I have just cycled through the top 200 – a reasonably safe list – but nothing excites. Over the years I have learned to bide my time, and I will.

Markets and stocks are fairly fully priced. Many will probably go higher but it is not a safe phase in the cycle, so caution is prudent.

|

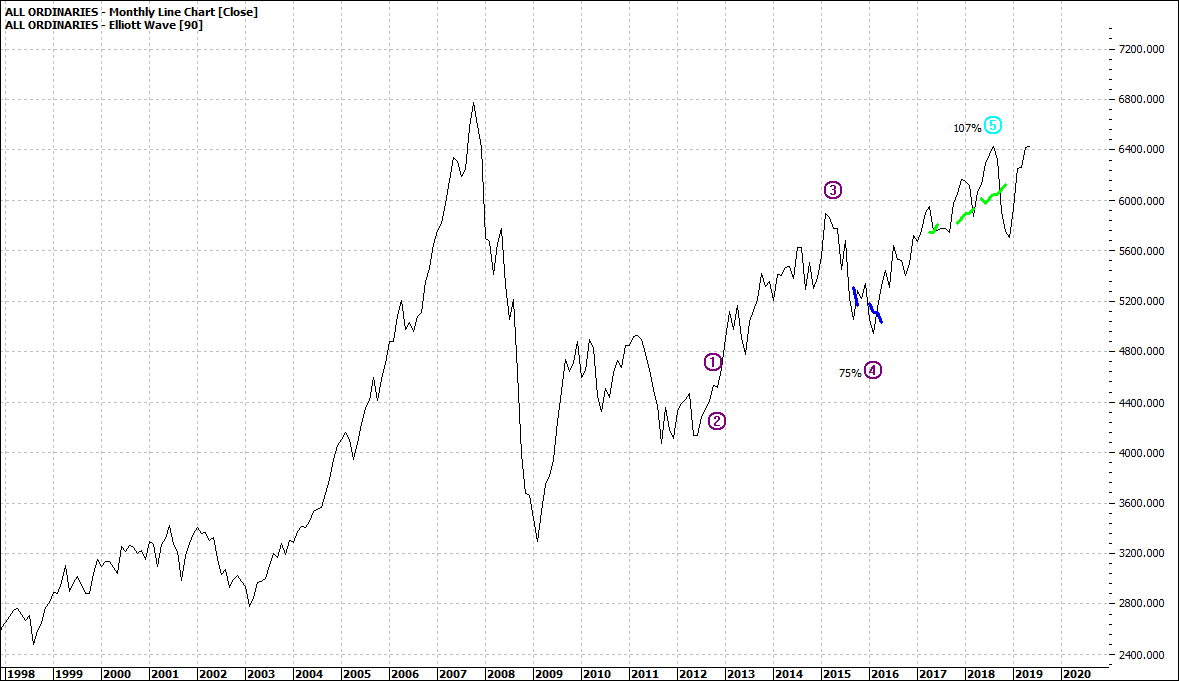

All Ordinaries (XAO:ASX): Monthly Line Chart

|

|

|

Click to Enlarge

It would be tough to argue strongly that a second wave five high will be reached. Could, but the probability is low.

