Despite all the sabre rattling by the usual global bully political suspects no-one seems to be scared out of their wits. I am not saying they should be, but you would ordinarily expect they would be. Maybe just very clever poker faces. For the moment.

Bond prices are rising and so it appears that some global interest rates could ease further. I do not use the expression 'fall further' as they can’t go much lower; so by definition it can’t be a 'fall'.

What is most important is not the level of interest but the fact that a further easing is an indicator that low interest rates are likely to be around for quite some time - perhaps even years – and this will give confidence to investors.

Markets will remain buoyed for some time as there are few places you can park your money.

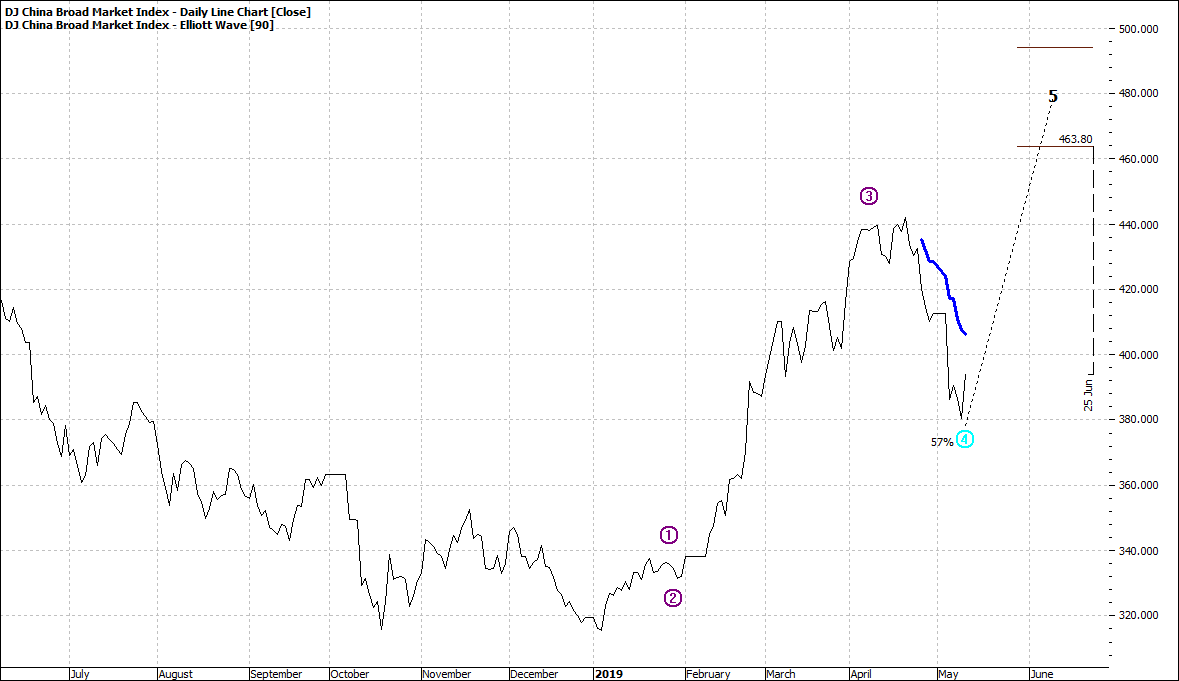

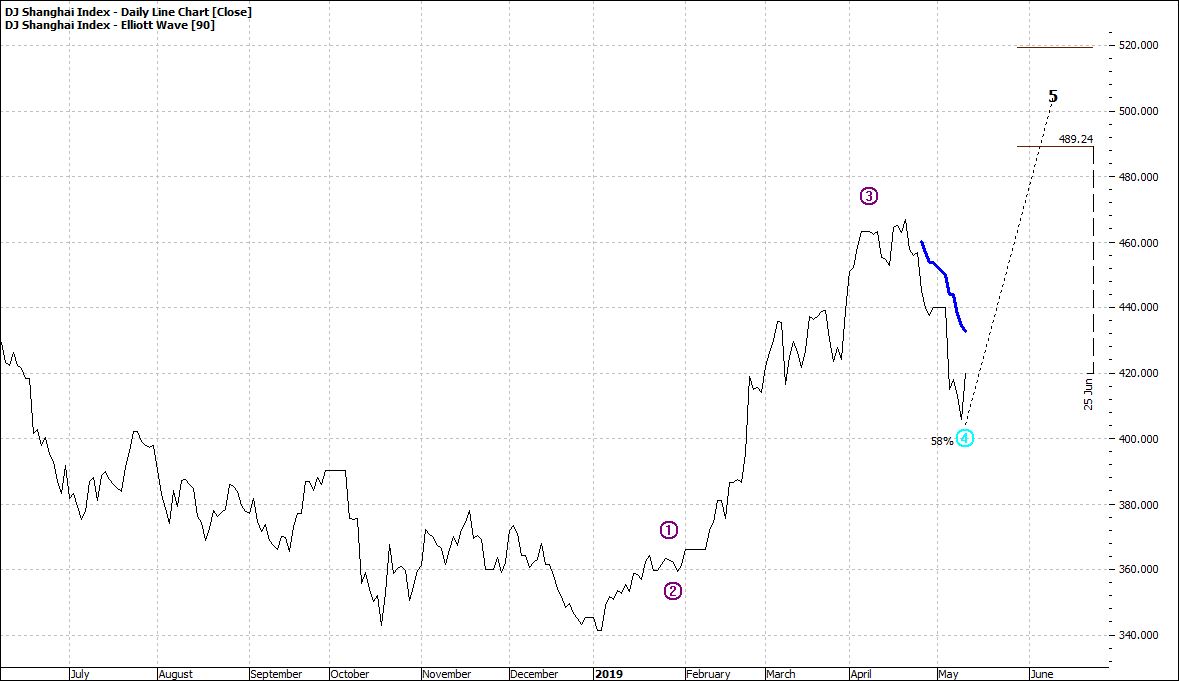

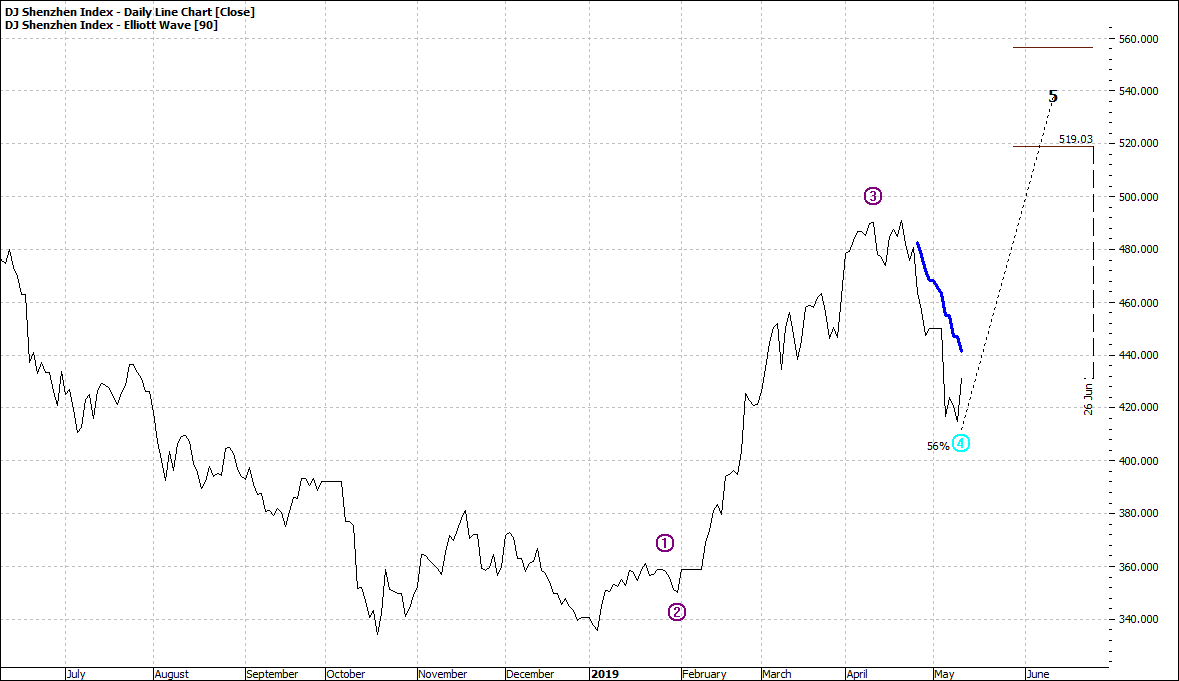

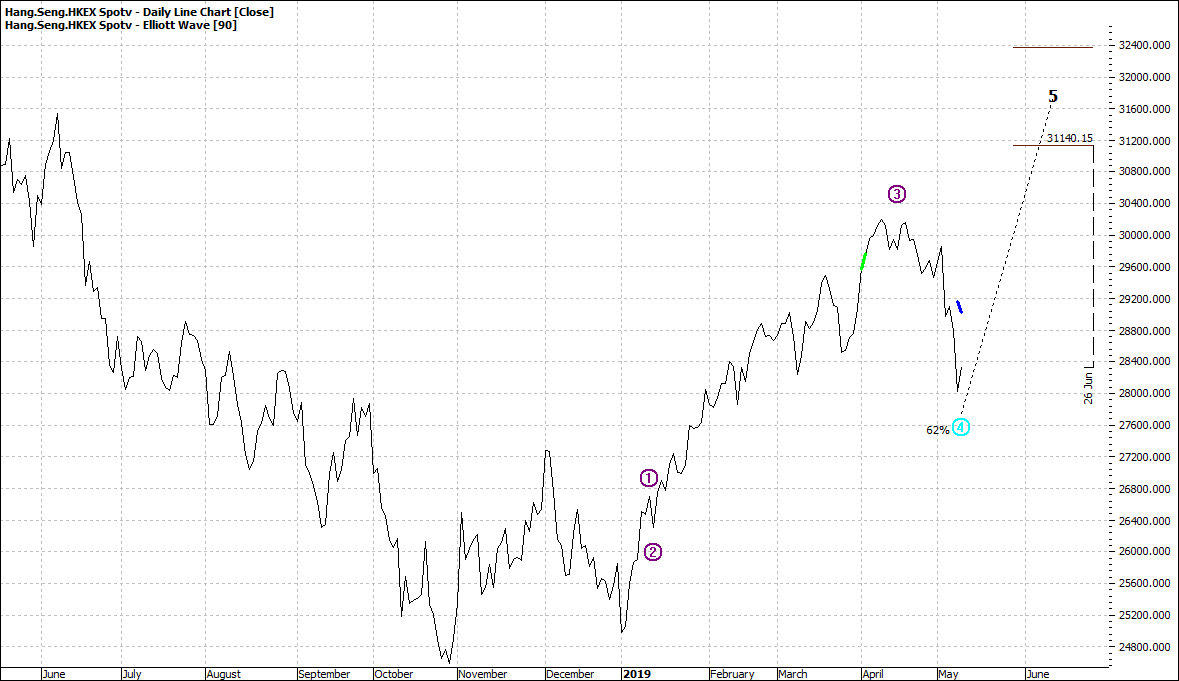

And when I look at Chinese equity market proxies, I see little fear from investors in China. Likewise, US indices suggest that investors are not really phased by all the trade posturing which is starting to bite despite the poker faces.

Take a look at my four chosen China indices:

|

DJ China Broad Market Index (DJCHINA:CBOT) - Daily Line Chart

|

|

|

Click to Enlarge

|

Dow Jones ShangHai Index (DJSH:CBOT) - Daily Line Chart

|

|

|

Click to Enlarge

|

DJ Shenzhen Index (DJSZ:CBOT) - Daily Line Chart

|

|

|

Click to Enlarge

|

Hang Seng (HHA-Spotv:HKEX) - Daily Line Chart

|

|

|

Click to Enlarge

There is consensus. Investors are affirming that China is not overly worried and investors are holding strong. For now.

The VIX did murmur a little early this month but has settled and so the fear index is also confirming investor ease.

As far the Australian market is concerned little has changed, and the market is business as usual. Uncertainty at the top of market period highs are normal and certainly there are no signs of over bearing downward pressure.

So the Bravehearts will stay steady for a while yet.

Enjoy the ride

Tom Scollon

|