Yes, two stocks caught my eye as I cycled through the top 400 – it takes a mere ten minutes – and can be done over a leisurely coffee.

The two stocks are ASX and BBN – there are others which I will mention later – but for now let’s look at the charts:

ASX:

|

ASX ORD (ASX): Daily Line Chart

|

|

|

Click to Enlarge

BBN:

|

Baby Bunting Group (BBN): Daily Line Chart

|

|

|

Click to Enlarge

I am not saying they are perfectly ripe for a move but are worth keeping an eye on.

Before I press the "buy" button I do a little more analysis and an essential step in that is checking the oscillator.

So, let’s try again with the oscillator in each case:

ASX:

|

ASX ORD (ASX): Oscillator

|

|

|

Click to Enlarge

BBN:

|

Baby Bunting Group (BBN): Oscillator

|

|

|

Click to Enlarge

In the case of ASX I would still be comfortable to buy for the short term.

You will note the two arrows which indicate a negative divergence.

I know many traders would not buy when you see negative divergence between price and an indicator.

I do not let that worry me as it is only a short-term flutter.

I also believe that many analysts find a reason to "NOT" get into a trade.

That is, they want every signal to point to profit.

I would not say I am trigger happy, but I do press the "send" easily - after analysis.

I know from experience that while negative divergence does expose the trade to some weakness, it is often not very meaningful.

In the case of BBN, I note the stock had a spectacular run in August and my oscillator confirms that.

So, it is not ready for a buy, but we will watch with interest as it pull backs to zero.

Some other stocks you might like to watch – again with the oscillator teaching us something:

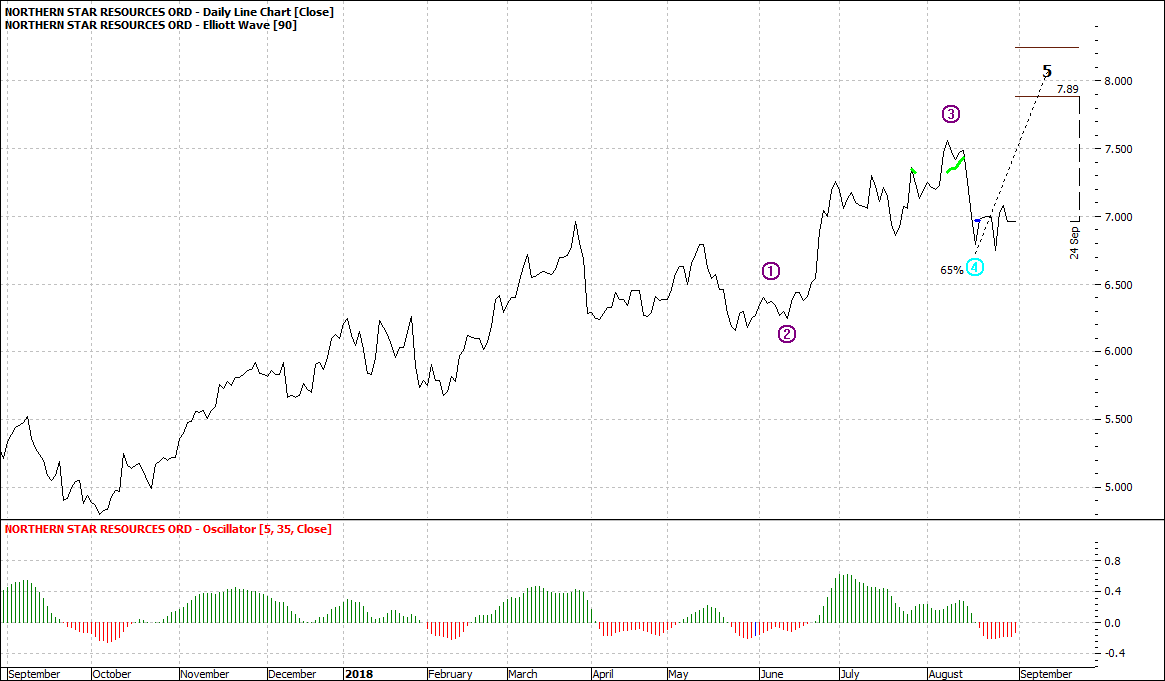

NST:

|

Northern Star Resources (NST): Daily Line Chart

|

|

|

Click to Enlarge

The oscillator has gone close to the -10% mark but I still like it as a short-term trade.

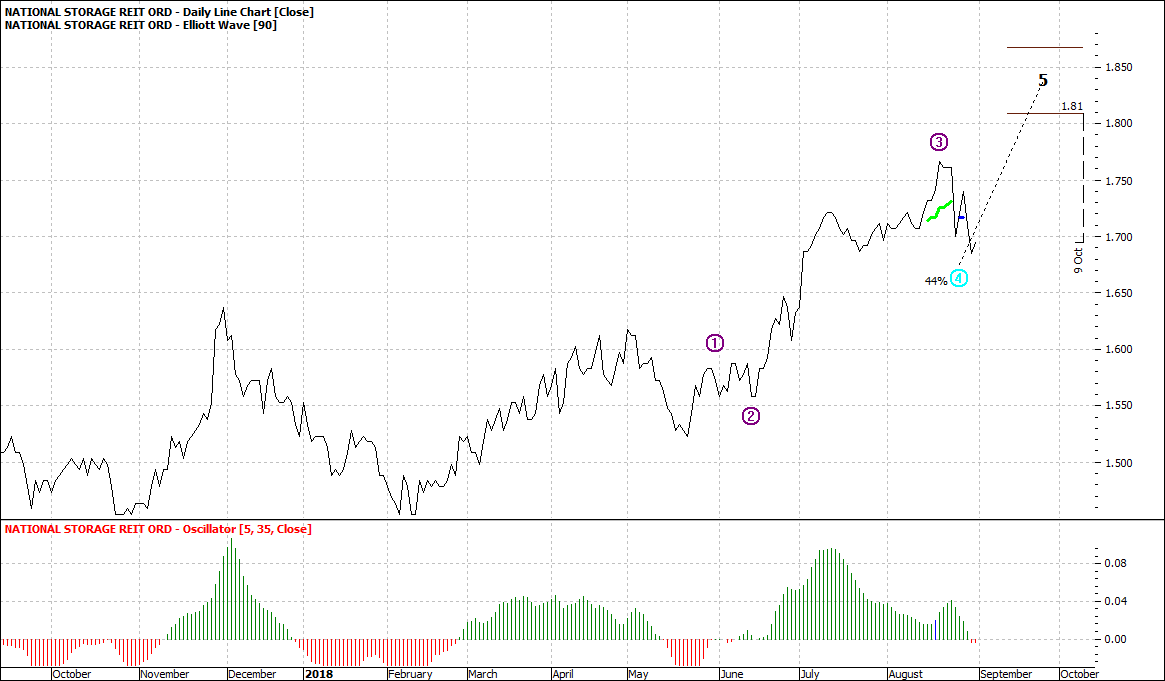

NSR:

|

National Storage REIT (NSR): Daily Line Chart

|

|

|

Click to Enlarge

Almost the perfect wave four pullback – but keep an eye on it.

For mine I would take the risk and be happy with it as a short-term trade – and be happy to throw it back in, if it fails.

Enjoy the ride

Tom Scollon

|