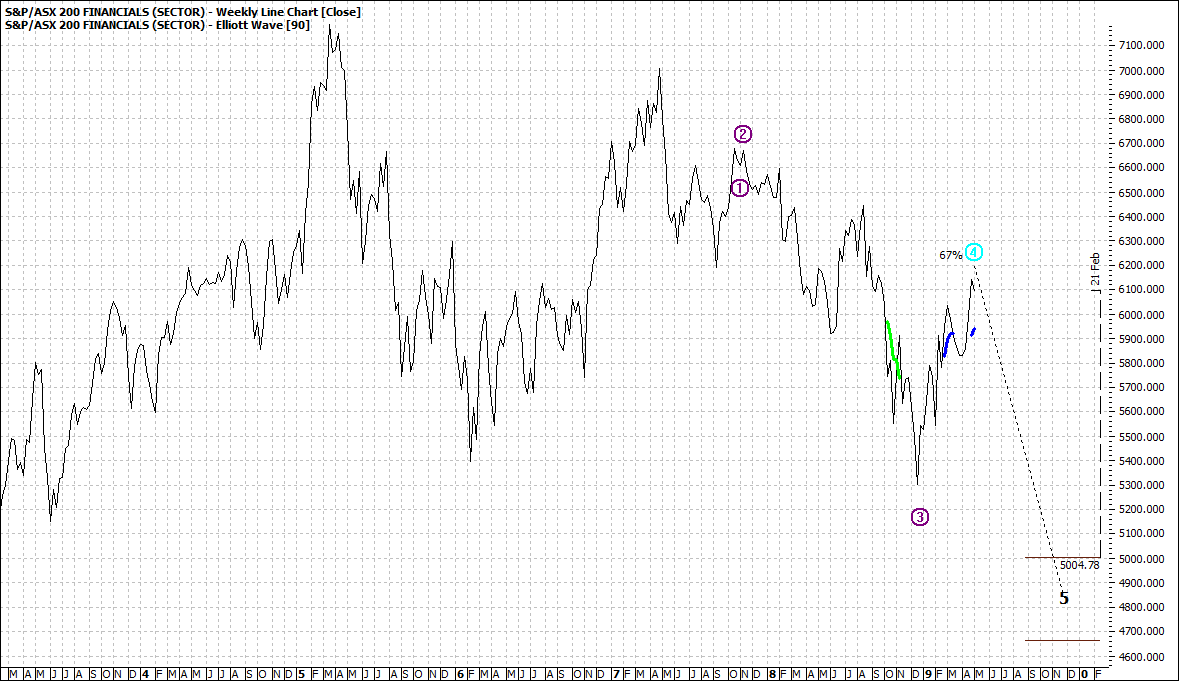

Again, we have the two major sectors – Financials and Materials working against each other:

|

S&P/ASX 200 Financials (XFJ:ASX): Weekly Line Chart

|

|

|

Click to Enlarge

|

S&P/ASX 200 Materials (XMJ:ASX) Weekly Line Chart

|

|

|

Click to Enlarge

Materials will most likely push higher and the Financials lower.

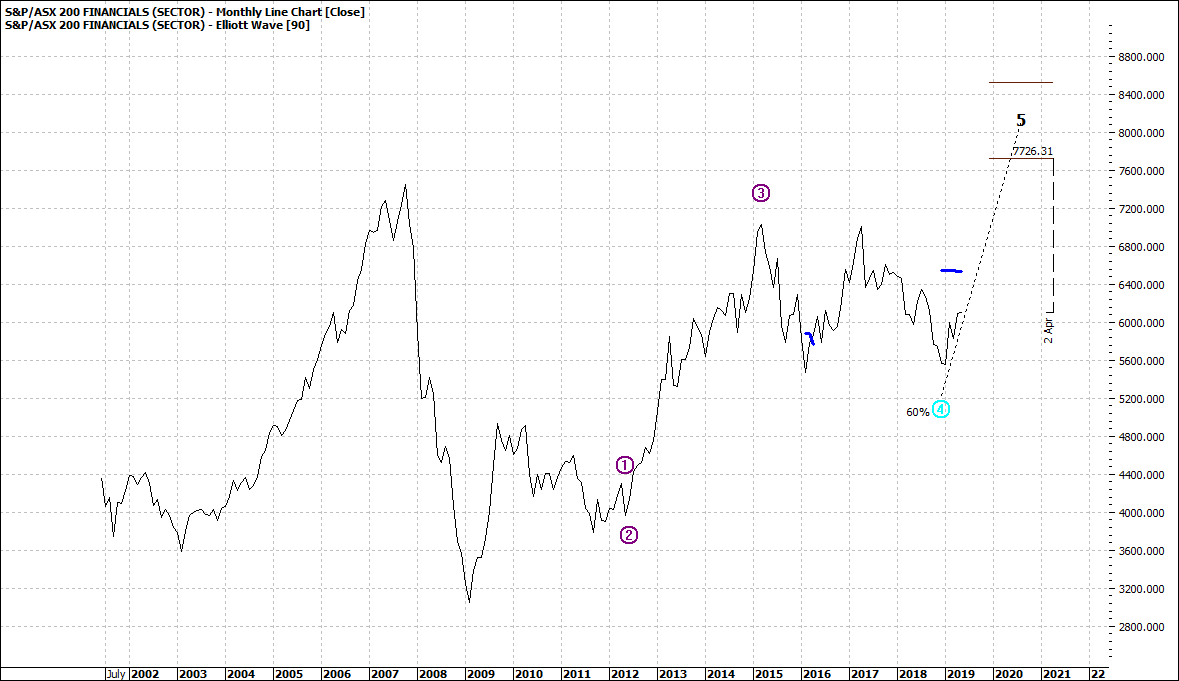

There is a long-term glimmer by way of the monthly Financials:

|

S&P/ASX 200 Financials (XFJ:ASX) Monthly Line Chart

|

|

|

Click to Enlarge

But you can go on a long holiday once you have cleaned out your current portfolio before any major pullback.

As I cycle through the market, stocks fall into two major categories – those that struggle to their top and those that are yet to find a low.

