Wow they were popular. Maybe still are; but I have not been to one in a couple of decades.

But I am really talking of Friday’s banks little spike.

And that is all it was and all it will be...

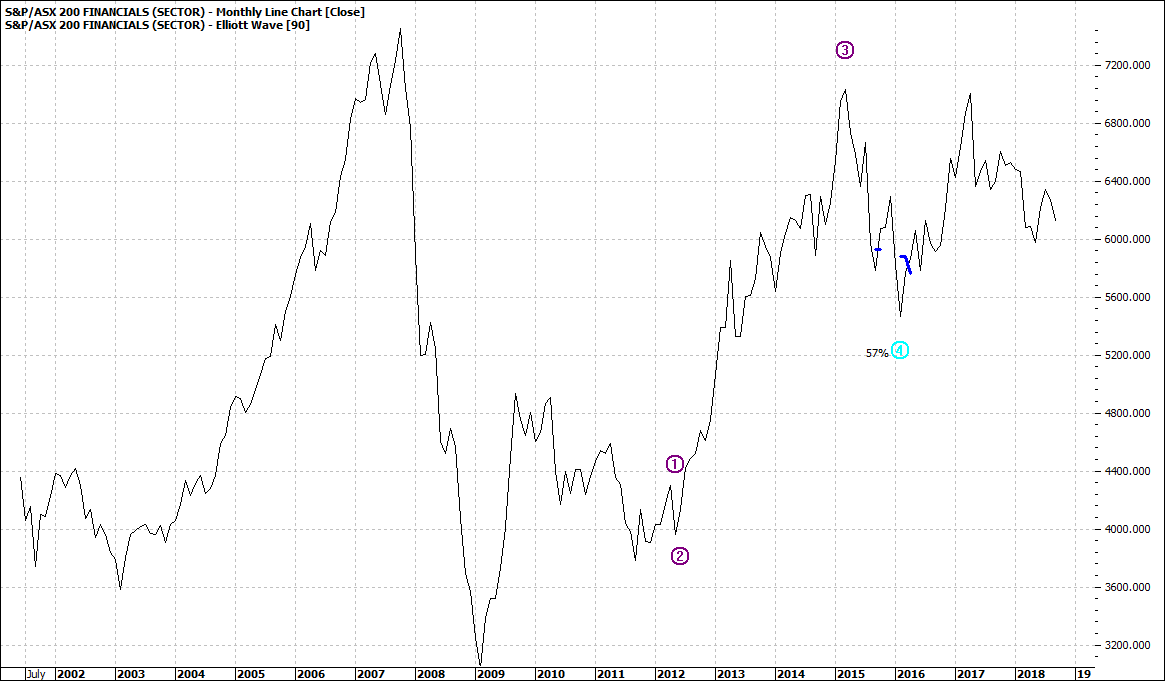

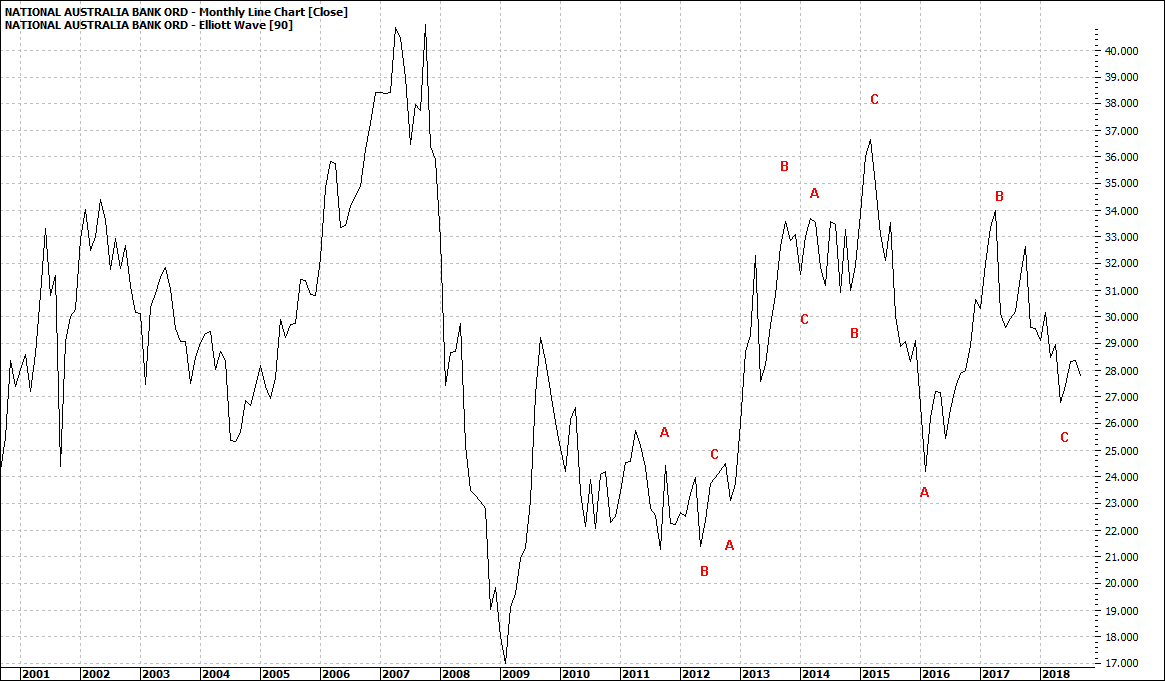

As I see the banks and finance sector generally – dominated by the banks anyway – are all tired.

They are back to 4-5-year levels.

