I am looking at weekly charts which I think is best if you want a quick overview. Of course, a daily will tell you about the short term, the now, but that is not good enough for investing in direct shares.

If you are trading derivatives it is still useful to know the weekly outlook.

So here we go:

|

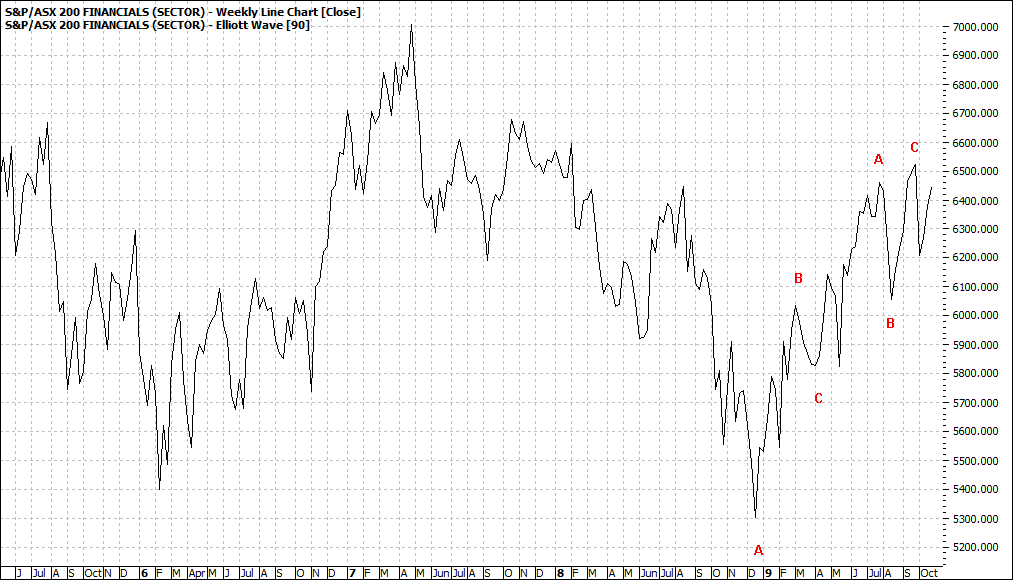

S&P ASX 200 Financials (XFJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

A lacklustre picture and that is what is causing the local market to drift sideways. It may take some months to snap out of this low energy phase.

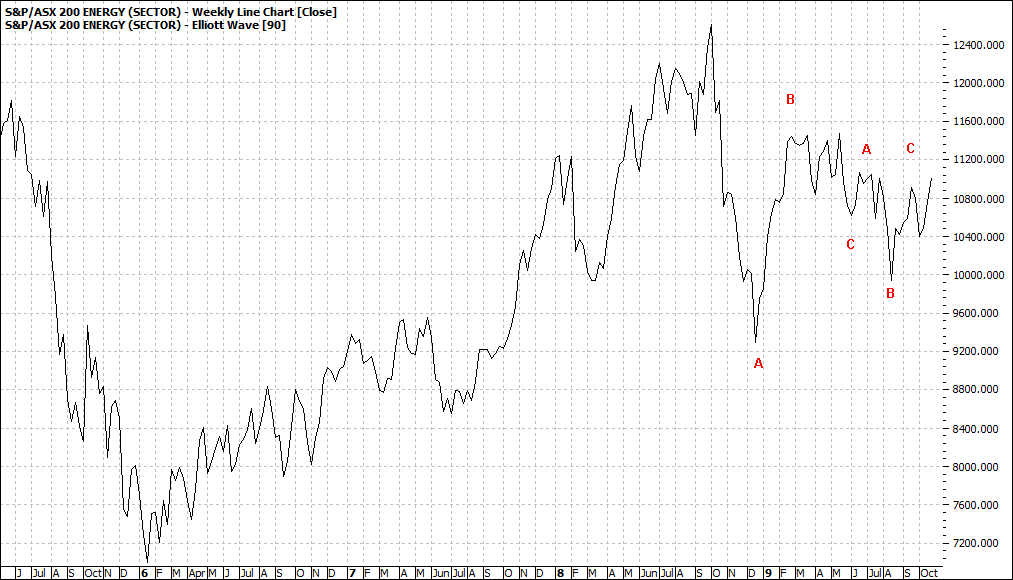

Energy is likewise going nowhere:

