Tom Scollon

Short term trades can be great to keep you match fit and also if you have been on the sidelines for a while you can test your skills/nerve. This approach reduces risk to some extent.

Before we talk further let’s look at the big picture first – the All Ord:

|

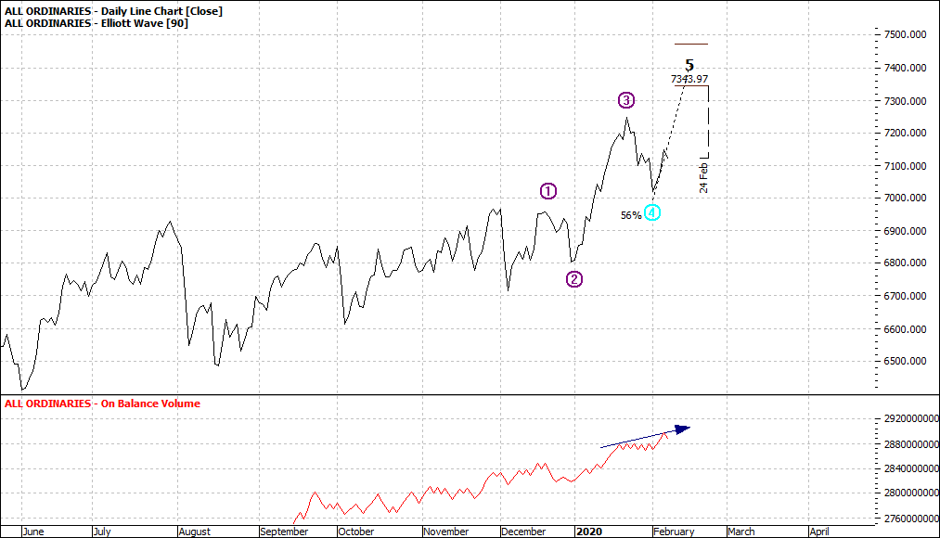

All Ordinaries (XAO:ASX): Daily Line Chart

|

|

|

Click to Enlarge

This is a daily chart and we can see the short-term pullback of a few days ago. Note also that OBV is strong and actually shows a positive correlation against the actual market. In simple terms not many people deserted the market with the recent Coronavirus sell down. That is not to say the C fears are all over. We don’t know where and when and how the ultimate affect will be played out as we cannot be definitive about this ‘’X’’ factor for the moment.

So, the risk is not great for a short-term play.

Let’s look at the weekly XAO:

|

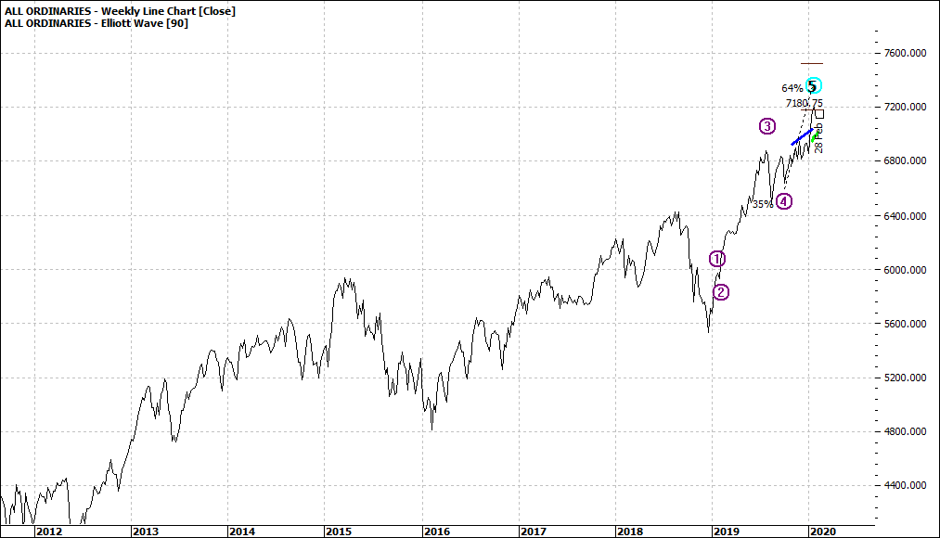

All Ordinaries (XAO:ASX): Weekly Line Chart

|

|

|

Click to Enlarge

We can see that the market is at an all time high and well into a wave five high and in the next chart we can see the market retreated from the first wave five high.

|

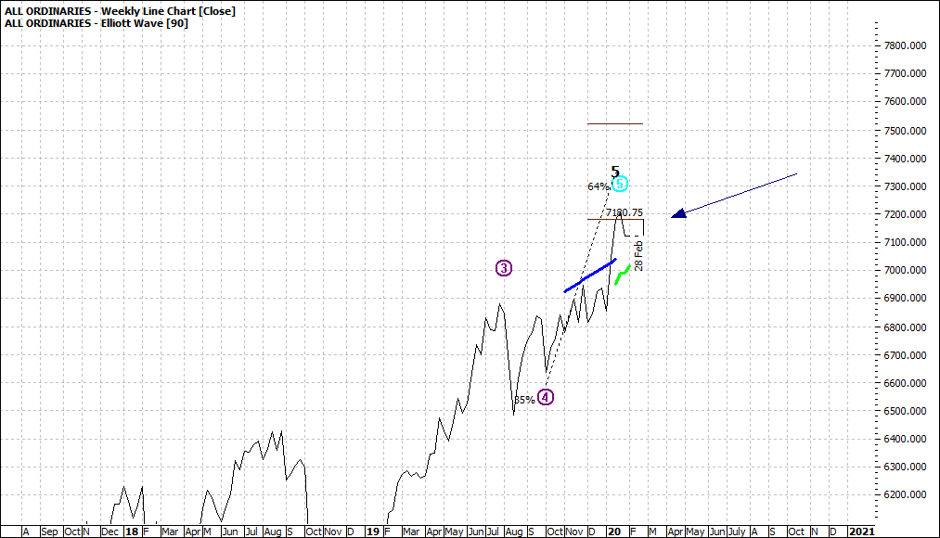

All Ordinaries (XAO:ASX): Weekly Line Chart

|

|

|

Click to Enlarge

Now Eyes will closely watch whether it breaks through and moves to the second wave high.

Regardless, this is not a time for a long-term play unless you have some inside knowledge.

So, what sectors would you look for a play?

I have done the work for you. My preferred sectors are XNJ, XDJ and XMJ.

I have also analysed the markets – the top 200 at least – and found some prospects for you that are worth you researching further:

ABC, BHP, BRG, BSL, CTX, CWM, FMG, NEC, NST and TGR

I stress they are short term prospects and remember to have your risk management plan switched on!

Enjoy the ride

Tom Scollon

|