Let’s take a quick run through them starting with the sector chart, then the four majors ANZ, CBA, NAB and WBC – all monthly charts – as we want to form a long-term view.

charts:

XFJ:

|

S&P Financials (XFJ): Monthly Line Chart

|

|

|

Click to Enlarge

ANZ:

|

Australia and New Zealand Banking Group (ANZ): Monthly Line Chart

|

|

|

Click to Enlarge

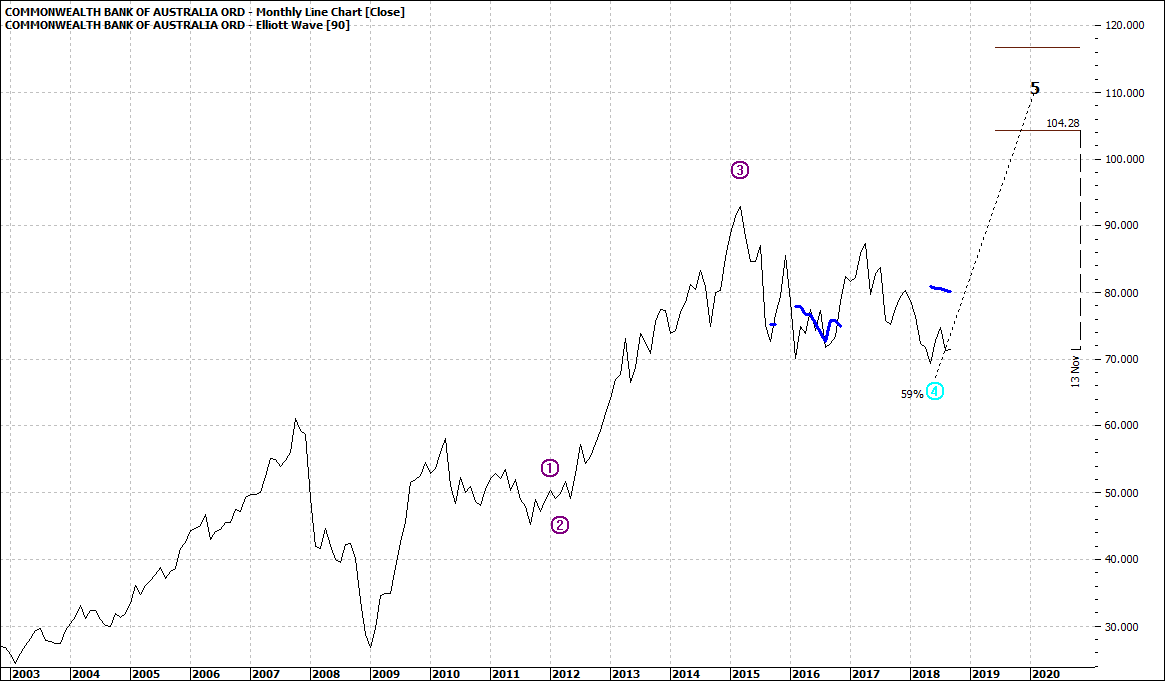

CBA:

