When we talk about stocks that may be

affected by the housing downturn it is complex for many reasons; It is a truism – but some will be more

affected than others.

There are few stocks that are purely

Australian housing related. And stocks

that will experience a direct hit are spread over many ASX sectors – such as

Materials, Realtors and of course the likes of banks and other financial

services companies will feel the effects of a sustained downturn.

Some stocks

for example may be part of the Materials sector but are more focussed on non-dwelling

construction rather than housing.

Some stocks will be hit by the buying and

selling of houses, whilst others will be affected if there is a correlation

between downturn in buying as opposed to a downturn in housing construction.

Housing construction has been a major

driver of the domestic economy for many decades. The Asian buying is a relatively short-term phenomenon.

Certainly, a downturn in buying or selling

will flow through to housing construction as both are affected by the same

factors – e.g., tightening of credit, rising interest rates, consumer

confidence etc.,

There are many would be buyers who have

been sitting on the side lines waiting for this pullback.

But now that it has come many will not be able

to obtain a loan or big enough loan to buy their dream.

One thing I do know from riding out many property

pullbacks over my years is that any hiatus is followed by a burst of activity

and a new sustained surge in construction as there is a constant shortage of

stock. Australia is not building enough

stock for future demand. It is a classic

boom bust pattern.

So, the scene is complex in Australia when

it comes to looking for investment opportunities in building/housing related

stocks. And this is where technical

analysis comes into its own. You do not

need to understand my long preamble.

The stocks that I have shown below are

material suppliers to housing construction – whether that be new or renovating. And certainly, there is a tight correlation

between the latter and the buying/selling of houses.

Here we go:

