Well don’t blame USA either, or trade wars.

When markets get to or near the top, they get jittery. Well investors do. Millions of investors have their own individual view. The summary of these views is reflected in the markets. If in balance investors are bearish the markets react negatively to machinations on the world scene. And they react positively to good news.

When markets are fully or near full valuation they tend to react more to bad news. No particular world event necessarily has a greater tendency to influence a move. Investors rarely make a well thought through logic to react – it is just a summary of feelings.

So right now, the market moves are little to do with a trade war per se as this has been looming for some time and it was only a matter of time. And in the context of time this trade war looks not a lot different from others except it comes at a time when markets are stretched, and the economic outlook is not great. So bad timing. But the sun will shine again.

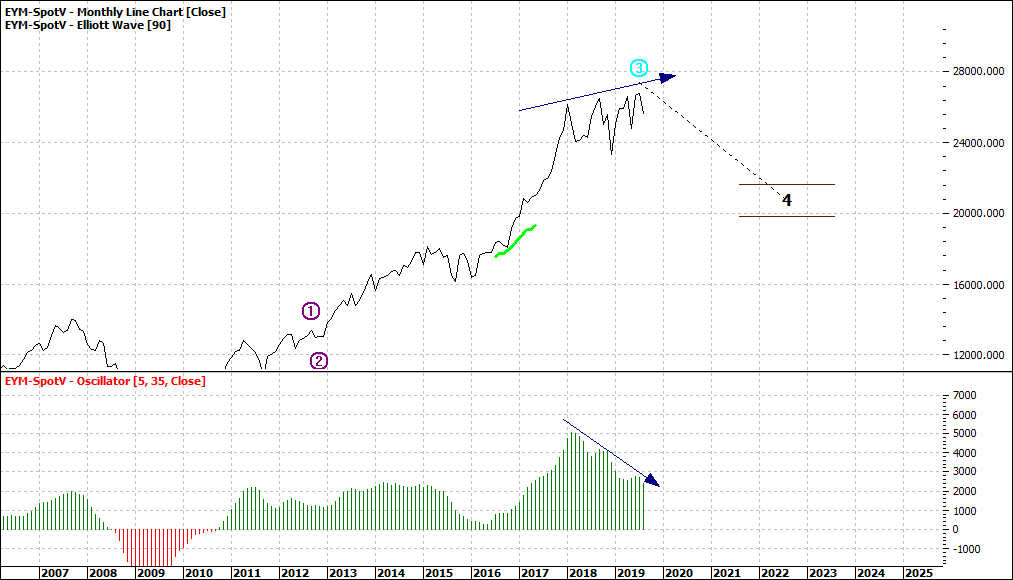

So, my view is little changed since last week. Possibly a long slow grinding pullback:

|

Dow Jones Futures (EYM-Spotv:CBOT) Monthly Line Chart

|

|

|

Click to Enlarge

A slightly different chart to last week. This chart shows a pronounced negative divergence between the price line and the oscillator. In effect more of you will withdraw from the market – oscillating between nervousness and weariness.

Enjoy the ride

Tom Scollon

|