|

S&P ASX Energy (XEJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

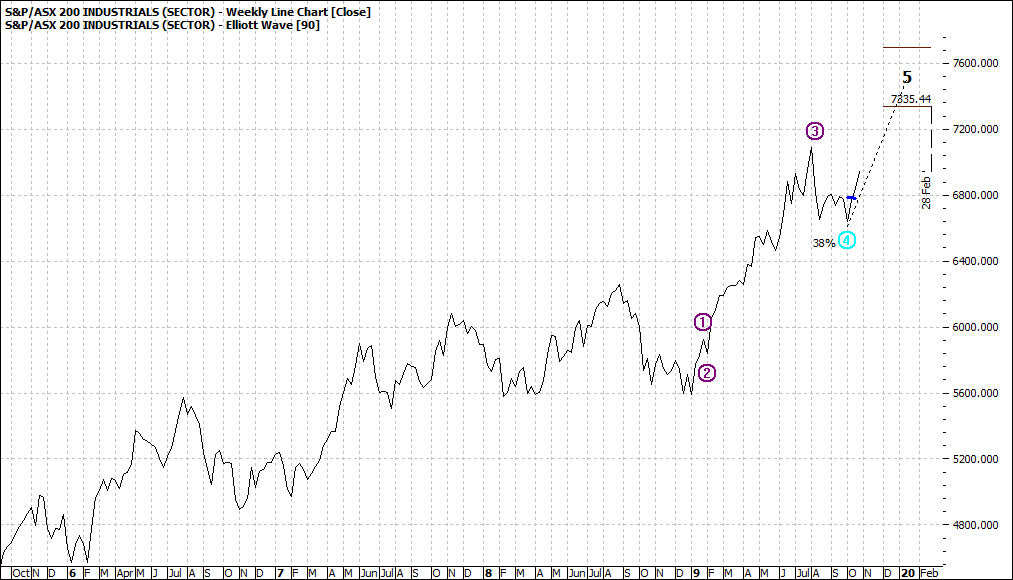

Industrials are helping to underpin the market:

|

S&P ASX Industrials (XNJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

This sector will buoy the market in the coming weeks.

Staples may retreat a little but should recover quickly:

|

S&P ASX Staples (XSJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

Remember this is a weekly chart and thus what and how we consume over the coming festive holiday season will not be influenced too much. There are other factors at play.

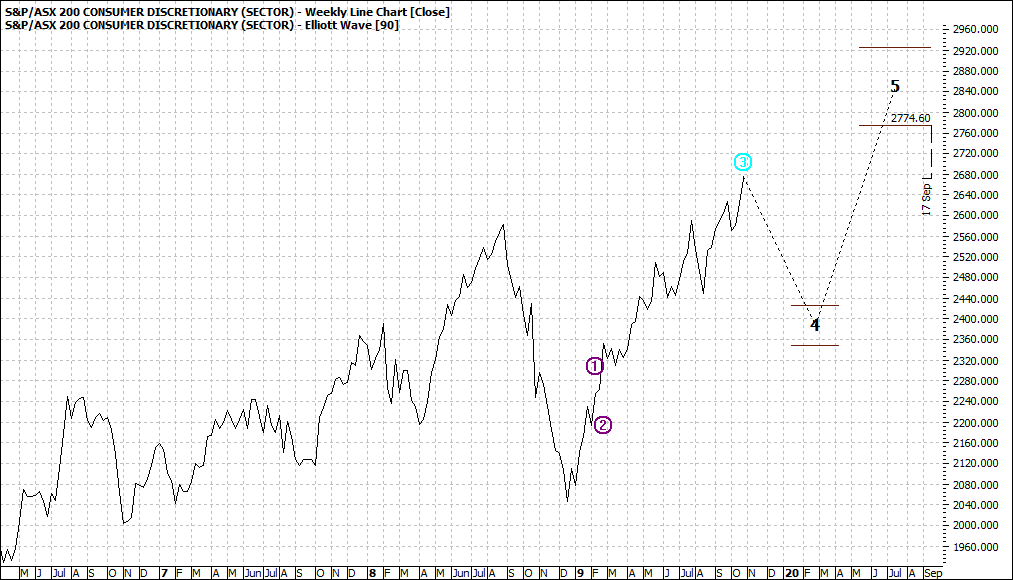

"Discretionary" is the weakest of the overall market:

|

S&P ASX Discretionary (XDJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

It is facing a major pull back and it is the sector that suffers most at times of uncertain economic outlook. And we are not spending, and this is causing the Reserve Bank some concern as their further easing of interest rates is not enticing us too much. At the end of the day consumers are smart and will not be kidded into spending more than they should.

Well most consumers.

