Getting late maybe, but sharp timing is now needed if you want buoy buying.

We will focus on the USD to start. Forget politics and Supreme Courts. This is strictly monetary.

Let’s look at daily, weekly and monthly of the USD:

|

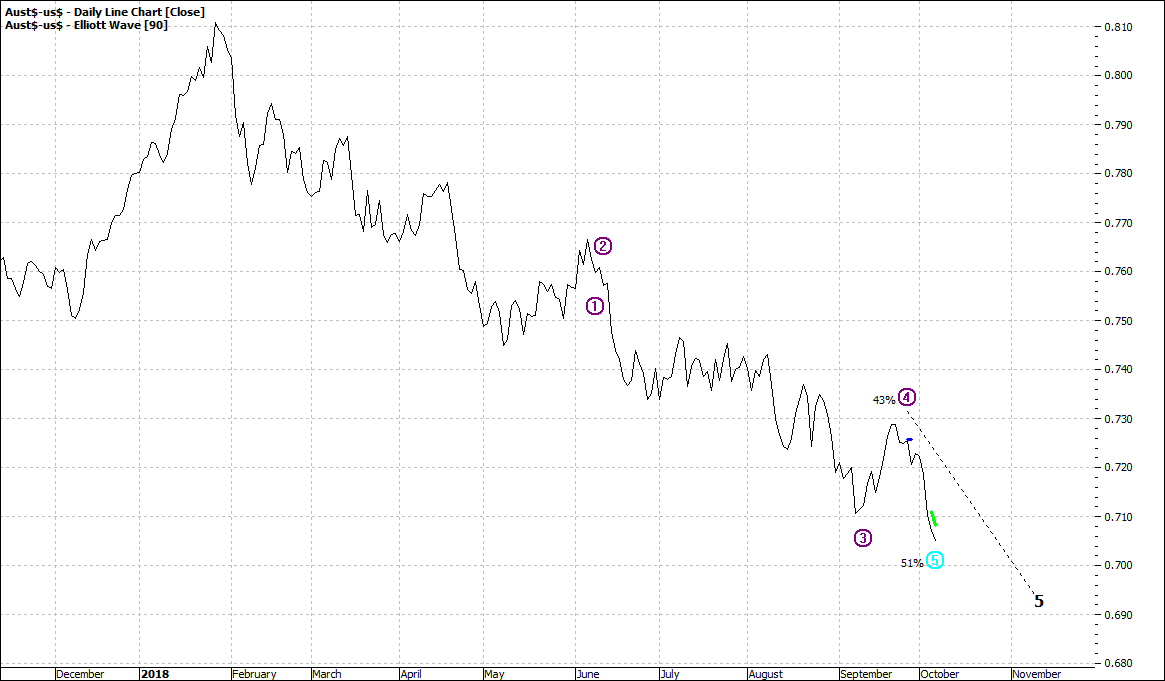

AUD/USD (FXADUS) - Daily Line Chart

|

|

|

Click to Enlarge

|

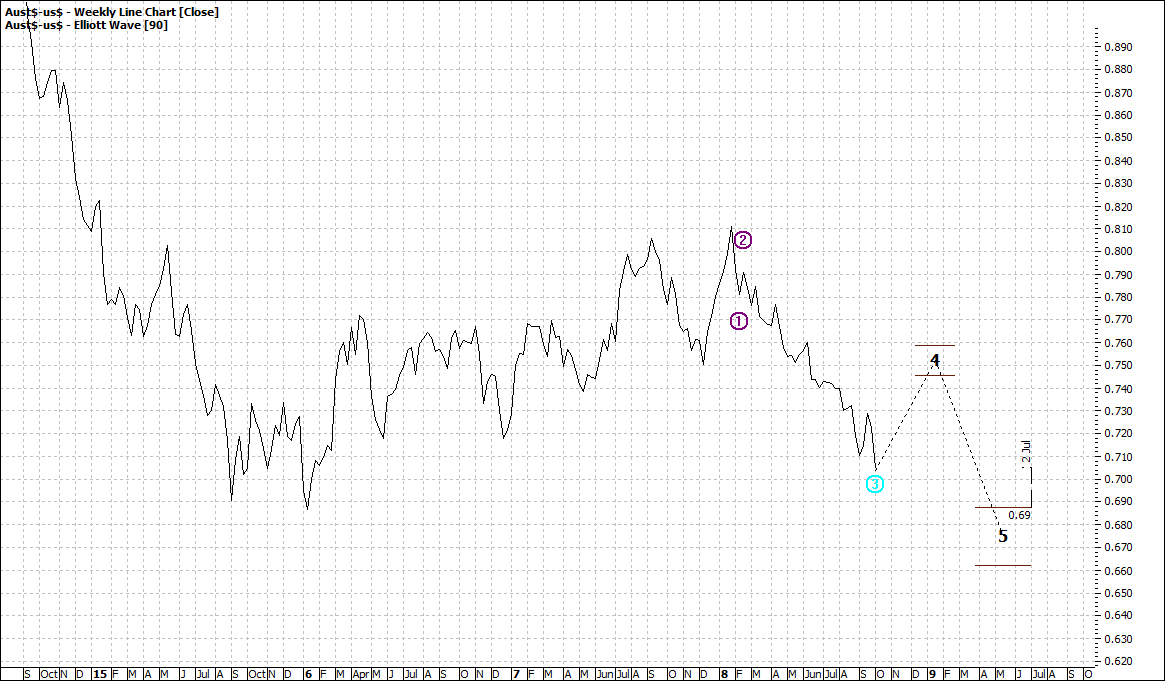

AUD/USD (FXADUS) - Weekly Line Chart

|

|

|

Click to Enlarge

|

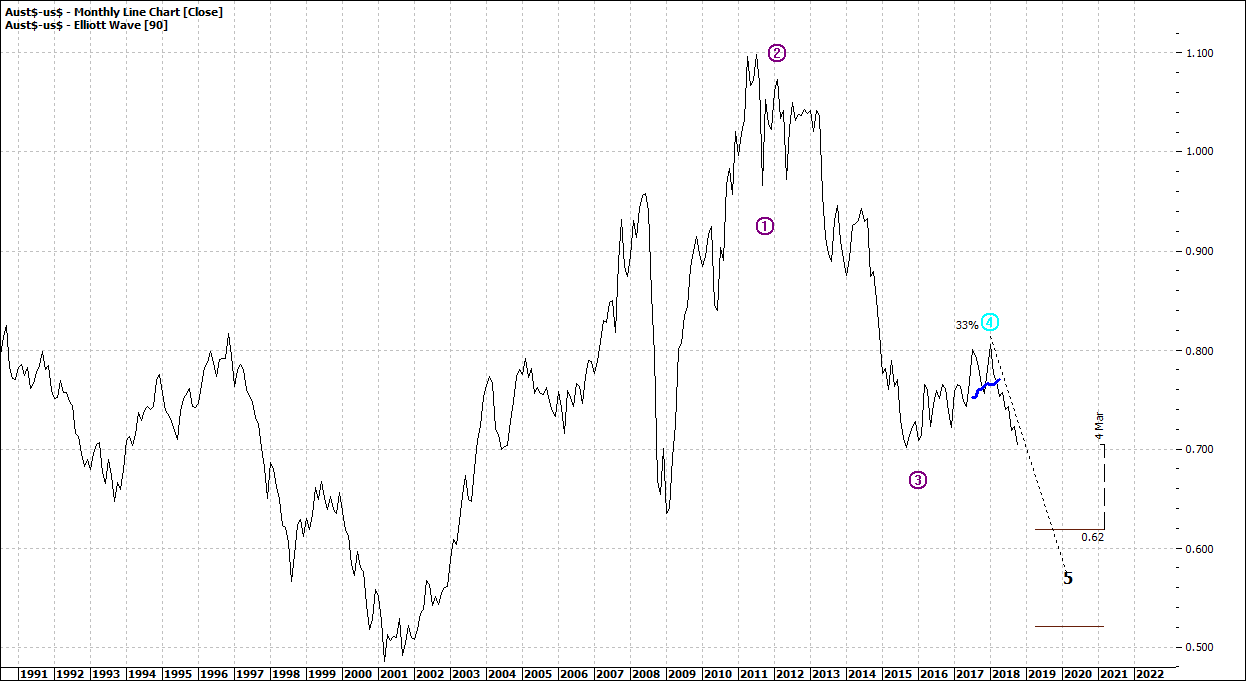

AUD?USD (FXADUS) - Monthly Line Chart

|

|

|

Click to Enlarge

So that is the outlook. Not precisely of course, as life is not that predictable. But what Elliot does is to assign probabilities of outcomes.

And I expect that what we see above is likely to come to pass.

The daily chart shows a looming low of about 60/70 but that is a near term outlook.

The monthly chart suggests a low of around 55/60 cents – the likes of which we have not seen in over fifteen years.

Expect that as the low.

Great for exporters but not for importers, their high-end clients or for travellers. Of course, we generally must accept and find ways to work around it. For example if we want/need to travel we certainly need to accept.

We have a small window to buy USD as what we see in the weekly chart shows a possible recovery to about 75 USD.

If I needed USD I would start buying well before 75 cents and to be happy with an average of about 73 cents.

As the market gets close to 75 cents there is every chance it could tank because the short sellers will run amok. Easy money.

The weekly pattern is something I wrote about a few months ago and it was then that the buying was important.

In this low interest environment, I see no harm having USD that might keep one in reserve for 2-3 years, as that is the time before we are likely see an Aussie rise again.

I do not suggest that as a currency play, but rather as sound risk management.

For the Euro; it is all over red rover...

You may be able to buy around 60 cents but the Aussie to Euro is nearing a cliff.

Why is the Aussie looking sick? Well with much shenanigans in Europe and Brexit, rising interest rates in USA and the prospect of some form of declining world economy ahead, we are seeing a resort to the still strong USD.

AUD is a trading currency and we are seeing a weakness in resources because of a likely fall in global growth which Australia holds in abundance, and thus a reduced demand for the AUD is an absolute given.

As they say, hang onto your britches – it could be a rough ride in coming months. Not just currencies but also equity markets.

Once bonds reverse expect rough waters. A certainty. The only debate is how rough and when.

Enjoy the ride

Tom Scollon

|