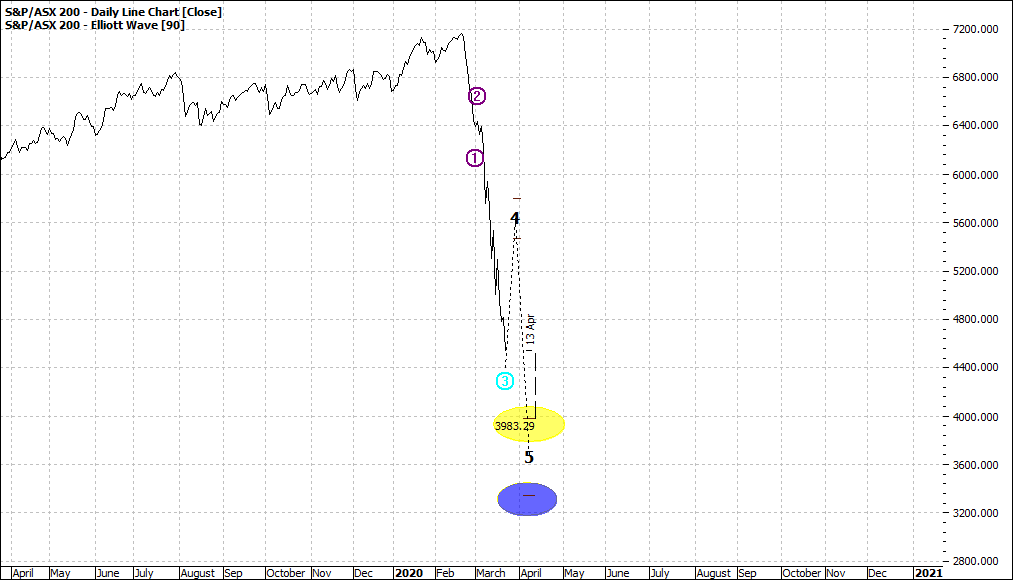

I mentioned in yesterdays article that we could see the market fall – XJO – to possibly 4000 - yellow as a next major level. This will take us all the way back to 2008/9 levels of 3200 – blue circle:

|

S&P ASX 200 (XJO:ASX): Daily Line Chart

|

|

|

Click to Enlarge

We saw 4400 the first Elliott wave five level hit today. So, as I explained with new data Elliott adjusts the outlook and so the first wave five is now 4000 and the second one 3200!! There was some action around these levels about twenty years ago we should not ignore:

|

S&P ASX 200 (XJO:ASX): Daily Line Chart

|

|

|

Click to Enlarge

This is true bear market stuff. Many pundits were calling a bear market with a sell off of 20%. Puny.

We have not seen a long-sustained bear market in the lifetime of most current day investors.

The market today opened 8% down and it recovered with some punters thinking the worst is over.

One thing I will say about the market is that with the recoveries whether they be intraday, intra week or whatever, it does give the sense of some settling – some rational thought of what the next move might be. But we are by no means nearing consolidation phase. This is a prerequisite for a long-sustained move higher.

Where to now... I expect some movements higher and further falls. Stating the obvious. We could also however reach a capitulation phase where many retail shareholders just have to bale out because for many their share investments have a link through negative gearing to their family home. Scary to risk both.

Some institutional holders will also have to sell to maintain qualification status for their type of fund.

Enjoy the ride

Tom Scollon

|