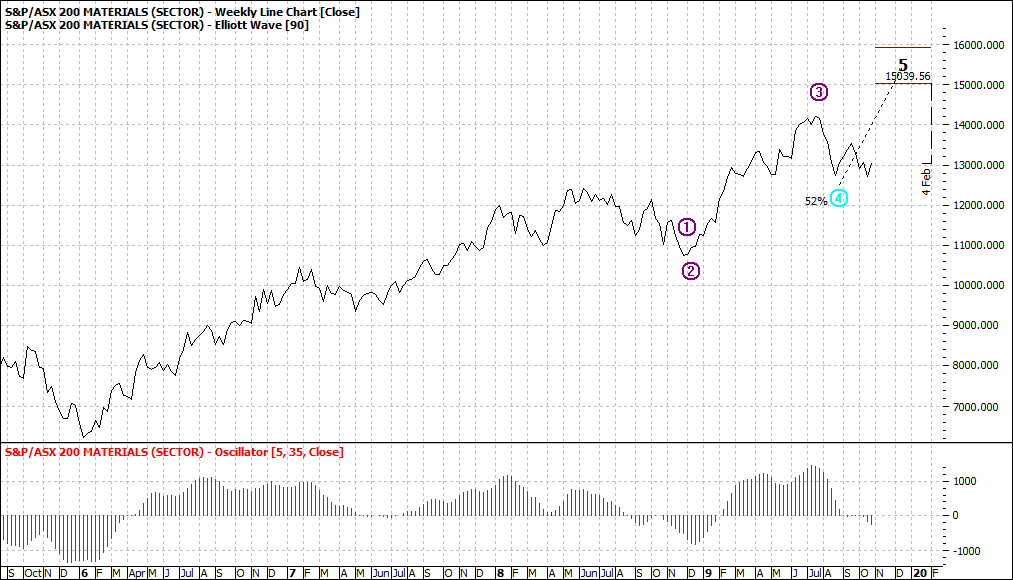

Resources are already into a pullback:

|

S&P ASX Materials (XMJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

We watch closely the oscillator to see if it pullbacks too much. Resources weakness is manifestation of a weak global outlook.

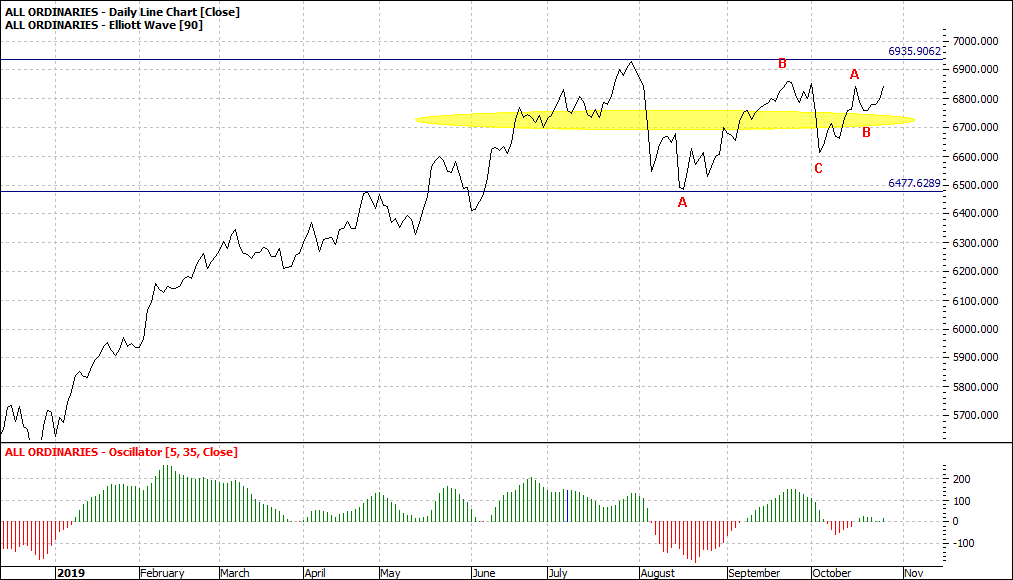

So, we see a mixed recent history/outlook amongst the various sectors:

|

All Ordinaries (XAO:ASX) Daily Line Chart

|

|

Click to Enlarge

And really the overall market has been ranging trading now for about six months. It is often a moot point about how you define a range trading market and where it starts and where it finishes.

For me it is about six months old for now and I have shaded yellow the respective period

Enjoy the ride

Tom Scollon

|

|

|

|

|

|

|

|