This is just plain vanilla tech analysis. As per last weeks’ article – when bonds make a major turn then fear, uncertainty sets in, currencies go awire and equities fall.

This is not genius bar stuff.

You don’t have to even know a single indicator.

Common sense tells you markets, whatever they are; bonds, property, equities, art – the lot – have ups and downs.

Firstly, the mother, the queen of all markets – the DOW:

|

Dow Jones (EYM-Spotv): Weekly Line Chart

|

|

|

Click to Enlarge

It has been a long run from 2009. Consolidation from late 2015 and then another big unabated run. Maybe a double top 2018.

But all of this now is history and of little interest to traders.

To the theoreticians yes, it is of interest. But our interest is making money.

So, the only questions for most – including non-investors – for example the media – is where the bottom of may be – retreat, pullback, downturn – whatever you think it might be.

Let me give you three charts of the DOW – daily, weekly then monthly - and then an overview:

stocks:

|

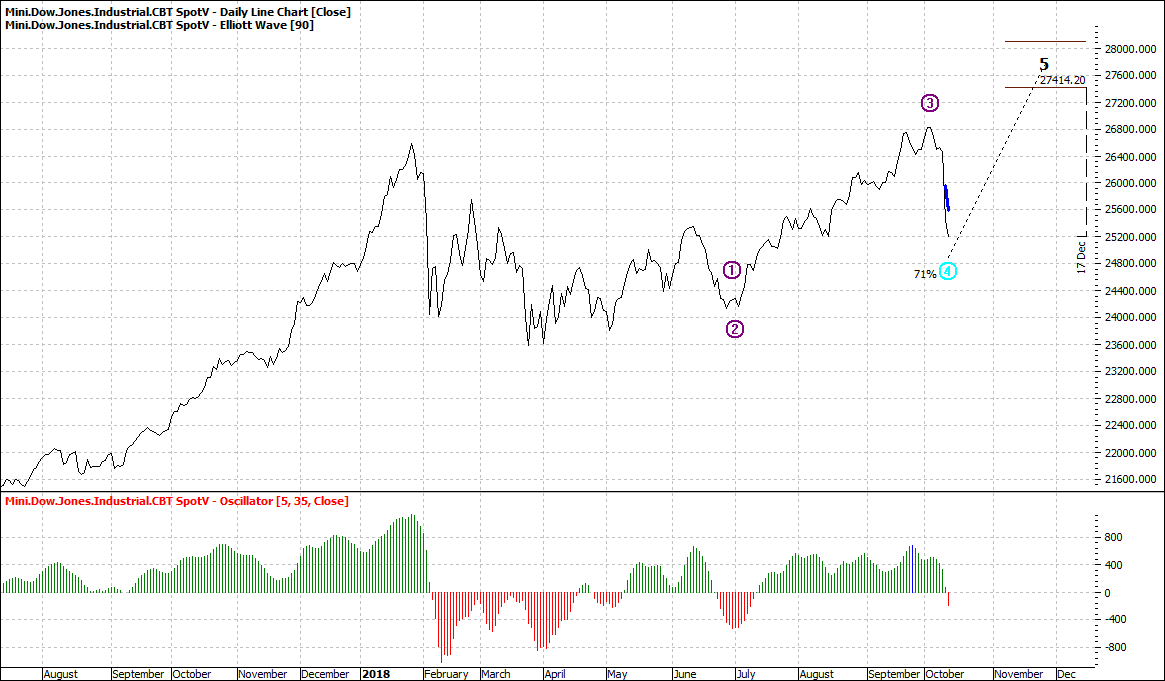

Dow Jones (EYM-Spotv): Daily Line Chart

|

|

|

Click to Enlarge

|

Dow Jones (EYM-Spotv): Weekly Line Chart

|

|

|

Click to Enlarge

|

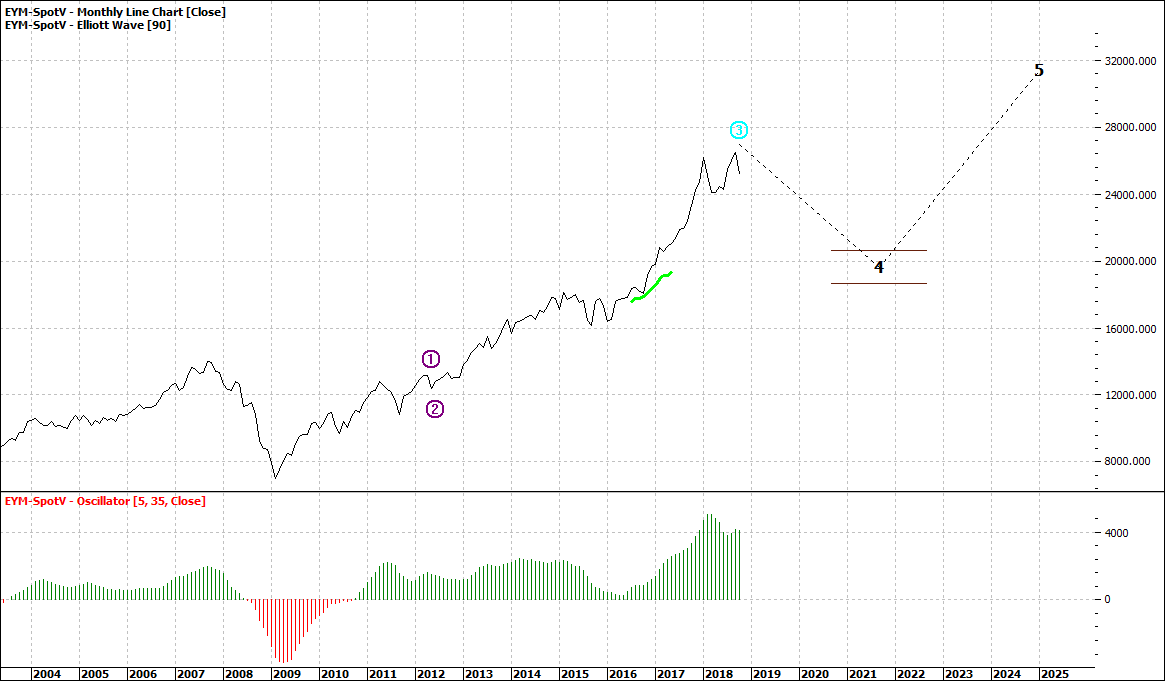

Dow Jones (EYM-Spotv): Monthly Line Chart

|

|

|

Click to Enlarge

Daily chart says a quick recovery. Me thinks not. Oscillator looks weak.

That is not to say there will not be attempts at a recovery.

The weekly also says a merry carry on but again if you look at the oscillator diversion it does not look likely.

The monthly suggests a retreat over the next 2-3 years. In fact, a major retreat that could feel very much like a bear market.

A buoyant market needs buyer. It would take a lot of courage to buy "en masse" right now. There will be a lot of bystanders at best, and at worst a lot of nervous buyers bailing out.

If we don’t see a major retreat, then it will still be a languishing market.

