|

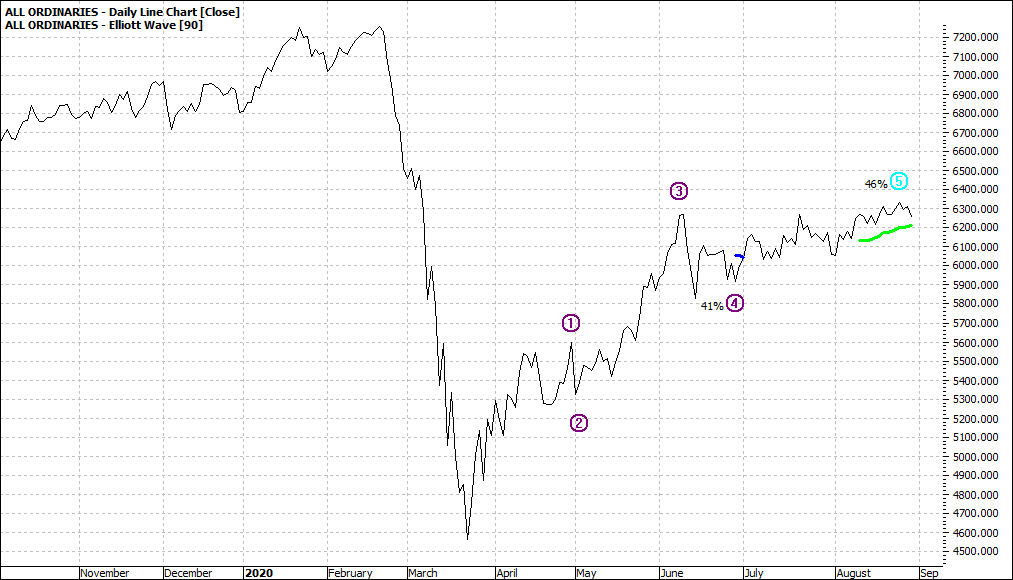

All Ordinaries (XAO:ASX) Daily Line Chart

|

|

Click to Enlarge

You can see that it is still at June levels and so the market could be categorised as range trading. We have seen a number of ABC patterns over the last few weeks and now we see a wave five high in the making. It could be all but over but we not doubt the markets ever and we could see a new second wave five show up.

A quick overview of key sectors:

Financials are flatlining:

|

S&P ASX 200 Financials (XFJ:ASX) Daily Line Chart

|

|

Click to Enlarge

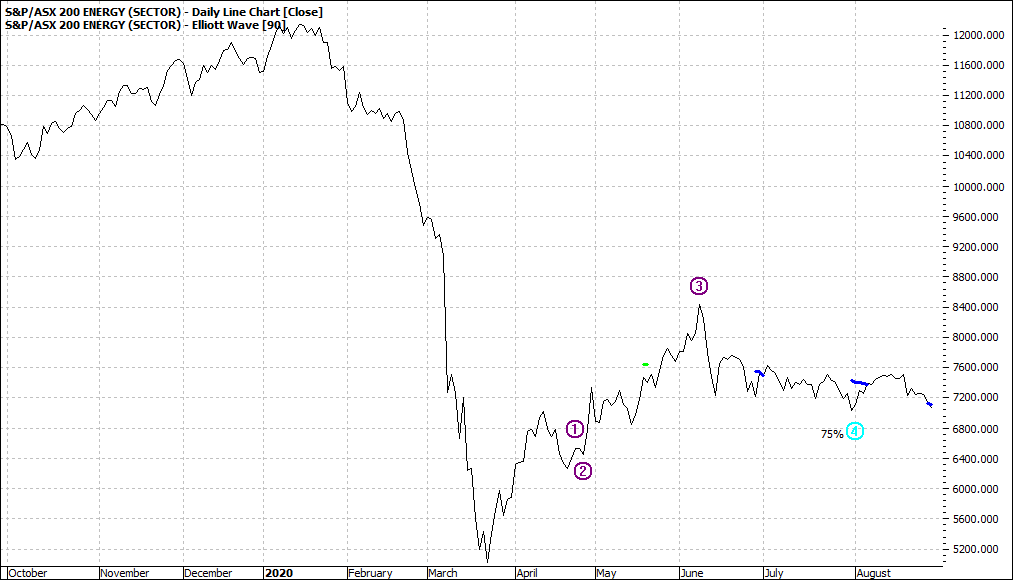

Energy flat lining down:

