The uncertainty around Covid has little sway with the markets. They just keep climbing higher. Well at least the bears are not lurking yet.

Of course, most markets/stock softened last week but some kicked on Friday after strong profit results from US Tech stocks.

Covid – a topic I am totally fed up with and I think many people are – but it is a real threat and cannot be ignored if you are a market player. Put aside the health and welfare and fatal nature of the pandemic – the economic threats are real. One does not have to be an economic Einstein to see that with rapidly increasing unemployment, chronic interruption to normal business, mounting government debt there will be a point in time when businesses and consumer expenditure will take a massive hit and there will be an inevitable hit to the bottom line of consumers, businesses and government. I am sure many of you will have already noticed empty shelves in large retailers.

The responses you get begin with ‘’C’’. Not just C for Covid but also C for China.

Is this the beginning of a long-term disruption of supplies from China as business and government rethink vulnerability and thus supply lines?

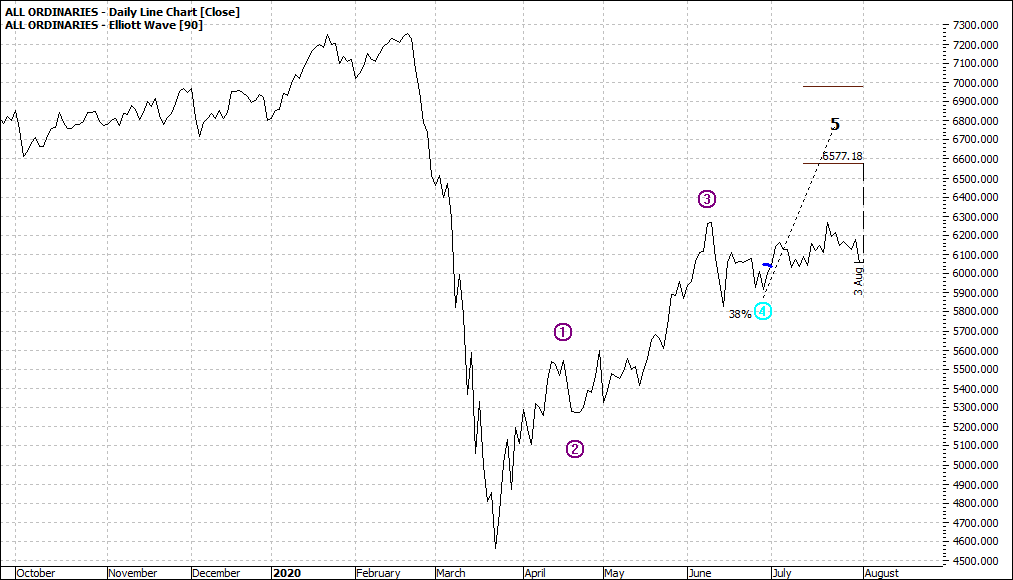

The Australian All Ords:

|

All Ordinaries (XAO:ASX): Daily Line Chart

|

|

|

Click to Enlarge

This week we saw the first useful Elliott signal for the Australian market.

I had to fiddle with the settings to get the above chart. Hardly legal but I do it to challenge my thinking and consensus out there.

I have applied a 90-day setting as opposed to the standard 300 day.

I also cycle through the top 20 and I see some very limp charts. That is not to say the markets will not head higher. And we do know that markets stretch – over stretch – in both bull and bear markets.

Though when we look more closely at the action of the last two months, we really see no stretch as markets have really been in range trading mode. Despite some bravado the reality is YOU are not going long Australian equities.

|

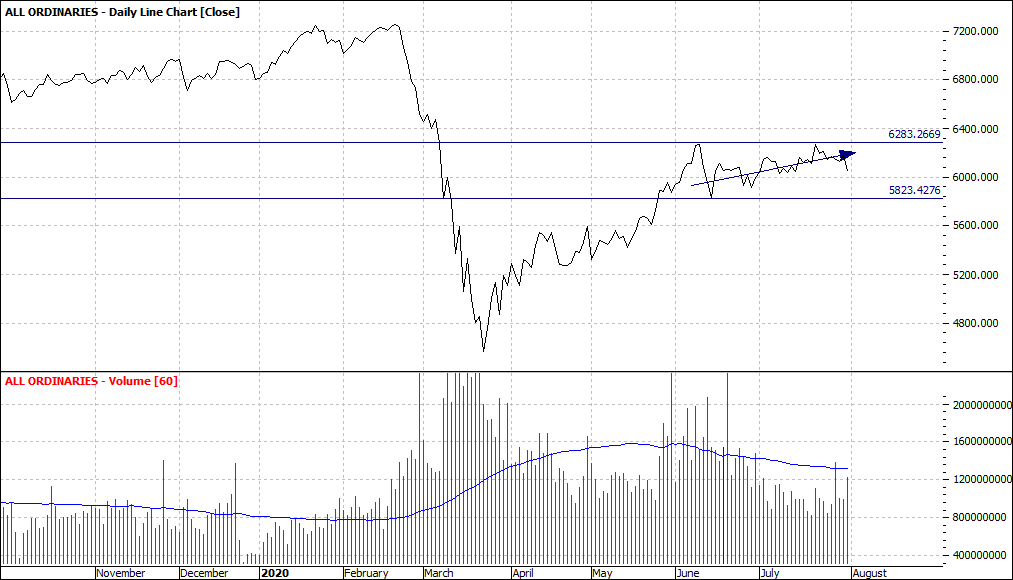

All Ordinaries (XAO:ASX): Daily Line Chart

|

|

|

Click to Enlarge

Nor are you bearish or panicking – well not yet.

Reverting back to the chart there has been a price trend upward in July, but volume is coming off.

I guess like most of you I can’t find a compelling reason to buy right now.

So, we continue to sit on the sidelines.

Though we do know there will be action one way or t’other before long.

Enjoy the ride

Tom Scollon

|