The charts do not give us a precise answer – but that is usual – we merely get guidance or an indication. Some traders who are mechanical follow specific buys and sells. If you follow a proven system with discipline you will make solid returns.

When we look at a market index, we are only looking for the overall picture.

Today I would like to look at the Australian key index – the XAO. As per usual over three time spans – daily, weekly and monthly – in that order:

|

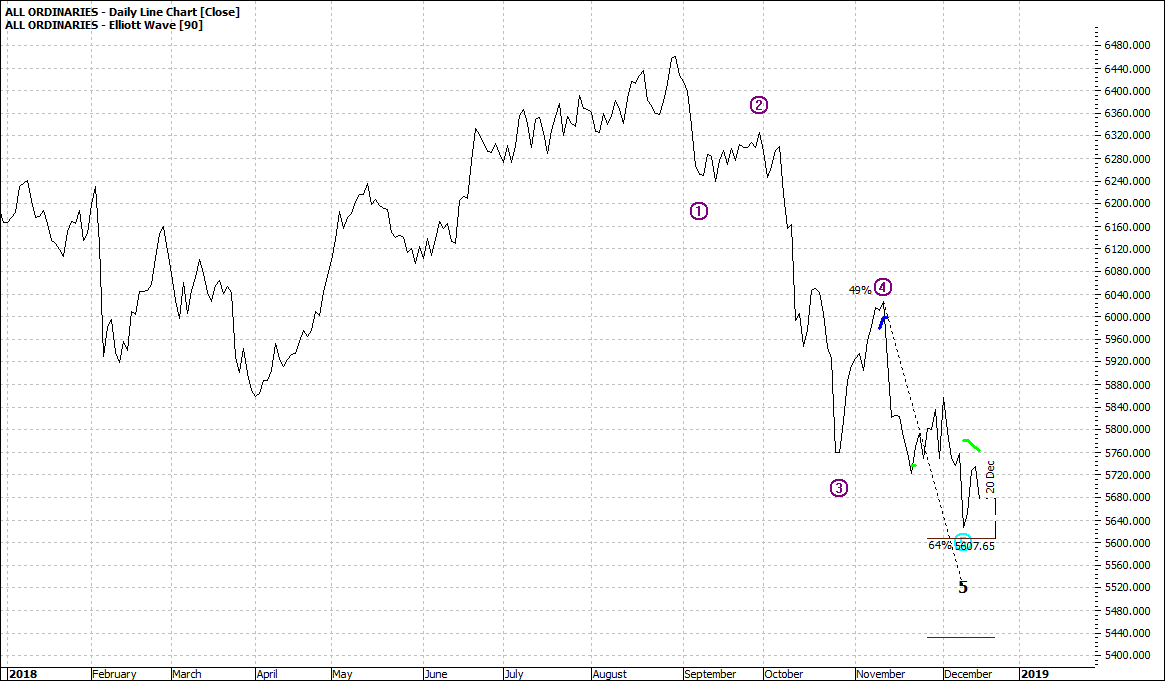

All Ordinaries (XAO:ASX): Daily Line Chart

|

|

|

Click to Enlarge

|

All Ordinaries (XAO:ASX): Weekly Line Chart

|

|

|

Click to Enlarge

|

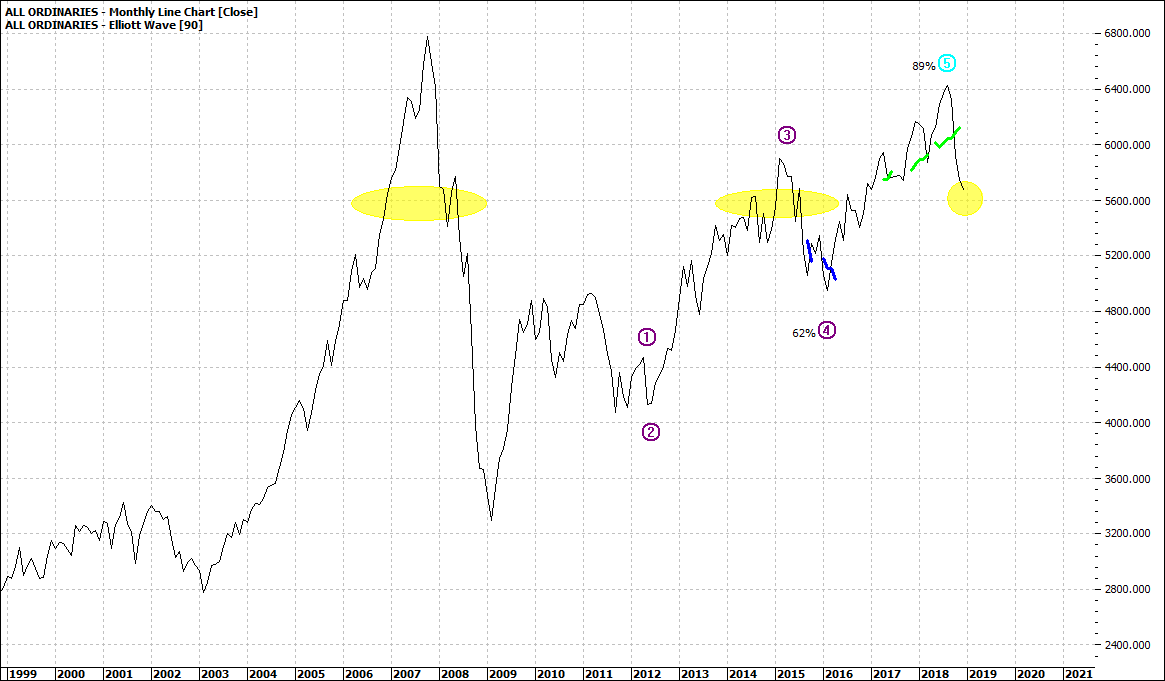

All Ordinaries (XAO:ASX): Monthly Line Chart

|

|

|

Click to Enlarge

The daily tells us that the end of December could well be volatile – a possibility of a rally and then a final dive. With year ends it is tough to call. Volume is light as the big players are basking in the Bahamas or skiing in Austria , so it takes little to move markets.

Also, there can be some window dressing to show great 2018 results. But that is all it can be – window dressing as if you pump up returns for one year-end then you might have to pay the piper in the following year.

The key features to note in the weekly is the deep low – but also the oscillator which confirms what we know, that is, that the market has been convincingly sold off.

The monthly is more telling. I have noted three shaded areas of yellow – all around 5600. Most believe that markets have memories and history repeats itself. The market looks likely to hit around 5600 in the coming weeks/months a level about which it has had much experience. It will be familiar territory.

It is a stark reminder of the rout in 2008. In those months of early 2018 many investors vacillated – perhaps even put their hands over their eyes – wishing and hoping and praying the worst would not happen. But it did.

Over the three years the market flitted – or even flirted with the 5600 level but eventually recovered.

What is likely to happen this time?

I am inclined to think it could be more like 2013-2015. A time of many ups and downs. There are many uncertainties in this current weird geopolitical world – but no major ‘’X’’ factors as we see it now. But that is the nature of ‘’X” factors. Most of the world does not see them coming.

At a minimum for now, keep your portfolios tidy.

Enjoy the ride

Tom Scollon

|