If you weren’t looking at charts for the last couple of weeks you would have ‘’felt’’ that the market was on the skids. But it really has been a mere gentle slide.

Nevertheless, we don’t know if the slide can gather more momentum. Bulls and Bears are sort of in balance with maybe the bears having a slightly stronger grip.

There has been remarkable resilience over the last few weeks against much uncertainty. I am more surprised that those who have not had to buy have done the talking with their money.

Volume is relatively strong:

|

All Ordinaries (XAO:ASX) Weekly Line Chart

|

|

Click to Enlarge

You can see a divergence between volume and price for most of the year.

But I also sense a piece of bad news could change all this as the market is priced for perfection.

Let’s take a quick look at the indices

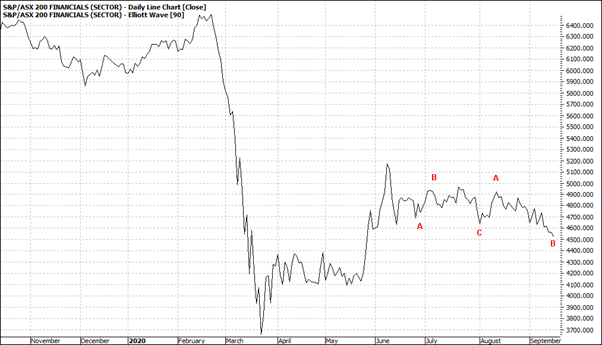

Financials:

|

S&P ASX 200 Financials (XFJ:ASX) Daily Line Chart

|

|

Click to Enlarge

Very soft. Looks even weaker on the weekly chart:

|

S&P ASX 200 Financials (XFJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

Energy:

|

S&P ASX 200 Energy (XEJ:ASX) Daily Line Chart

|

|

Click to Enlarge

A carbon copy of Financials.

Industrials:

|

S&P ASX Industrials (XNJ:ASX) Daily Line Chart

|

|

Click to Enlarge

Not so weak, just going nowhere.

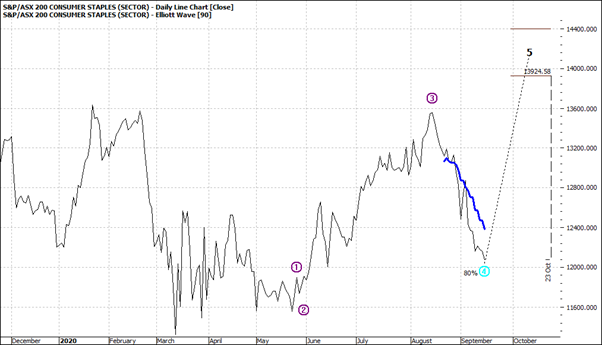

Staples:

|

S&P ASX Consumer Staples (XSJ:ASX) Daily Line Chart

|

|

Click to Enlarge

You are watching your pennies!

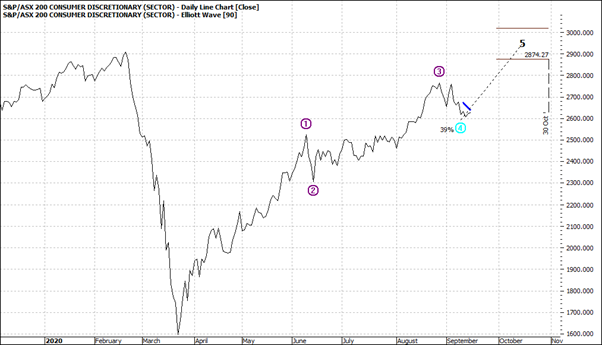

Discretionary:

|

S&P ASX Consumer Discretionary (XDJ:ASX) Daily Line Chart

|

|

Click to Enlarge

Those of you with a job are spending like "you can't take it with you".

