The US has been pacing the floor now for some time over the US election. Other markets pretended not to watch on, but they too are now pacing the floor but not quite as nervously.

So, if technical analysis is so good then why should the US markets be so stressed you might ask?

A good question. My answer is that qualitative or fundamental events are in a way only a manifestation of market history. The ‘’smart’’ money sees ahead. They have already cast their vote. If markets were oversold, then in my view they would rebound regardless of the outcome of the election. The reverse is true.

Markets have been well priced with not much room for bad news so it is almost like investors are looking for bad news that they can adversely react to – if there was in fact a majority view by investors either way about the election result.

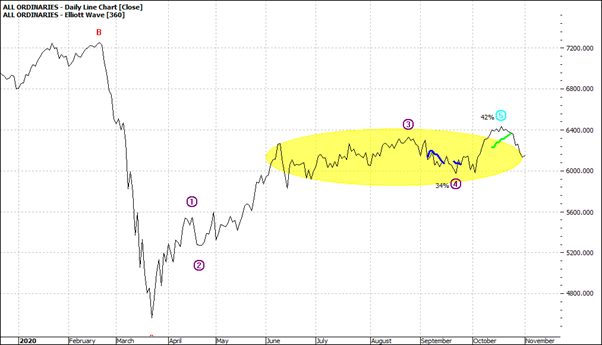

Looking at the Australian market – and charts – we know the market has been in range trading mode now for the last 5 months:

|

All Ordinaries (XAO:ASX) Daily Line Chart

|

|

|

Click to Enlarge

We are just around the corner from the actual US voting day, but the final outcome could be weeks away and it could be a rocky few week. We simply do not know what the outcome will be - NOR more importantly – what the reaction to the outcome might be and so the waiting game could be more protracted. All this uncertainty is unlikely to end November 3.

If the markets are overpriced and the USA election passes without any major surprises, then investors could find other reasons to cause the market to range trade – or start a new impulse move – in either direction.

USA election aside these are unusual times and if the market wants to be a worry wort then it will find a reason to do so one way or t’other.

Enjoy the ride

Tom Scollon

|