|

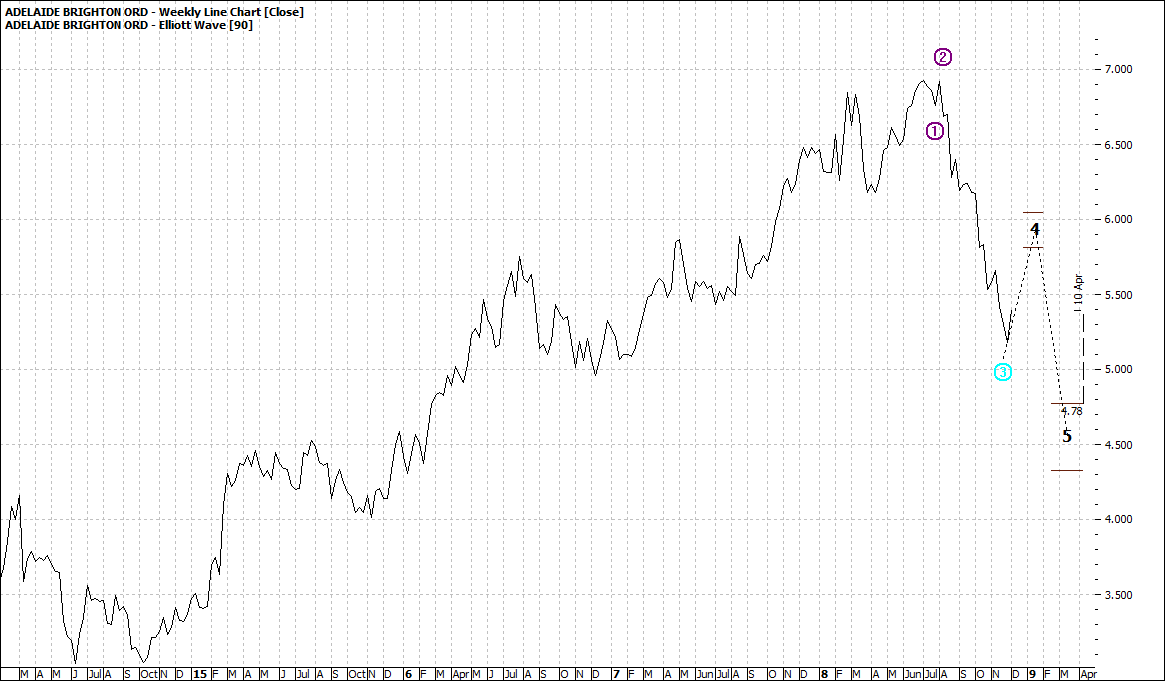

Adelaide Brighton (ABC:ASX) - Weekly Line Chart

|

|

|

Click to Enlarge

|

Boral (BLD:ASX) - Weekly Line Chart

|

|

|

Click to Enlarge

|

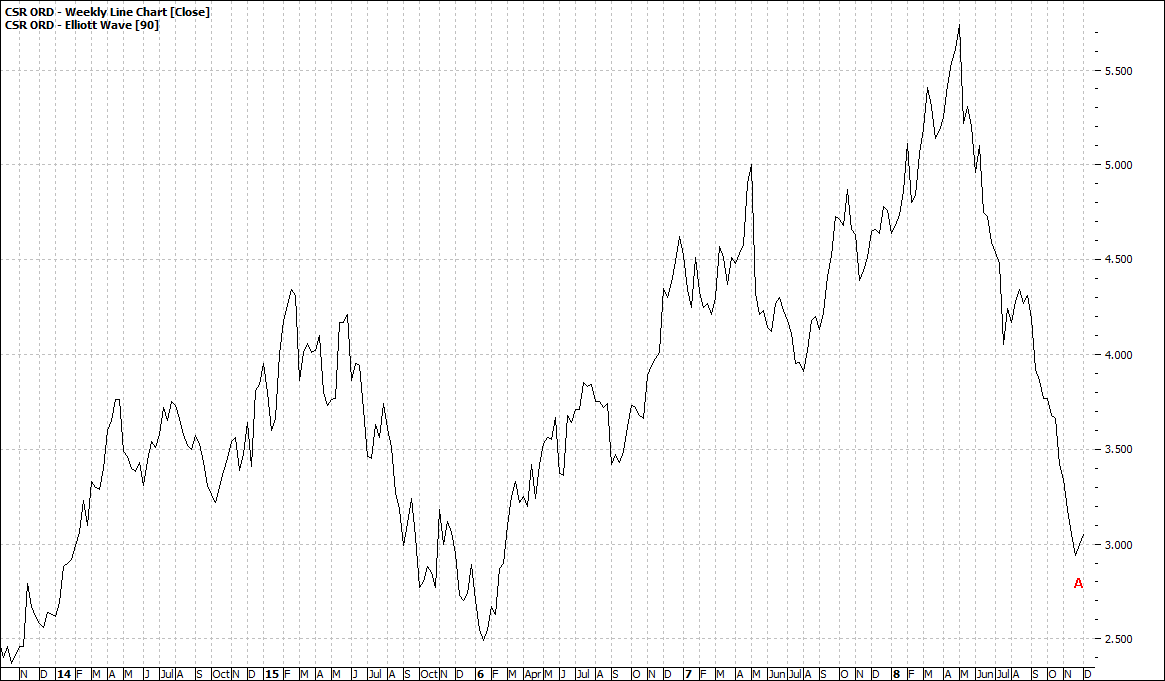

CSR (CSR:ASX) - Weekly Line Chart

|

|

|

Click to Enlarge

|

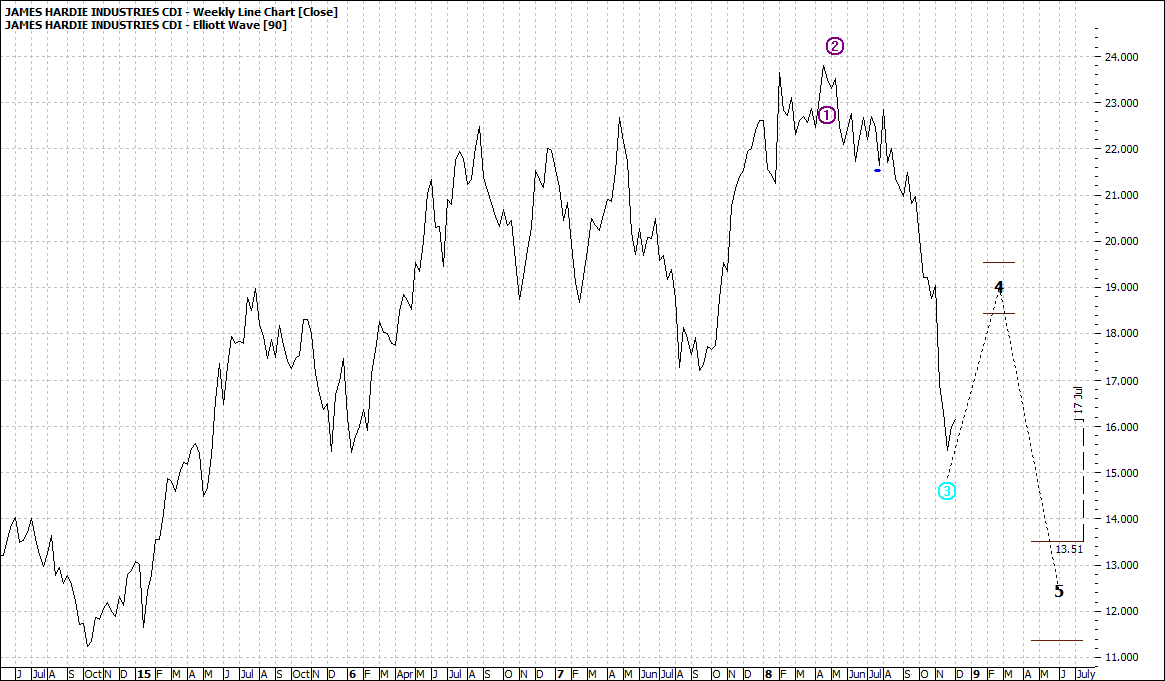

James Hardie Industries (JHX:ASX) - Weekly Line Chart

|

|

|

Click to Enlarge

The sample stocks show conforming patterns. They are all on a slide.

Where they land is any one’s guess.

The above charts are weekly, so they will take a while to play out.

It is not worth taking a punt on such stocks – if you are a long-term player.

If you are a trader, then there are some fantastic opportunities ahead.

Enjoy the ride

Tom Scollon

|