I won’t confuse by throwing up a whole bunch of charts but rather concentrate on a couple that are significant.

Let’s focus on three – Copper, Oil and China:

|

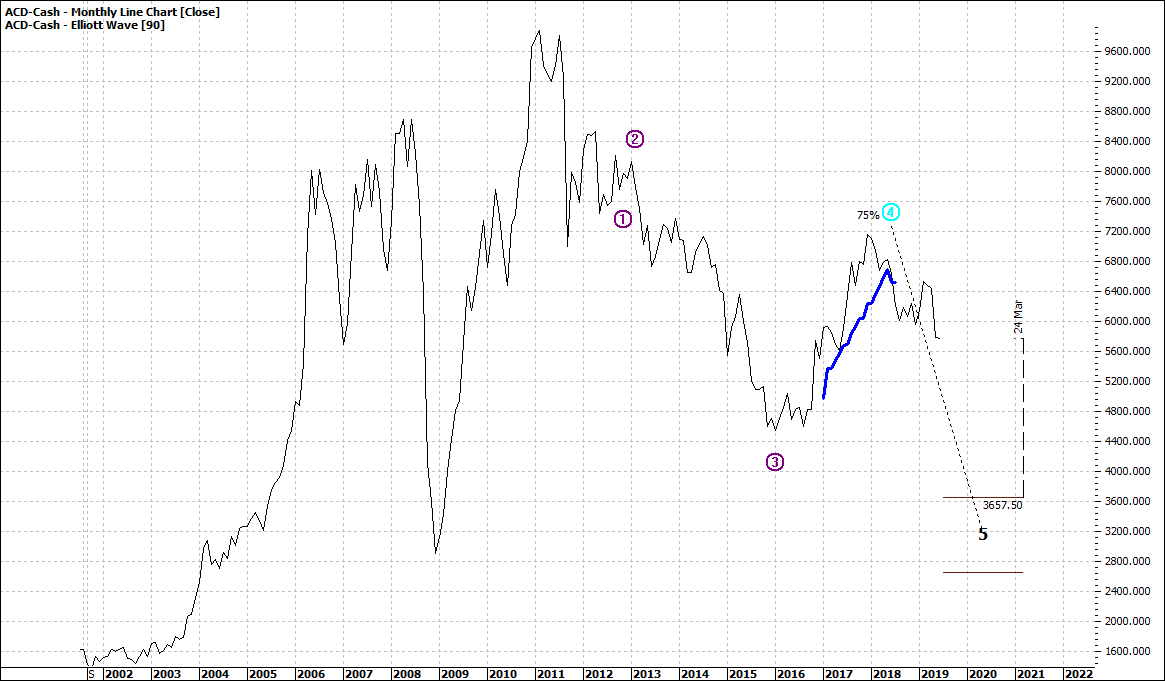

Copper (ACD-Cash:LME): Monthly Line Chart

|

|

|

Click to Enlarge

|

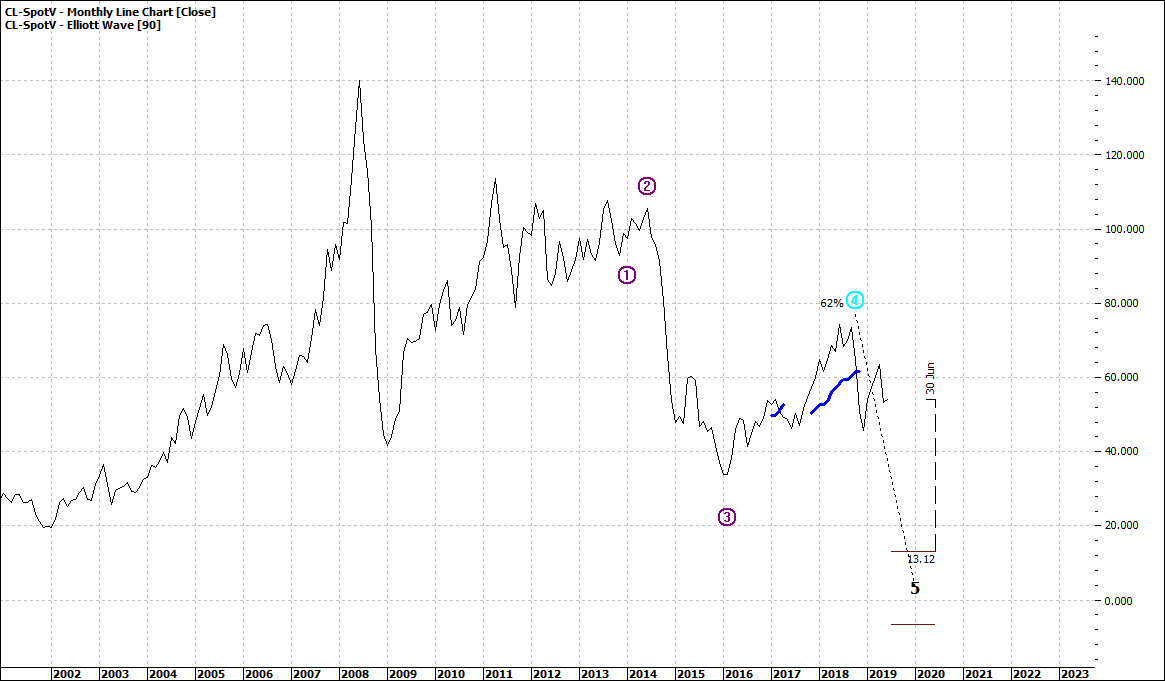

Oil (CL-Spotv:NYMX): Monthly Line Chart

|

|

|

Click to Enlarge

|

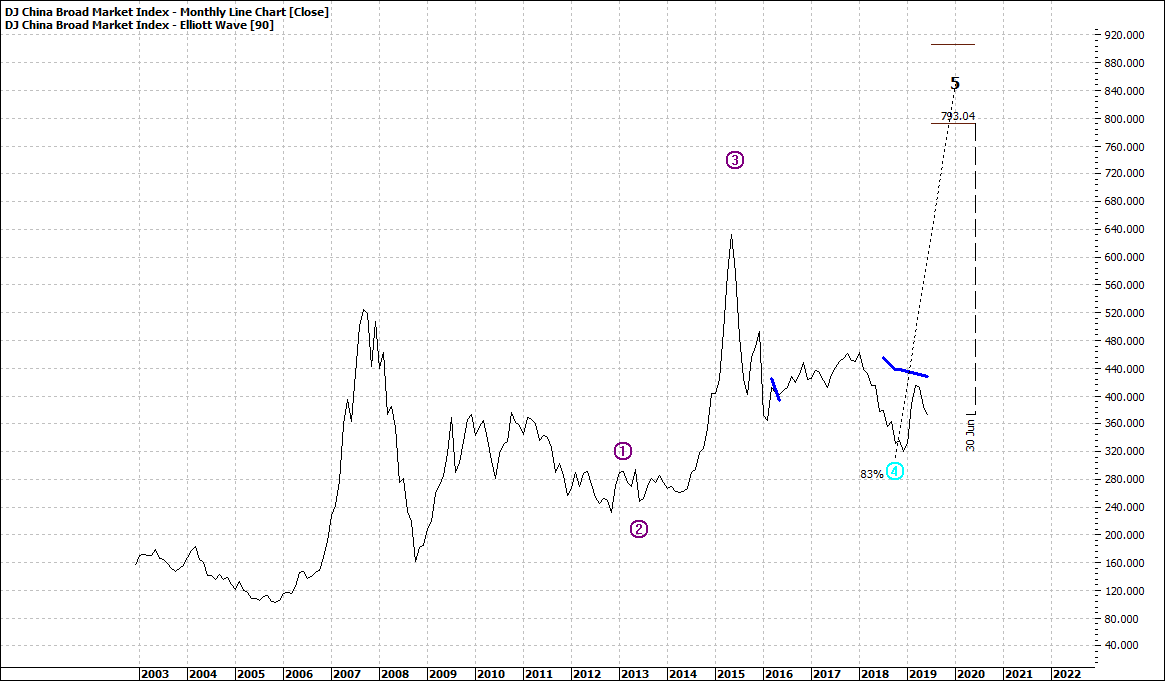

DJ China Broad Market Index (DJCHINA:CBOT): Monthly Line Chart

|

|

|

Click to Enlarge

I have a short list of futures that I could cycle through in less than five minutes, but I must confess I don’t look at all of them as often as I should.

When I do, I am often surprised by the charts which can be a total disconnect with the media hype. I am also sometimes very surprised at the divergence in the indices. What I "feel" is a contrast with reality – that is the objective historical facts as presented in the charts.

Copper has long been my proxy window into the health of the world economic outlook. Of course, it is an old-world indicator in that it shows demand in the so-called emerging economies.

Well we used to say that, but the reality is that we really mean the emerging world economic powers. That is China and the rest of Asia – and the so-called BRIC nations. Often many people in the non-democratic countries in the west are increasingly blind and are not acknowledging what is happening in this mad world. Democracies are under threat while countries like China and Russia are basking in the crumbling of the west. Literally eating the West’s breakfast daily.

So, we don’t use much copper per head as say China does, but our economy’s health is closely connected to the outlook for global copper. The copper chart says the world outlook is not bright at this point in the cycle and the direction for demand is down.

But then we look at the third chart and we see that the outlook for the main Chinese index is very positive. I cannot work that out.

I read the headlines on oil and then look at the chart and I see disconnect. And despite the ongoing uncertainties in the middle east the oil price looks soft.

My overall take on all of this is a sense of caution. An eerie sense.

Enjoy the ride

Tom Scollon

|