It is tough to find a good lead on where the markets are going at the moment. Other than sideways as I showed in my charts a couple of weeks ago.

Of course, there is much postulating out there and it is easy to write volumes about the markets, but to be frank I can’t see a strong reason to buy or sell the markets in this climate. There is nothing wrong with that. Markets do not have to be in rapid movement – up or down – all the time. It is almost like drawing breath and a little peace is not ok.

It would be absolute heresy to even suggest an economic slowdown would be healthy. But in so much of the world, economic growth is inextricably tied to employment, wellbeing, mental health and so on.

Some would say life is like a pack of cards – a pyramid of cards and when that collapses their worlds fall apart.

So, if the world does not think about the worst possible scenario then we will not be prepared. It is fact that few people have much squirreled away for the worst. I did not wake up this morning feeling doom and gloom. I am not a glass half empty guy and I don’t sit at my bay window looking out for Armageddon, but I sort of do plan for ‘’what ifs’’.

To the markets more specifically. Many would have wished they bought the March low. If you didn’t you need not be too tough on yourself as there will be more buy opportunities. They always come.

But right night now I say to myself that buying is not a compelling story.

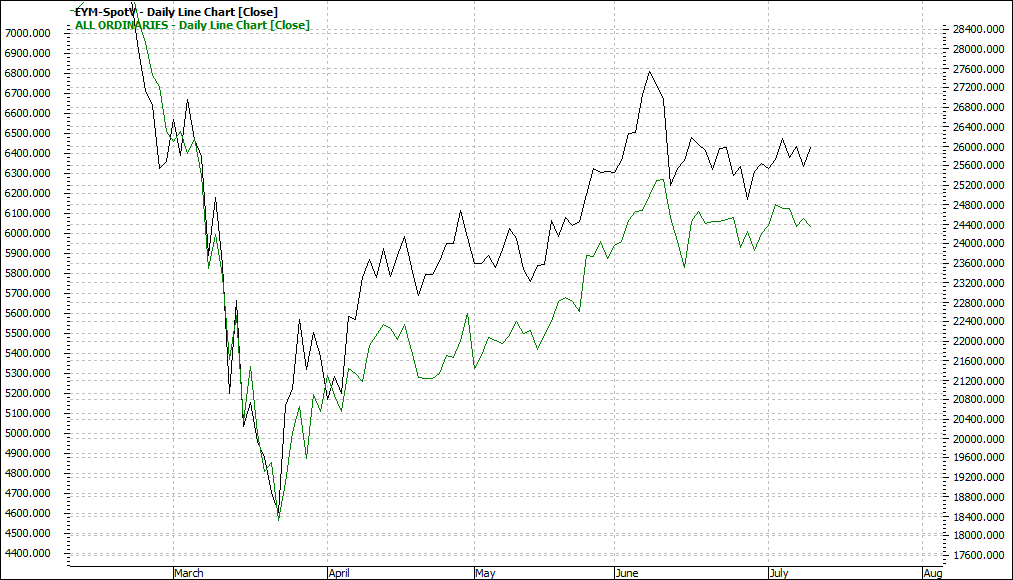

And I look at the chart below of the All Ords overlaid on the Dow and it gives me no inspiration or call to action or reason to buy

|

Dow Jones v All ordinaries Daily Overlaid Line Chart

|

|

|

Click to Enlarge

Now that is a snapshot of the overall market in the last few months but to me its is a mindless rising market.

We can however still see some potential buy opportunities.

Stocks I am watching now are: AMP ANZ ASX BHP BKL BLD LNK NAB RIO

These stocks are in a wave four pullback, but I wait to see if they can hold this pullback and not succumb to overselling.

There are numerous others also in a wave four pullback – quality stocks such as BSL CSR GNC RHC – but they appear to be at risk of being oversold. I can see this via the oscillator.

So, it is not cut and dry and so it is a matter as usual of being patient and disciplined. It works. This is not a sprint but a marathon.

Enjoy the ride

Tom Scollon

|