The heading went this "3 Warren Buffett Stocks to Buy in November"

He doesn’t need to say anything but somehow as he is the guru and investors follow slavishly his every move.

So, his November stocks are Apple, Mastercard and the lesser known brand Markel which is in one of his long-term sector favourites – insurance.

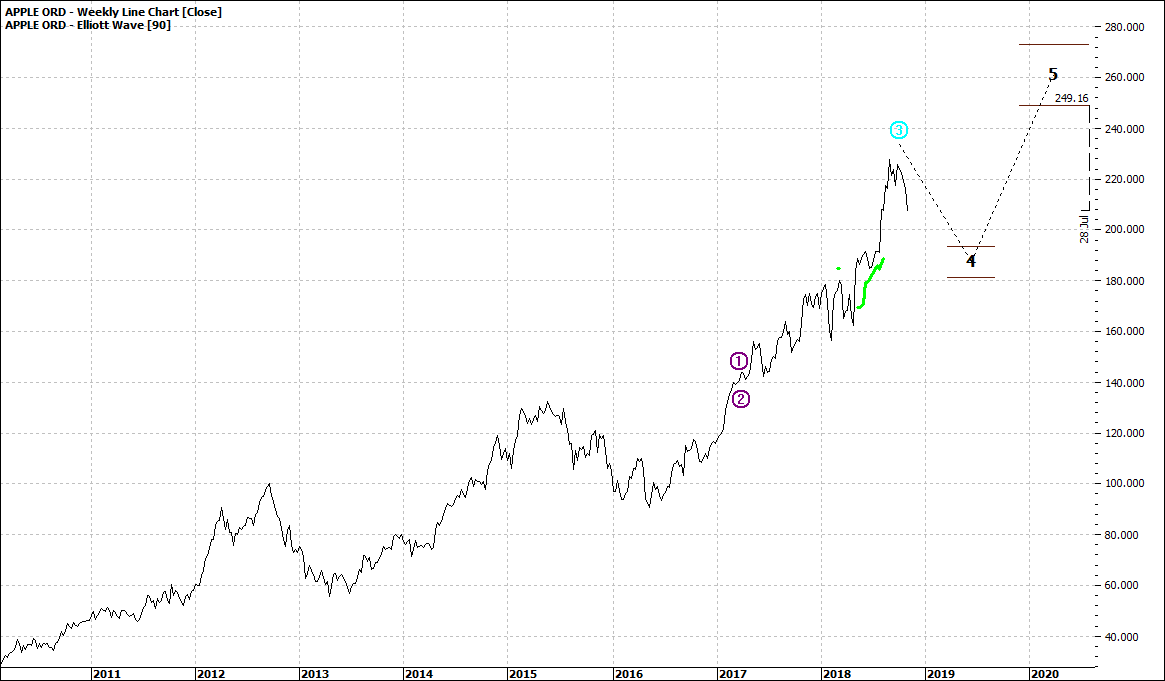

AAPL is the largest stock in his portfolio so I guess it is a good bet to keep buying. Because of the sheer weight of Berkshire’s buying or selling it is hard to go unnoticed and for that reason taking a long-term position is almost the only option. AAPL is facing the prospect of a 20% fall so I guess he would like you to be in their buying heaps with and so prevent a 20% fall. But it is going to happen anyway, and I know at what price level I like to be with him.

And that won’t come in November.

Let’s look at the three charts:

|

Apple Ord (AAPL:NASD): Weekly Line Chart

|

|

|

Click to Enlarge

|

Mastercard (MA:NYSE): Weekly Line Chart

|

|

|

Click to Enlarge

|

Markel Ord (MKL:NYSE): Weekly Line Chart

|

|

|

Click to Enlarge

I'm not saying he is wrong but for the average investor their long-term horizon might be 30 years. I have not known many investors who invest for generations ahead – admirable that might be. The Oracle of Omaha has already been investing for 70 years and I daresay Berkshire is one of those companies that will be around in another 100 years. Almost dynastic. Yes, it is safe to buy for the long term.

The average investor needs to typically fine tune his/her entry because they are more likely to be buying a few parcels. Berkshire are almost constant buyers so topping up is support for the initial decision to invest in that stock. And time horizon is shorter to achieve performance.

And an individual’s buying will hardly shift markets.

How do you look forward 30 years anyway? Insurance and banking/finance will always certainly be there in decades to come, but I wonder what the mobile phone landscape will look like in 30 years’ time and how does Apple last all those years and be not just relevant but rather exciting year on year. I just don’t want another iPhone. Its share price has been driven by riveting developments. Can the pace be maintained?

All three stocks have had a long-sustained rally with almost no pullbacks to speak of so waiting for one could send you grey. But crashes do come and will come. And in the meantime, there are mere minnows out there that will be the next exciting new age stock.

Of course, the three are good businesses but I can’t get motivated to fork out money in November on them.

Enjoy the ride

Tom Scollon

|