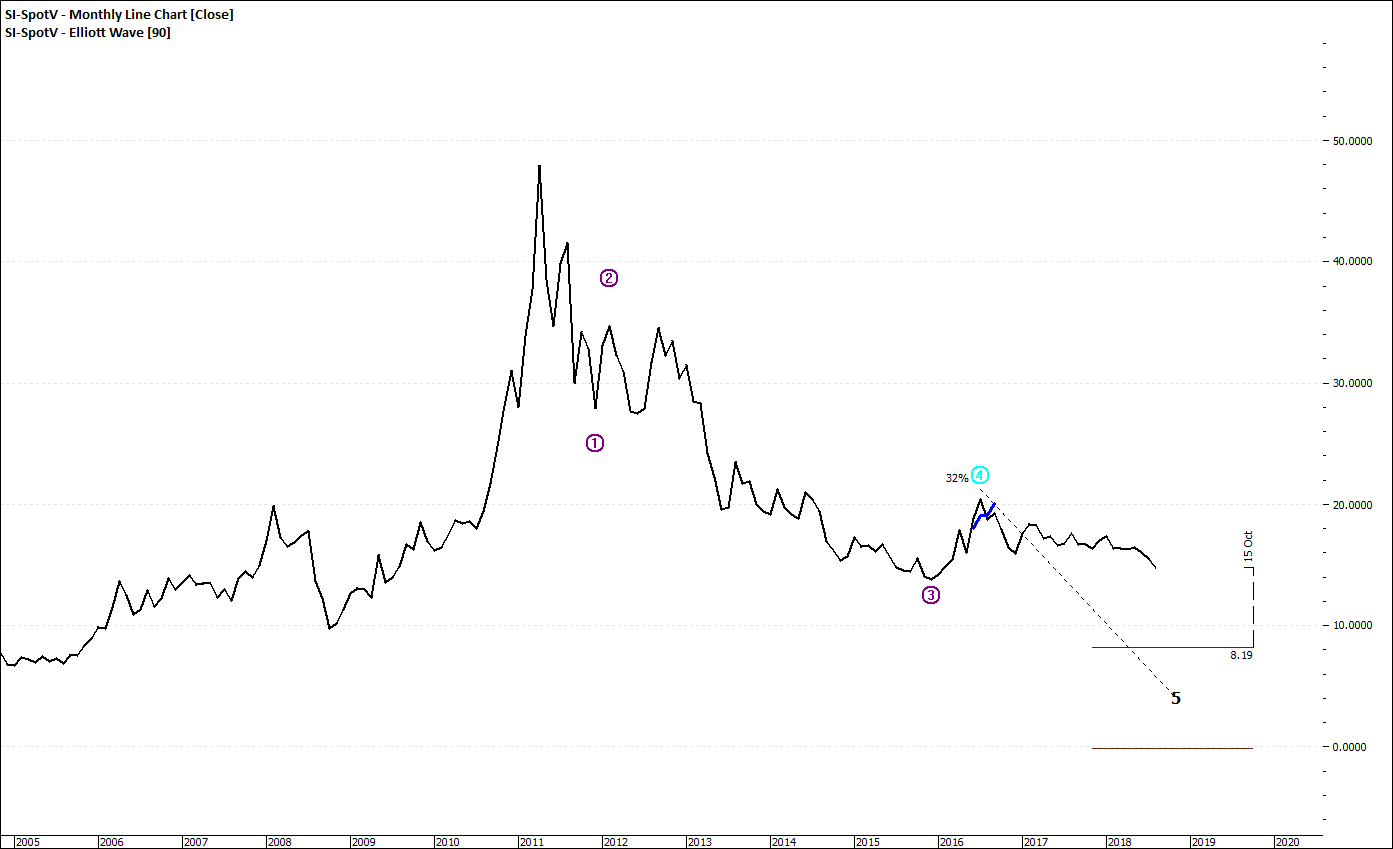

Silver outlook is no better:

|

Silver (SI-Spotv): Monthly Line Chart

|

|

|

Click to Enlarge

They sort of go hand in hand – in price – and in actual mining.

So not really the market for creating a cache – but a fabulous market to "trade".

Enjoy the ride

Tom Scollon

|