Most of the major indices are looking soft especially those we come into contact in daily life – for example our consumer spending and banking; Both very soft. But not all indices are soft...

Let’s firstly look at the overall market through the All Ords, and then resources – materials – XMJ

Firstly XAO:

|

All Ordinaries (XAO) - Daily Line Chart

|

|

|

Click to Enlarge

|

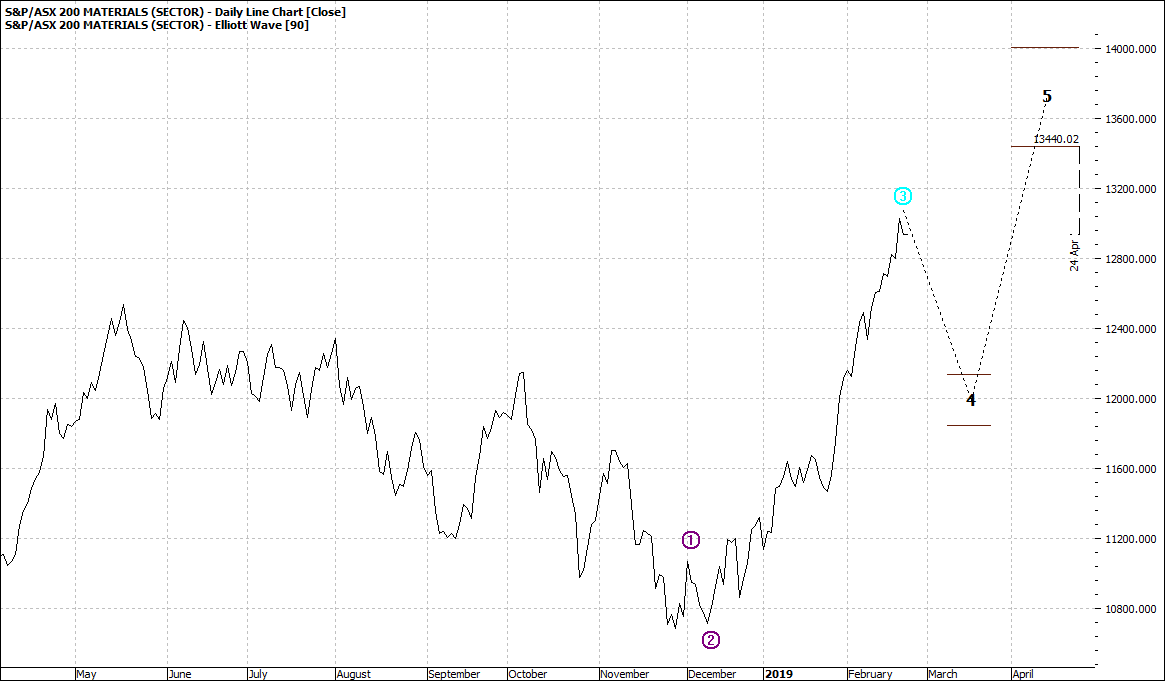

S&P ASX Materials (XMJ) - Daily Line Chart

|

|

|

Click to Enlarge

Identical patterns and the only two indices that have such a pattern at the moment.

I had doubted that the XAO would go much higher, but I had not looked at the other major underlying market indices.

Looking at both of these charts, I can say from experience that though we see a wave four pullback – minor one – the wave three could push up to the wave five projection.

I have witnessed that numerous times and would be very comfortable to buy stocks that show this pattern – buy for a short to medium run.

It appears there is not a high likelihood of a pullback in the overall market in the immediate future.

But I would not be a buyer in such a market for the long term. Short term? We may be seeing the perfect storm.

I must stress I would be very stock selective.

Enjoy the ride

Tom Scollon

|