|

S&P ASX 200 Energy (XEJ:ASX) Daily Line Chart

|

|

Click to Enlarge

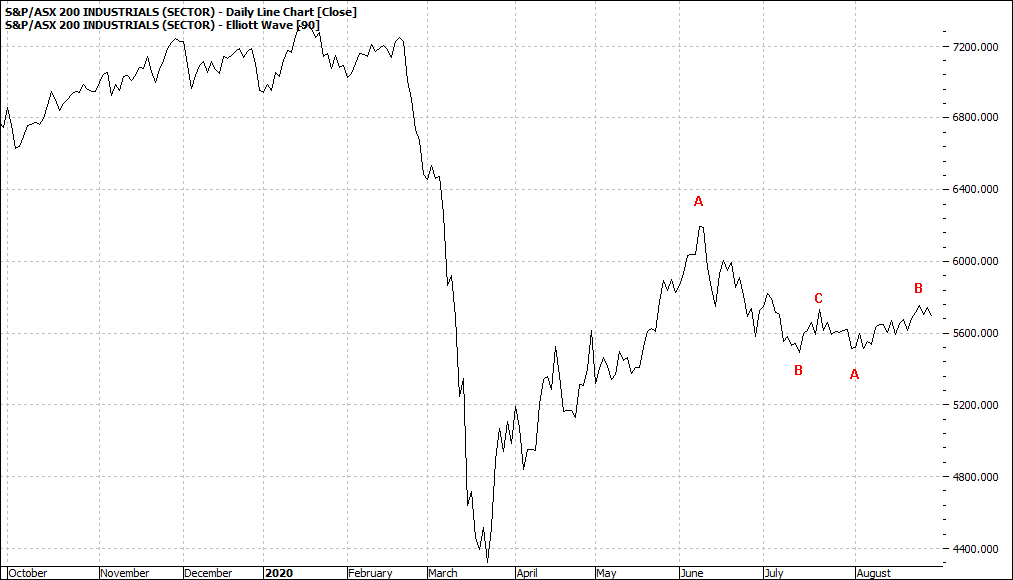

Industrials range trading and showing little impetus:

|

S&P ASX 200 Industrials (XNJ:ASX) Daily Line Chart

|

|

Click to Enlarge

Consumer staples actually heading south but could offer some good short-term trades:

|

S&P ASX Consumer Staples (XSJ:ASX) Daily Line Chart

|

|

Click to Enlarge

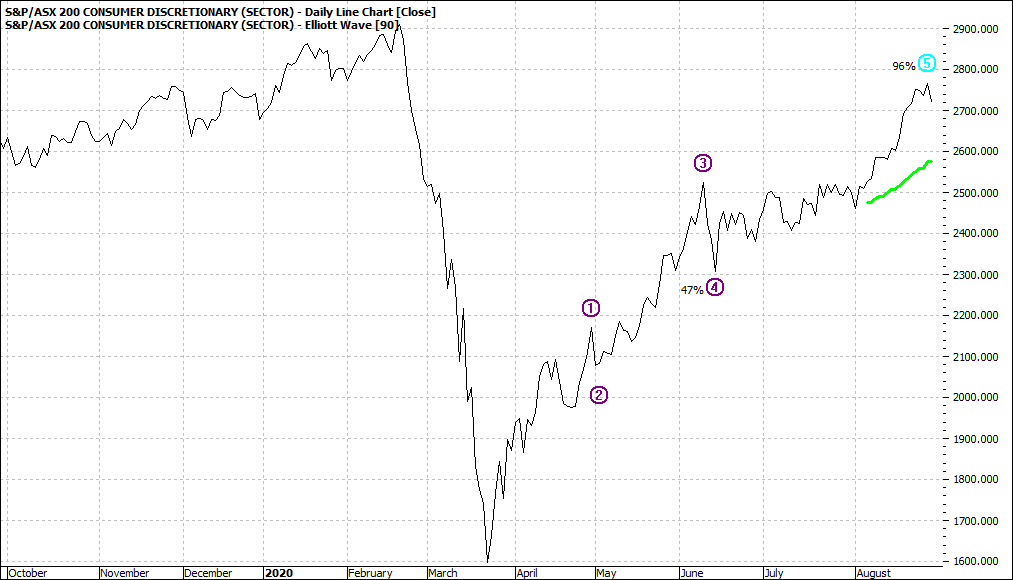

Consumer Discretionary are defying logic and rising:

|

S&P ASX Consumer Discretionary (XDJ:ASX) Daily Line Chart

|

|

Click to Enlarge

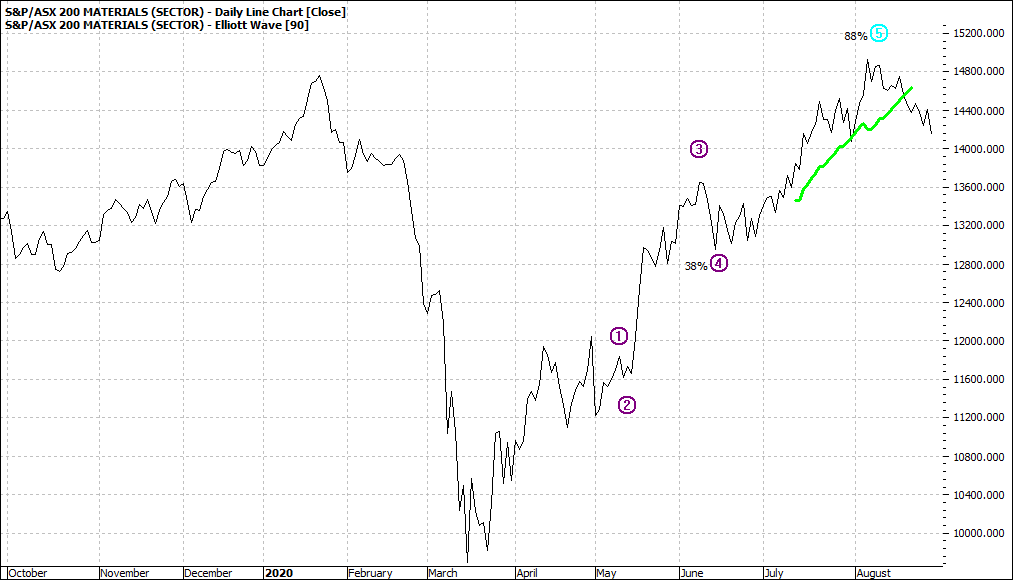

And Materials have run out of steam:

|

S&P ASX Materials (XMJ:ASX) Daily Line Chart

|

|

Click to Enlarge

I always ask myself the simple question “would I buy now?”.

The answer is no.

The risk is to the Downside.

Enjoy the ride

Tom Scollon

|

|

|

|

|

|

|