It seems markets are generally settling down – or even kicking higher with some uncertainties taken off the stress agenda. Mr. Biden will get the keys to the White House and Covid vaccines are coming at us from all directions. Well yes very positive news in what has been a fairly tough year. Of course, market movements are driven by these major events. Stress will remain on the sidelines for some time – until the next stress factor appears.

So, it appears we may see a Santa rally and then a possible upwards ‘’year-end’’ rounding off of markets which happens most years despite there not being much volume as buyers are taking a break. I say ‘’may’’ as always expect the unexpected as too much cosy consensus can lead us into a false sense of security.

Let’s look at key Australian indices:

|

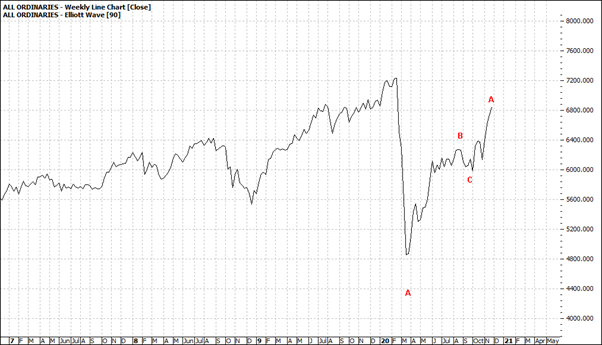

All Ordinaries (XAO:ASX) Daily Line Chart

|

|

Click to Enlarge

A good run up since the scary low of March and as many investors now feel a big sense of relief this may carry markets to the new wave five – by years end!

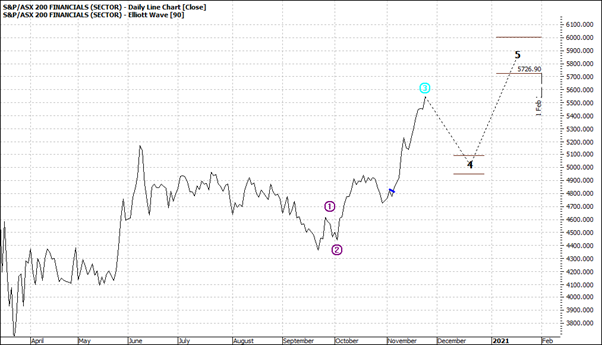

The weekly still shows no strong momentum either way:

|

All Ordinaries (XAO:ASX) Weekly Line Chart

|

|

Click to Enlarge

|

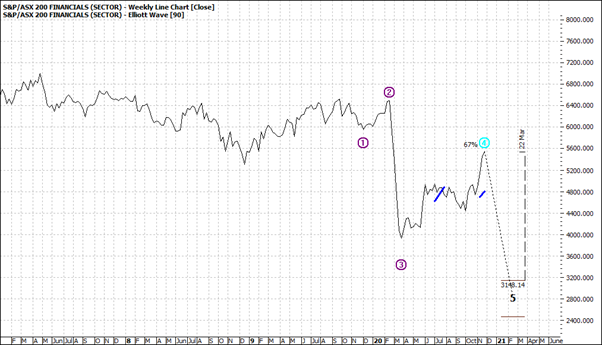

S&P ASX Financials (XFJ:ASX) Daily Line Chart

|

|

Click to Enlarge

|

S&P ASX Financials (XFJ:ASX) Weekly Line Chart

|

|

|

Click to Enlarge

The daily looks strong and the weekly looks a bit like doom and gloom. We will just need to watch and wait.

Energy:

