In the last few weeks, I can’t say I have seen before, so much flip flopping by even the experts. Covering their bases, having a bob each way.

I can’t think of a period where there have been so many extraneous factors surrounding the markets.

Nor have I seen so much geo-political market uncertainty and to boot we have a US federal election just around the corner and the count could go either way and even then, the result may not be accepted. Really weird times.

Let’s look at some charts for the Australian market:

|

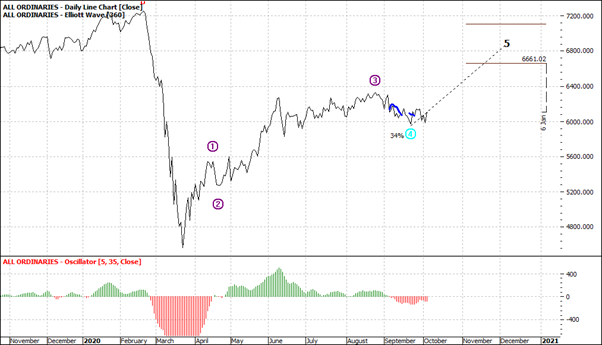

ASX All Ordinaries (XAO:ASX) - Daily Line Chart

|

|

|

Click to Enlarge

|

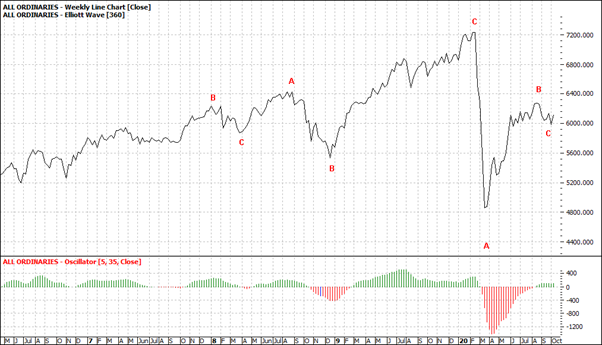

ASX All Ordinaries (XAO:ASX) - Weekly Line Chart

|

|

|

Click to Enlarge

|

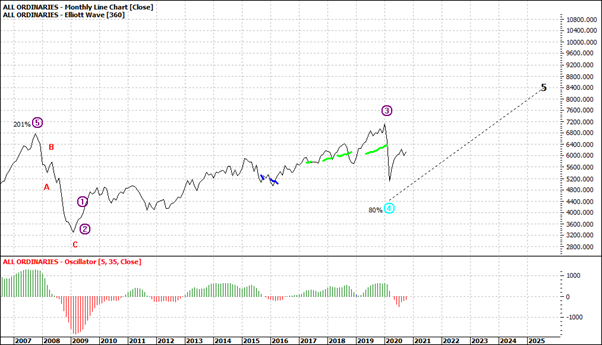

ASX All Ordinaries (XAO:ASX) - Monthly Line Chart

|

|

|

Click to Enlarge

It is times like these we would really like the charts to give us a single guidance for once.

Last week I thought we were seeing a bearish trend developing as the up days were not strong volume days and the down days were negative volume days and then we have a 2.5% solid swing up today (October 5) in the All Ords. Volume was down but some states were on a long weekend holiday.

Nevertheless, the charts have their own story. The daily suggests a run up to a new wave five high in the coming months. The weekly says more range trading and the monthly also says a run at a new wave five high. Of course, with different parameters than the daily wave five scenario.

As I say, you wouldn’t bet the bank on these forecasts.

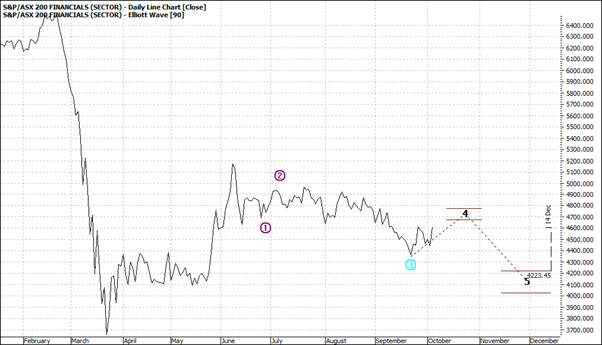

The finance sector makes up a solid chunk of the local market and that sector looks particularly weak:

|

S&P ASX Financials (XFJ:ASX) - Daily Line Chart

|

|

|

Click to Enlarge

Because there are more than the usual quantum of uncertainty much whiplash and oscillating is likely to cloud most of the month. The circus will roll on.

Some will punt to the upside and others will back a market fallout.

If your are a serious disciplined trader, you will look for better clues which will appear in time.

Enjoy the ride

Tom Scollon

|