I only half jest though a severe market crash can be almost a near death. In severe recessions, I have known executives to take their life. And if you have experienced a massive market fall out you will know it is a cold sweat experience like no other. I speak from my several crash experiences.

If you are a long term ‘’buy and hold’’ investor, then a market crash can still be a gross inconvenience although if you are a disciplined investor you will be constantly pruning and preening. There is no simple answer here as what I have also learned from experience is that when markets crash there is not knowing where the markets will find a ledge to cling to.

If you are a trader, you jump with glee as this as crashes are easy money for you. Though your sort of need to stay match fit as you cannot get on board at the perfect moment.

Elliott will give us advance notice but few of you will listen and the rest of you will not act. Elliott does not give a precise moment in time when Armageddon arrives though many do proffer their view and preach with only their forecast dates to come and go.

It is safer not to have a view or seek a precise view but rather keep a disciplined eye on the markets. That way I can say from coal face experience the pain will be much reduced and you should sleep well at night.

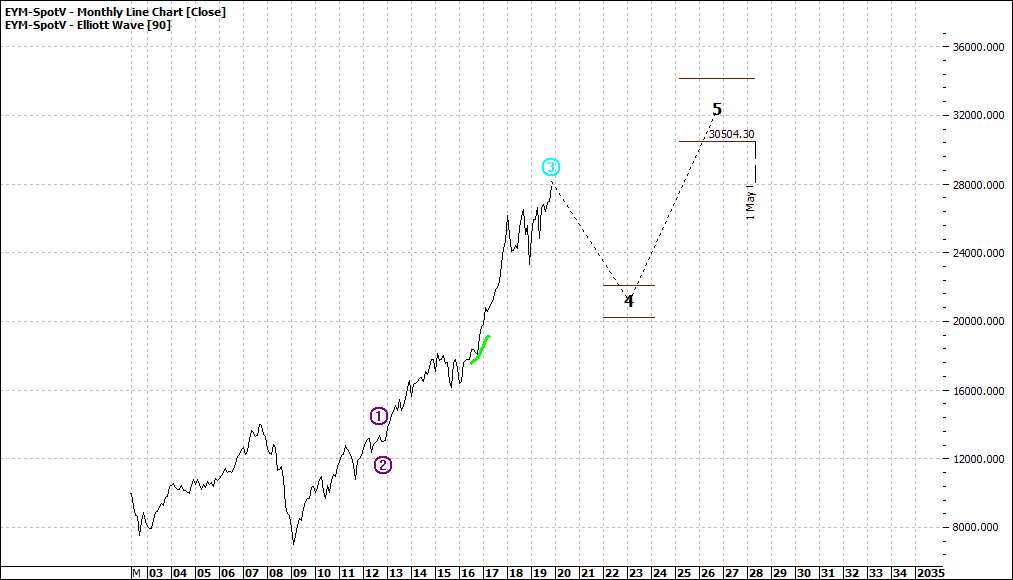

Let’s look at the charts to explore further. We are looking at monthly charts of the Dow and the Australian All Ords:

|

Dow Jones Futures (EYM-Spotv:CBOT): Monthly Line Chart

|

|

|

Click to Enlarge

|

All Ordinaries (XAO:ASX): Monthly Line Chart

|

|

|

Click to Enlarge

We look at the monthly charts as daily and weekly say that you are partying madly and thus, they will not give us any useful sense of timing.

Both charts suggest a major low about 2022 but I need to elaborate a little further.

2022 is 2-3 years away, but the process could actually be in process now – albeit without drama. We could see a mix of calm and drama, with maybe 2-3 major capitulations. That is usual.

We will see some chumps party through the last night. We will also see non-believers. We will see many dump all at false alarms although that is to be more admired than those who are waiting for the last dime of profit.

For mine I do tend to go early and if you have been in the markets for the long run I am happy to take a holiday and observe.

I raise this subject once again as now I see the ‘’experts’’ write on this topic. Particularly the bond players. If you want to know about timing for the equity markets watch bonds. That is key.

We are in a bubble without doubt. Increasing bond yields, unprecedented low interest rates, savings now outstripping spending globally resulting in too few assets available for the competing capital. And we are also undergoing structural changes in a way not seen for hundreds of years – the baby boomers starting to exit side stage, China re-emerging as world leader, democracy under unparalleled challenges from within. The list goes on.

There is much in the world and life to be optimistic about, but we must still keep an eye to the future to be smart investors.

Forgive me, I stray from quant analysis.

Enjoy the ride

Tom Scollon

|