|

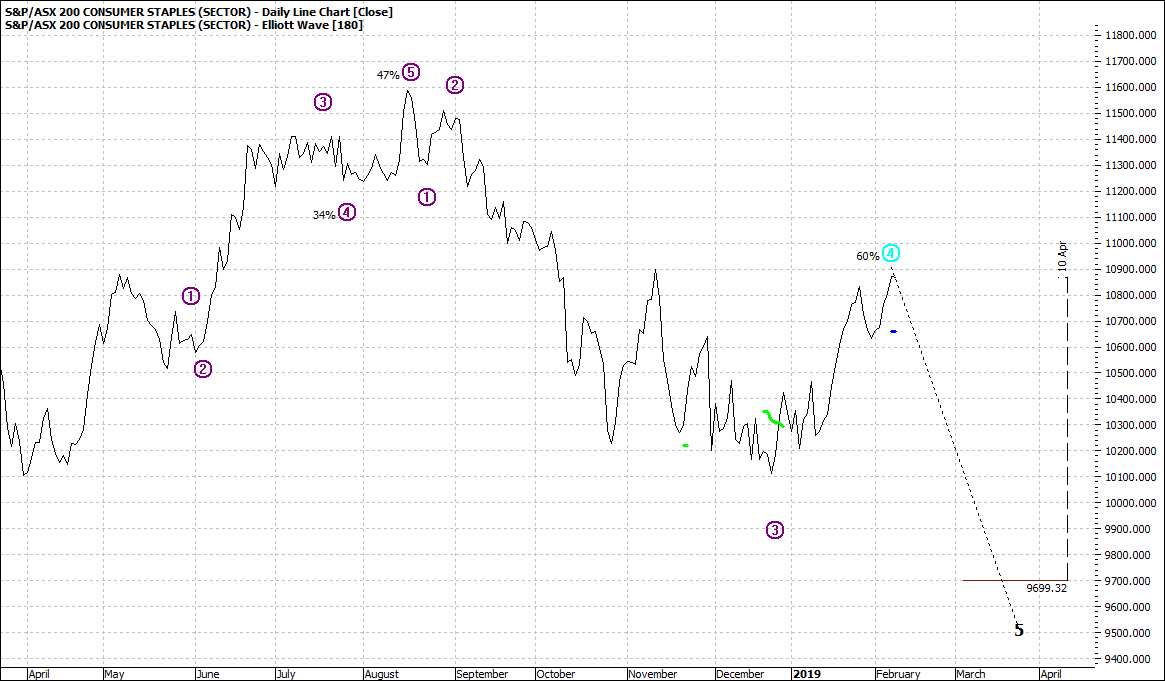

S&P ASX 200 Consumer Staples (XSJ): Daily Line Chart

|

|

|

Click to Enlarge

It does not take long to form a view – or for that matter it takes little time to set up the charts. Really there is little to say about individual charts as the obvious stands out clearly.

Every chart point to a pullback or a retreat of some degree. There is consensus amongst the indices. Maybe this is self-fulfilling.

The indices I have chosen, represent very different sectors of the overall market which is measured by the XAO.

They are not always moving in the same direction – in fact it is not common at all.

Consensus can be reason for us to be a little suspicious but in this case, we can see that each sector has risen steeply in the last month or so and all are what we might call ‘’toppy’’.

It is usual for markets to cool off a little after such a run.

The question at such times is what depth of retreat we might see. I would be surprised if it was a mere dip. I would also be surprised if it was an Armageddon fall plunge into oblivion.

So, to say something in between is not telling you anything you did not know. Maybe in another week we will have a clearer view and we can project more usefully.

We don’t always have to take a strong view.

There is nothing wrong with sitting on the fence at times.

I for one would not chase such a market anyway and if anything, I would be seeking to short and many will be doing just that in the coming days – but cautiously.

That in itself will be enough to cause the market to at least pause the rush of adrenaline we have seen in recent weeks.

Enjoy the ride

Tom Scollon