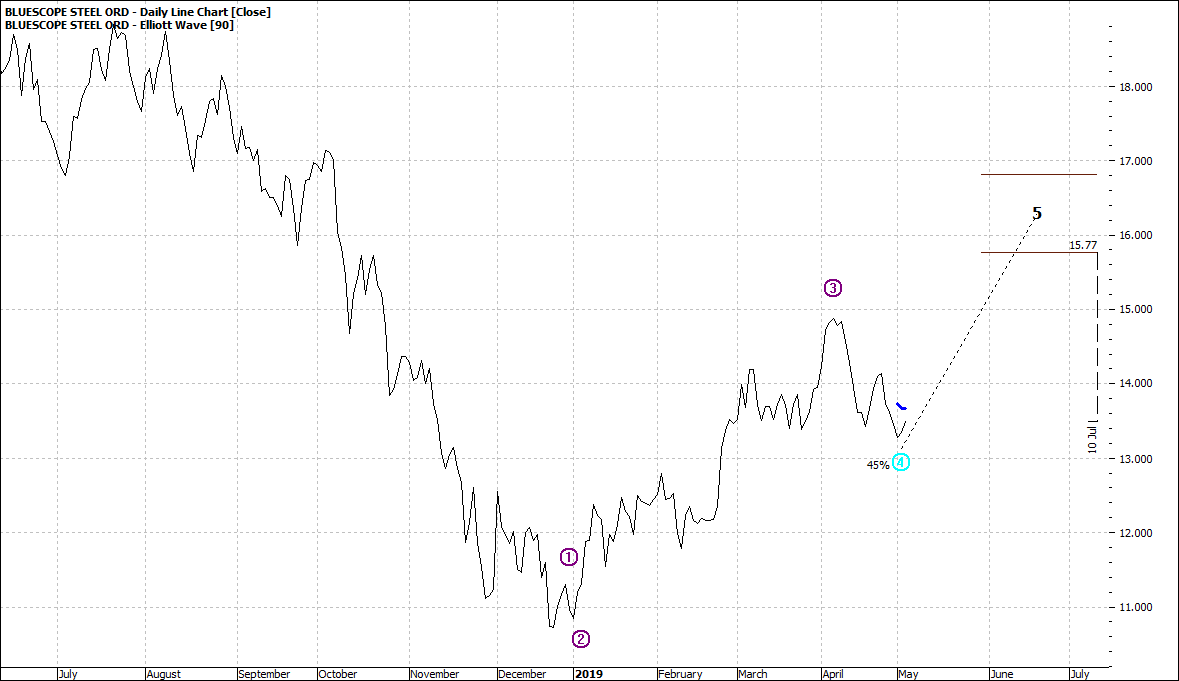

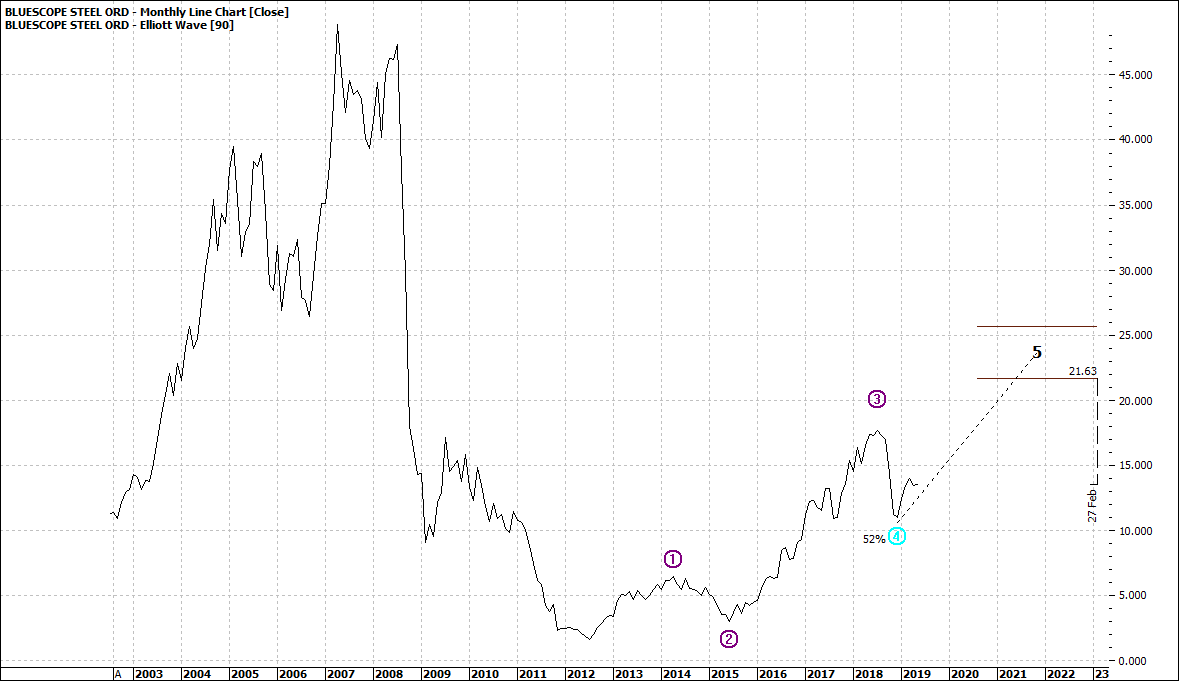

A case in point is BSL. You could take a punt on it at this pullback:

|

Bluescope Steel (BSL:ASX) Daily Line Chart

|

|

|

Click to Enlarge

But you could also be surprised by a sudden fall out:

|

Bluescope Steel (BSL:ASX) Weekly Like Chart

|

|

|

Click to Enlarge

But if you are patient you could ride a much more likely lucrative longer move:

|

Bluescope Steel (BSL:ASX) Weekly Like Chart

|

|

|

Click to Enlarge

Everyone else is waiting too, but few will time it with much success. That’s the markets for you.

Enjoy the ride

Tom Scollon

|