|

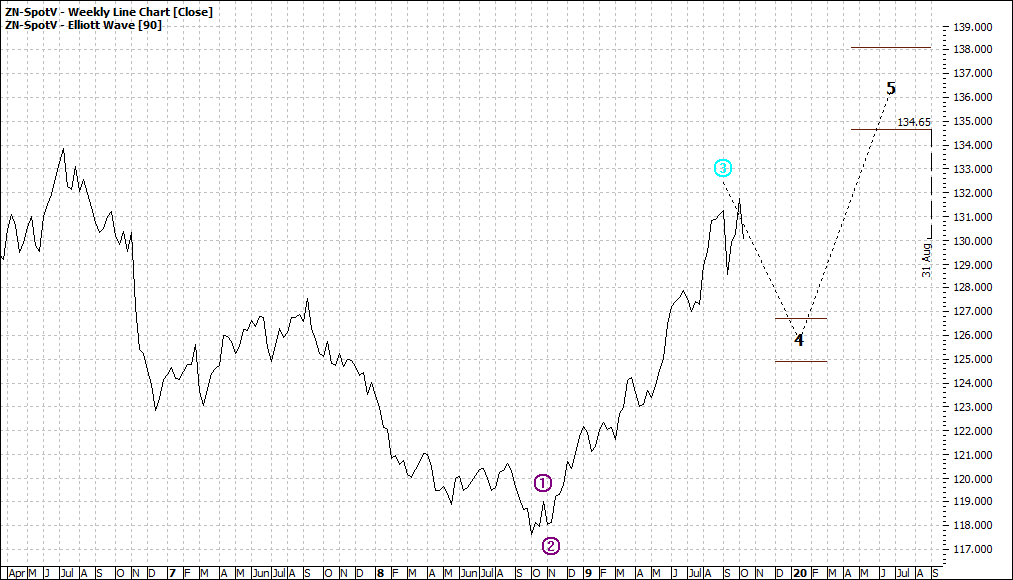

ASX Ten Year Bonds (ANX-Spotv:SFE) Weekly Line Chart

|

|

Click to Enlarge

So, as bonds climb higher so will interest rates drift lower. In other words, interest rates could actually go to zero and in fact below and in the latter case you could have to pay the bank money to hold your cash.

So, such assets as shares offer as an attractive haven even though risks will grow as so much money will be looking for a panic exit when share markets become over bought. I guess most say they will worry about that then.

A new experience for most of us

Enjoy the ride

Tom Scollon

|