|

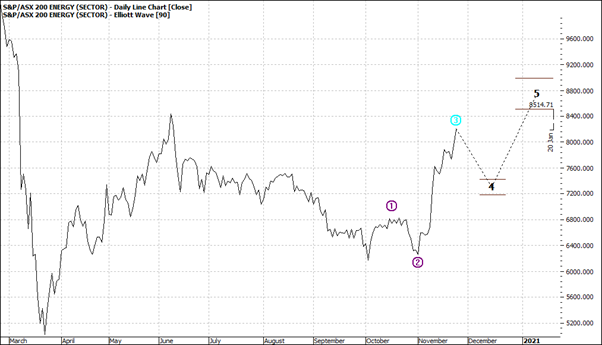

S&P ASX Energy (XEJ:ASX) Daily Line Chart

|

|

Click to Enlarge

|

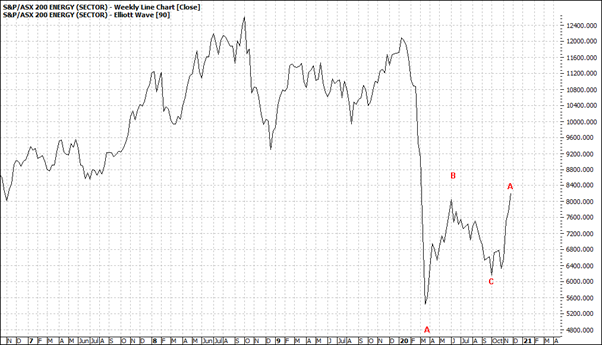

S&P ASX Energy (XEJ:ASX) Weekly Line Chart

|

|

Click to Enlarge

The energy looks strong daily wise, but signals to us that a pullback could spoil the Christmas fun. The weekly chart sits low in the context of the past 12 months and shows little signs of an immediate rise higher.

Contrarians may look for a contrarian view to OPEC’s stance. Or at least Saudi stance.

Consumer Staples:

|

S&P ASX Consumer Staples (XSJ:ASX) Daily Line Chart

|

|

Click to Enlarge

|

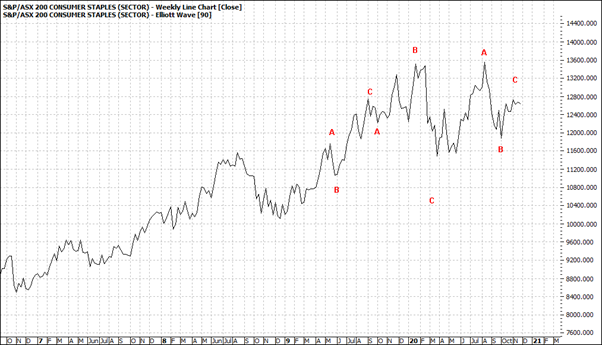

S&P ASX Consumer Staples (XSJ:ASX) Daily Line Chart

|

|

Click to Enlarge

Consumer staples is showing aftereffects from overindulging during the Covid lockdowns and the weekly picture says it may take some time before it will recover from the so-called good times of comfort foods and beverages.

Discretionary:

|

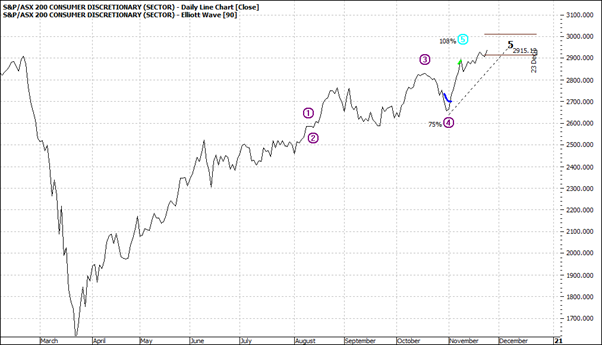

S&P ASX Consumer Discretionary (XDJ:ASX) Daily Line Chart

|

|

|

|

Click to Enlarge

|

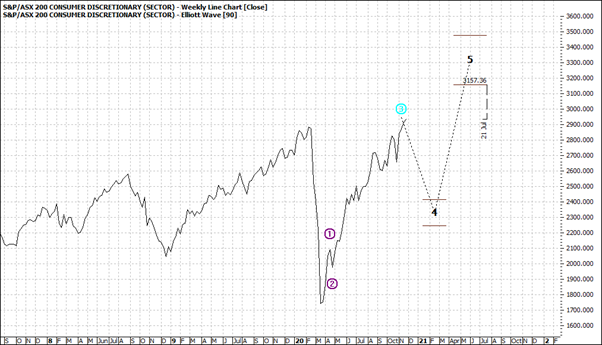

S&P ASX Consumer Discretionary (XDJ:ASX) Weekly Line Chart

|

|

|

|

Click to Enlarge

|

|

|

|

|

|

|