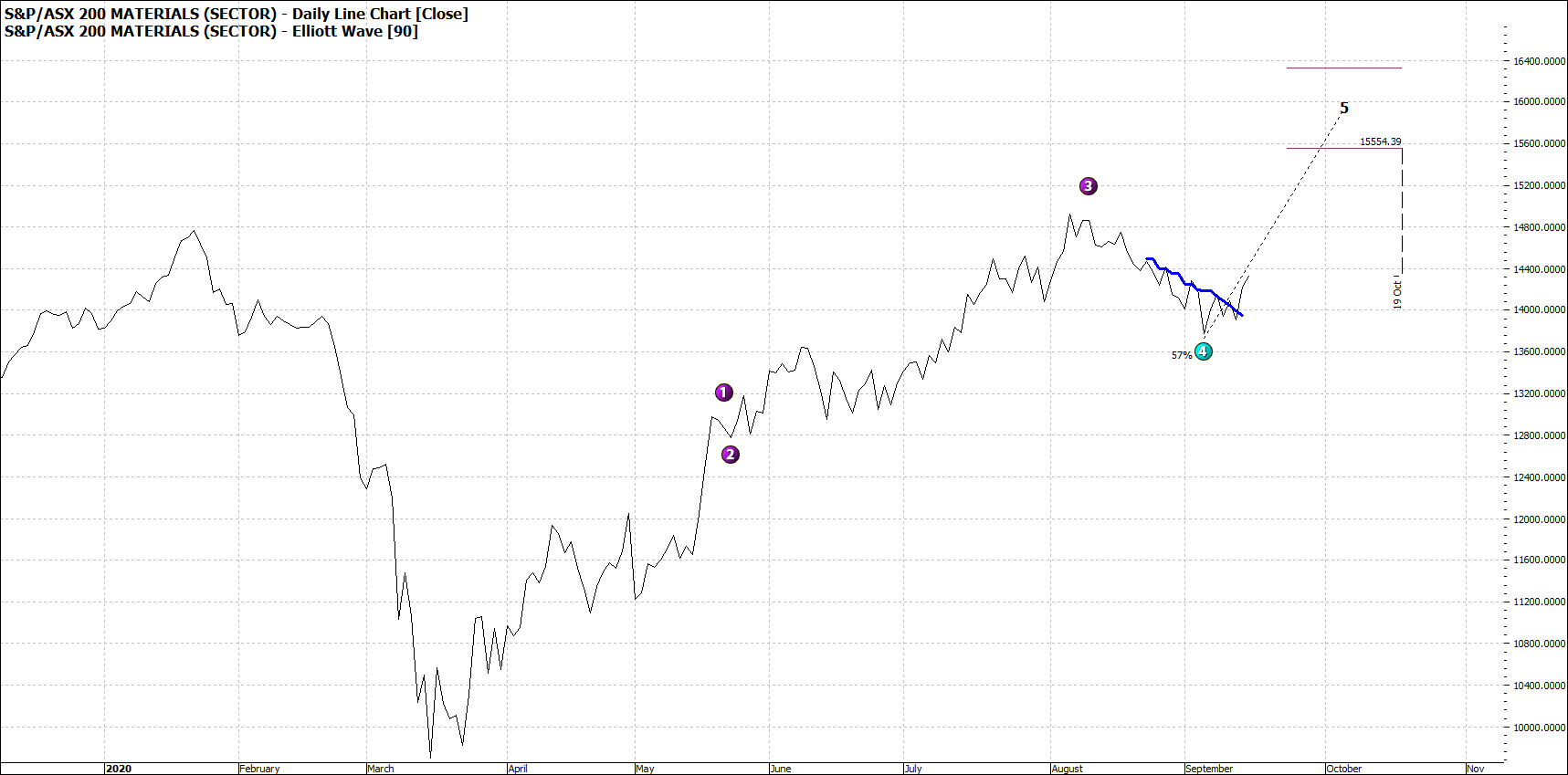

Materials:

|

S&P ASX Materials (XMJ:ASX) Daily Line Chart

|

|

Click to Enlarge

World demand is making a huge contribution to our economy - for now... So, nothing excessively worrying about the above - for now...

Enjoy the ride

Tom Scollon

|

|

|

|

|

|

|

|

|