So, you have sat on the sidelines for the last few months. With good reason – with the Covid Pandemic and USA election uncertainties – both cataclysmic events so there was nothing wrong about standing aside especially if you are a cautious investor.

But your cash is wasting away and if you are a retiree or ‘’soon to be’’ then your income has been clipped severely and you are probably eating into your capital more than you would like. Is there anything you can do?

Decent returns in fixed interest/term deposit and bonds are hard to come by. If the returns offered are attractive, then you need to look deeper. Maybe too good to be true. So, should you rethink equities? For at least part of your cash?

Let’s have a look at the charts to try and get a handle on the likely direction and most importantly to assess your level of comfort.

So, to the local XJO – daily, weekly and monthly:

|

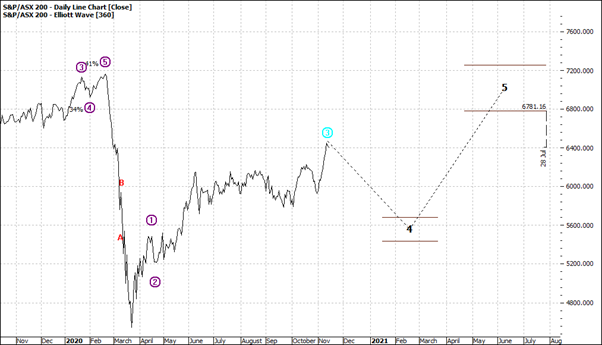

S&P ASX 200 (XJO:ASX) Daily Line Chart

|

|

|

Click to Enlarge

|

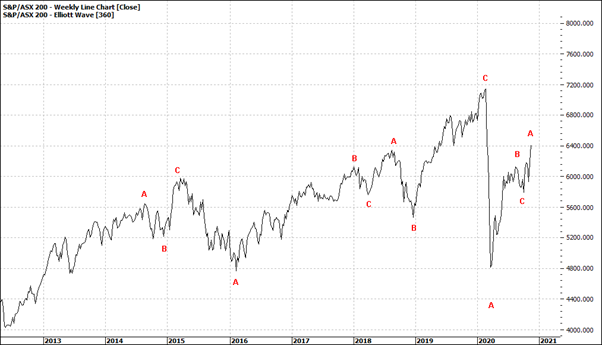

S&P ASX 200 (XJO:ASX) Weekly Line Chart

|

|

|

Click to Enlarge

|

S&P ASX 200 (XJO:ASX) Monthly Line Chart

|

|

|

Click to Enlarge

The daily offers some prospects – a wave four pullback in the making. Even though we have seen much range trading over the last several months we have seen a decent move higher from the March low. A pullback seems reasonable.

The weekly offers little clue although it suggests a benign market. That in itself is positive.

The monthly says a new major high is some years ahead. Yes years. So that means there will be surges and pullbacks along the way. That means you will have plenty of chances to get in and get out. Not a bad scenario. But timing is obviously critical but using basic technical analysis will offer great assistance. And it will not matter a great deal whether you are using range trading indicators or trending analysis. The important element is to have a plan and apply discipline.

Though the scary Covid pandemic and USA election have eased anxieties – that is not to say we will not face some ‘’X’’ factors but again sound risk management techniques should keep you soundly sleeping at night.

In the coming weeks we will look at sectors and specific stocks. Stay tuned.

Enjoy the ride

Tom Scollon

|