Wanting to and having the ability to do so are totally different forces.

Let’s take a look at the daily for the XFJ:

|

S&P ASX 200 Financials (XFJ:ASX): Daily Line Chart

|

|

|

Click to Enlarge

A wave five may happen but as you can see from the OBV there is not a lot of interest in finance stocks at the moment.

Why?

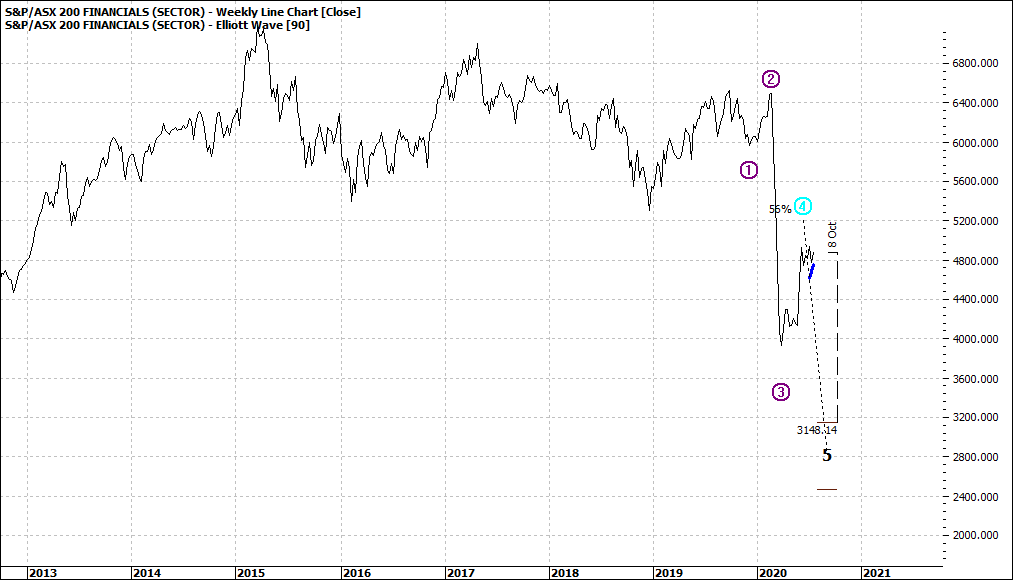

Well if you look at the weekly you can see there is a fair chance banks could be in for another shock move down:

|

S&P ASX 200 Financials (XFJ:ASX): Weekly Line Chart

|

|

|

Click to Enlarge

So, it is the fear of this that is holding back buyers. Even if it did no happen it is the inherent risk, that will keep buyers away. The reason for all of this is that there are many shareholders who would like to tighten their holdings in the sector and as soon as the price looks half decent the sellers will come in droves.

Thus, we cannot see any long term upward trend developing for some time.

Most stocks within the XFJ sector have very similar patterns for the weekly. There are no bargains.

There may be some short-term profit in the daily chart, but you need to ask is this low level of profit worth the risk of a buy in such a precarious point in time.

Enjoy the ride

Tom Scollon

|