|

Commonwealth Bank (CBA): Monthly Line Chart

|

|

|

Click to Enlarge

NAB:

|

National Australia Bank (NAB): Monthly Line Chart

|

|

|

Click to Enlarge

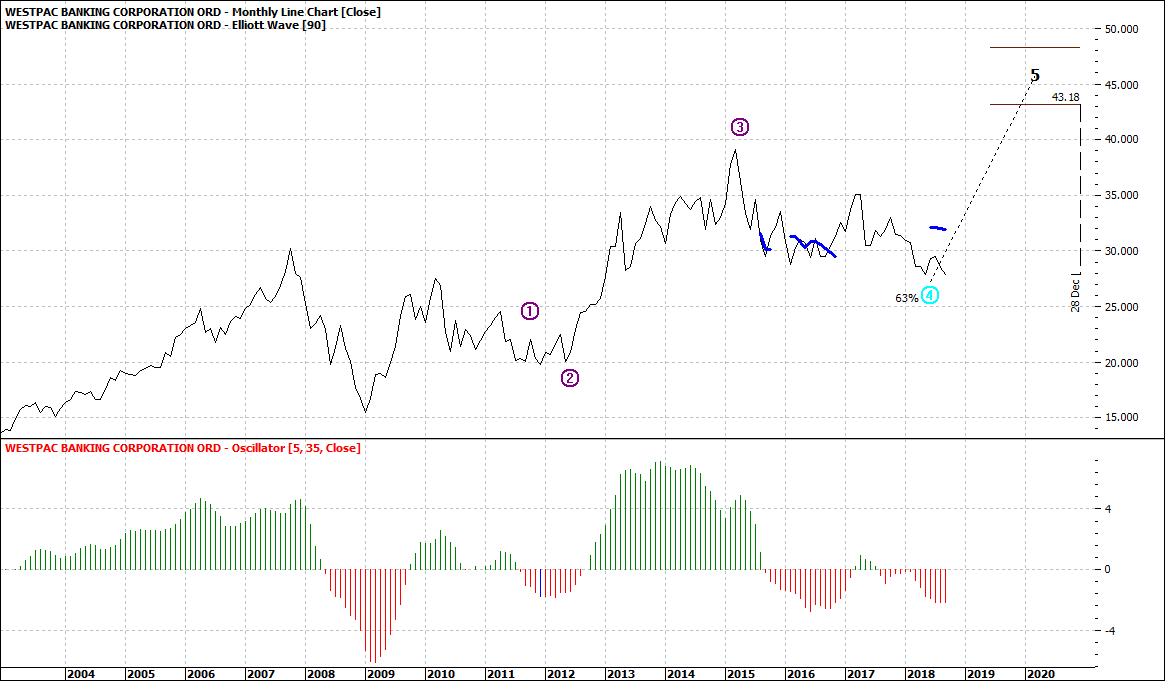

WBC:

|

Westpac Banking Corp (WBC): Monthly Line Chart

|

|

|

Click to Enlarge

Now that is not to say that there will not be up days and maybe periods of seemingly sustained movement – maybe – but we are not likely to see trending movement for many years.

Instos and retirees and long-term investors will continue to buy.

Banks will be good dividend servants and maybe even give a small annual percentage move. Perhaps more reassuring I do not see the stocks falling over a cliff. We might say money will be relatively safe.

I hear you asking what about CBA and WBC? Aren’t they looking at a wave five in the eye?

Study them for a moment and you will see that their retreat has been deeper than expected. Too late to bale out but not that bad anyway in the context of time.

CBA at $70 is not bad when you recall that listing value was of the order of $5.

If you are a long-term investor and bought at listing – you just see it out as you are laughing anyway.

To illustrate my point about "over retreating" look at WBC as an example:

|

Westpac Banking Corp (WBC): Monthly Line Chart

|

|

|

Click to Enlarge

This year it fell through support and is now languishing.

So if you want growth, look somewhere other than banks.

Enjoy the ride

Tom Scollon

|