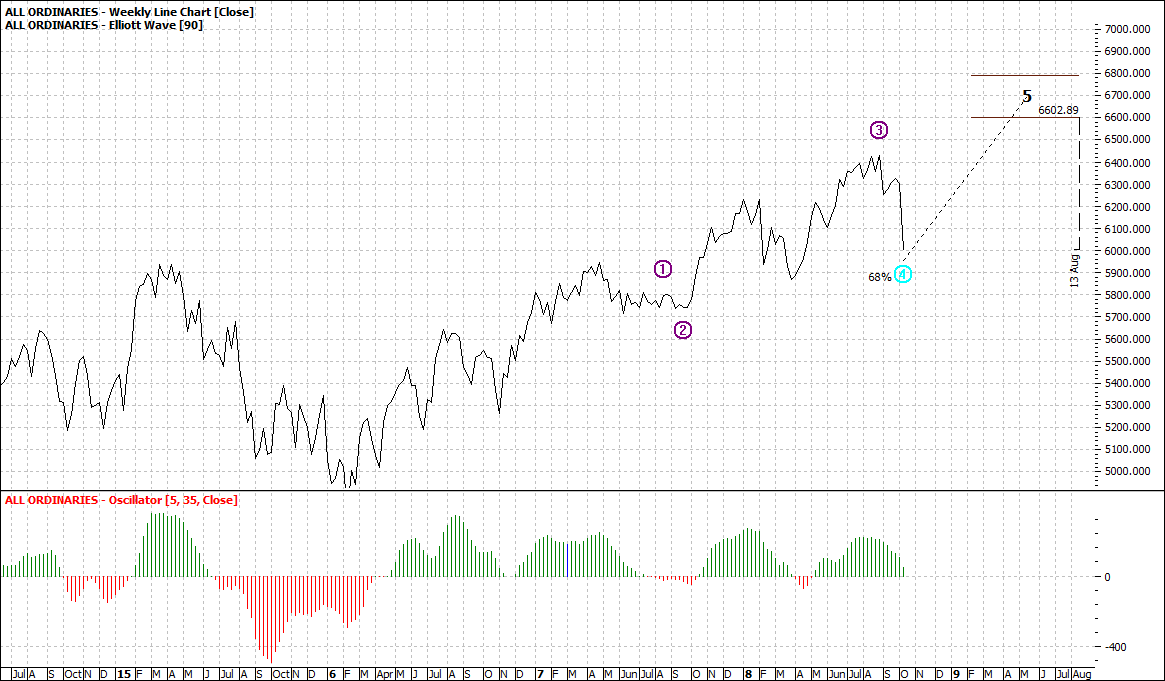

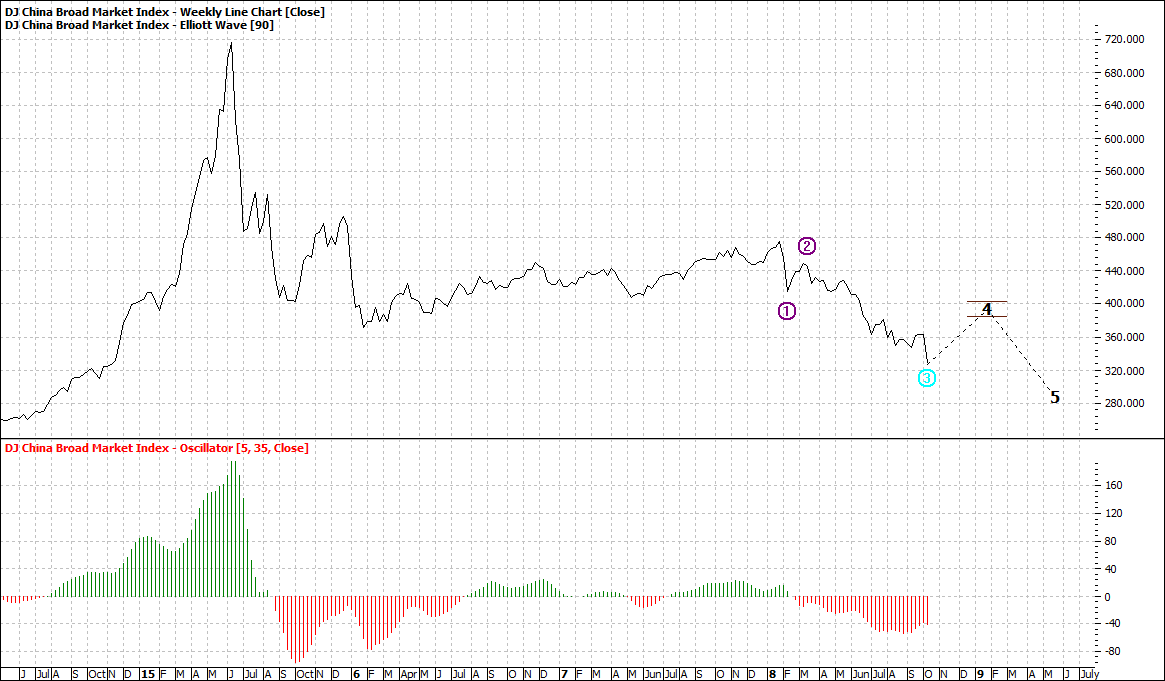

Here are some other global market following similar trends:

Australia:

|

ASX All Ords (XJO): Weekly Line Chart

|

|

|

Click to Enlarge

China:

|

DJ China Broad Market Index (DJCHINA): Weekly Like Chart

|

|

|

Click to Enlarge

Germany:

|

German Dax (DAX-Spotv): Weekly Like Chart

|

|

|

Click to Enlarge

I use the DAX as a litmus for Europe – although it is the economic pillar.

So far still looking fine but there is no upward movement and if we see other global markets slip further then Germany will follow suit.

At this stage we would say there is no "weeping and gnashing of teeth" as we saw in 2009 – not to say it could not happen.

For most term investors a peaceful weekend but derivative traders may have a very nervous one.

I am writing on USA Thursday so at this stage there is no knowing how the DOW may behave on Friday.

If we see major short players capitulate then that will start of the big ball rolling out of control down the long hill.

over.

Enjoy the ride

Tom Scollon

|