The bulls have been having a field day. They have been very confident. How long can this bullishness last?

Well those who are real investors and traders – as opposed to side-line ‘’Monday morning Quarter backs’’ – know that the market does not give clear signals. Especially on timing. Being deep in the cut and thrust is what makes overall victory sweet.

Yes, I often repeat myself and I must restate that what we talk about in technical analysis is probability. Success is not about being right or wrong in a particular moment, but rather picking and backing a trend which makes you money.

So, let us look at some charts:

|

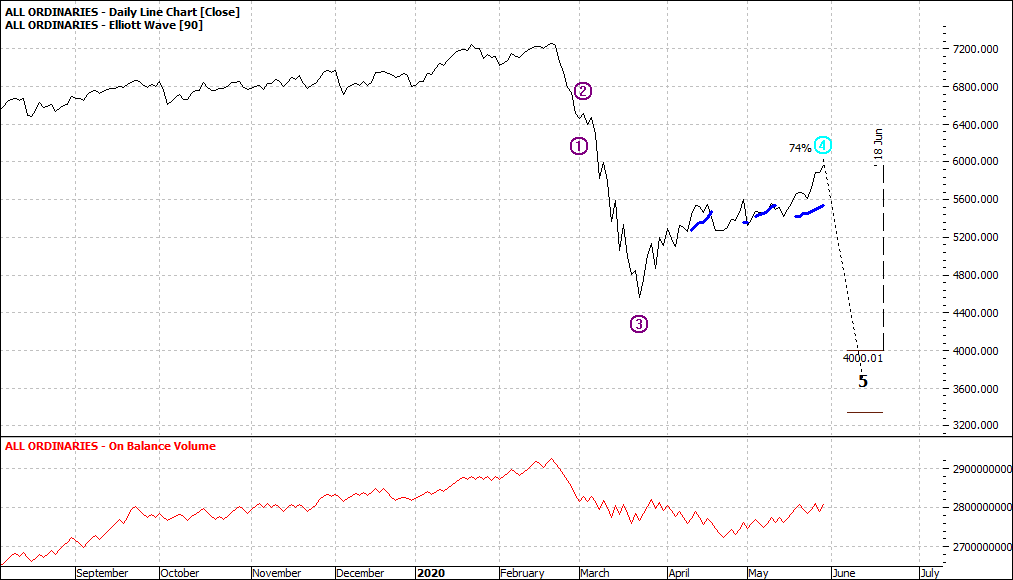

All Ordinaries (XAO:ASX) Daily Line Chart

|

|

|

Click to Enlarge

My money is on another leg down. If it does not happen in the next month as the above Elliott move suggests then I will not commit Hara-kiri. I will wait for another buy in opportunity. It will come. Guaranteed.

One thing we note in the above chart is that volume has not recovered. So despite the apparent bullishness in the last couple of week this is not a widespread sentiment.

I do not necessarily believe we will see a low of 4000 – levels of almost ten years ago – as projected, but we will see a lower low than March.

Just as no-one saw the Covid X factor coming – although again experts appeared from everywhere once it was entrenched – there are few experts talking about the next X factor. Generally, X factors are not obvious as with Covid and rarely do we see them coming. We could speculate what the next F factor might be – but time might be better spent at the beach.

But it will happen.

Enjoy the ride

Tom Scollon

|